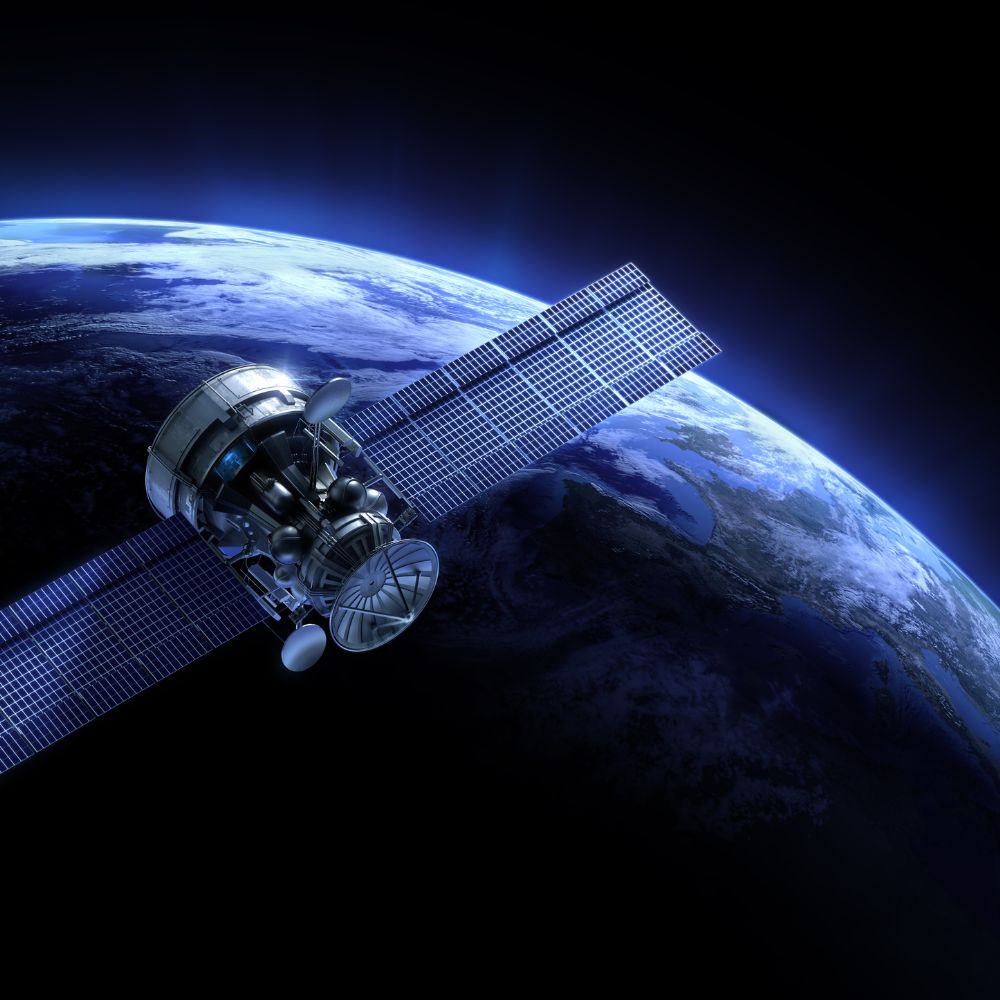

Elon Musk: Starlink to soon receive approval from telecom ministry to offer services in India.

Elon Musk’s satellite project, Starlink is, on the verge of receiving approval from the telecom ministry in India. Following security concerns a significant meeting is scheduled to take place where they may grant Starlink a license

Blue-collar staffing platform Smartstaff receives strategic investment from Persol

Persol, a leading APAC HR services provider, has strategically invested in Smartstaff, a blue-collar staffing platform, aligning with their focus on the Indian market. Smartstaff offers comprehensive staffing, recruitment, and

US-India: Legislation introduced in the US House to remove high-tech export barriers to India

During President Joe Biden’s visit to New Delhi, two prominent US lawmakers, Congressman Gregory Meeks, and Congressman Andy Barr put forth the “Technology Exports, to India Act.” The objective of this bill is to eliminate obstacles in the export of technology thereby encouraging the flow of sensitive technologies to India and enhancing technology collaboration, between the two nations.

G20 Summit: Joe Biden and the leaders of India, Saudi Arabia, and the UAE are likely to announce a joint infrastructure deal at the G20 summit

At the G20 summit, President Joe Biden and leaders from India, Saudi Arabia, and the UAE are set to unveil a strategic infrastructure plan to connect Gulf and Arab nations, bolstering regional ties and countering China’s influence.

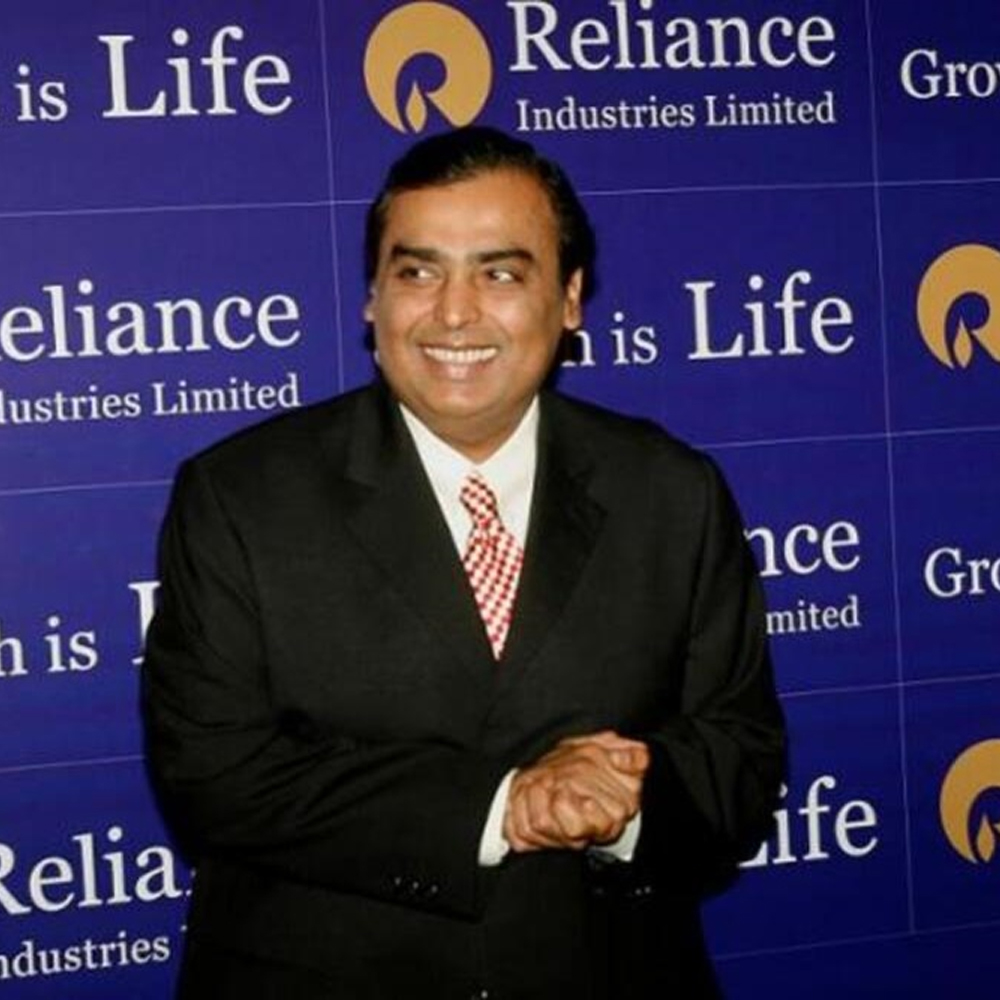

Indian Football: Reliance Retail’s Performax activewear becomes the official Kit Sponsor for Indian Football Team

Reliance Retails Performax activewear has been chosen as the kit sponsor, for the football team and they will unveil their latest kit at the upcoming 49th Kings Cup 2023 in Thailand.

Founder Arrested: Ed arrests Jet Airways founder Naresh Goyal in a money-laundering case of 538 crores

Naresh Goyal, the founder of Jet Airways has been taken into custody by the Enforcement Directorate (ED) in connection, with a money laundering case involving a bank fraud of Rs 538 crore, at Canara Bank.

Business Deal: Torrent Pharma submits a non-binding bid for a stake in Cipla says Sources

Torrent Pharma, based in Ahmedabad is currently considering acquiring a stake, in Cipla, a company. Should this acquisition be successful it has the potential to position Torrent Pharma as India’s pharmaceutical company.

Inox India Ltd files draft papers with SEBI to raise funds through a public issue

In India Inox India Ltd, a known manufacturer of tanks has recently submitted initial paperwork for an IPO. The proposed offering will involve the sale of 22.11 million shares, by existing shareholders and promoters including Siddharth Jain and Pavan Kumar Jain.

Managed workspace operator Table Space set to invest Rs. 1,000 crores to expand operations

Table Space Technologies plans to invest Rs 1,000 crore in the year 2023 24 to expand their operations by 4.5 million square feet. This comes after an expansion of 3.2 million feet, in the previous year which cost them Rs 800 crore.

Jio AirFiber will be launched on the occasion of Ganesh Chaturthi, i.e., September 19, 2023

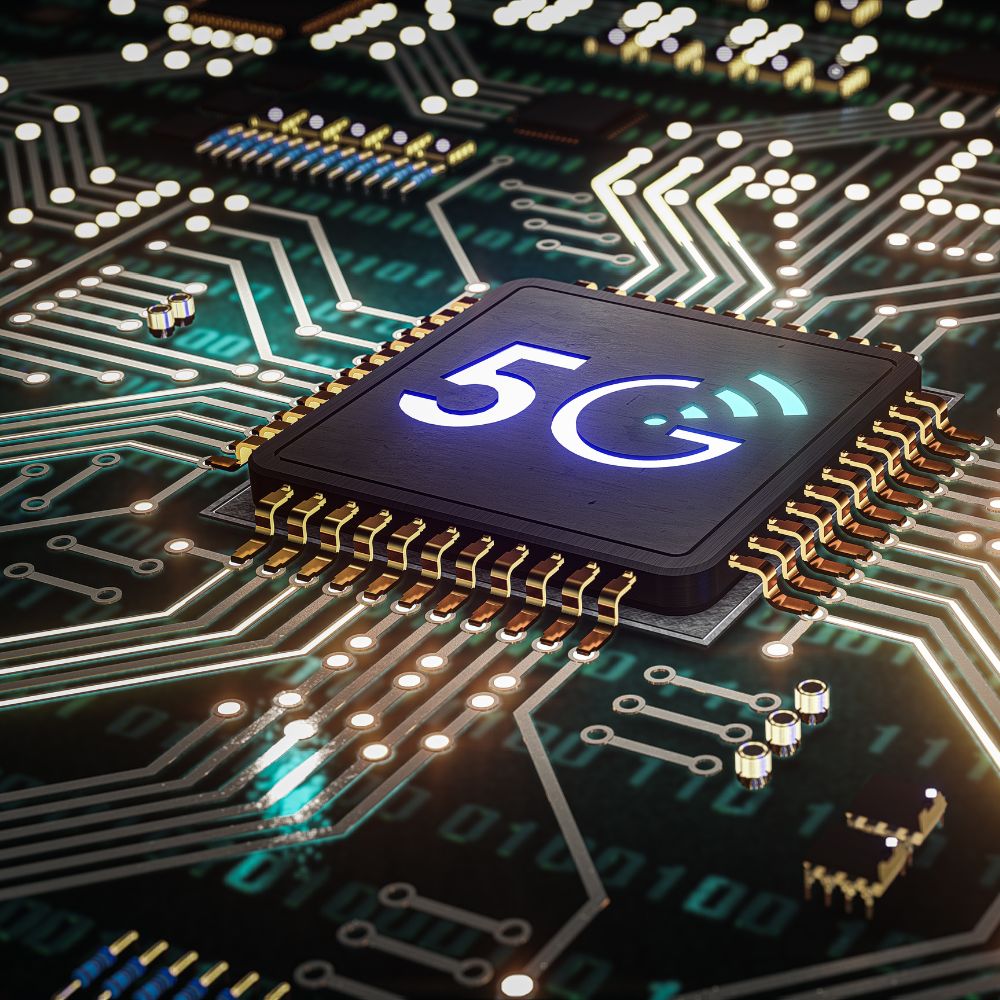

Jio AirFiber, set to launch on September 19, 2023, coinciding with Ganesh Chaturthi, marks a milestone for Indian telecom leader Jio. With its innovative technology utilizing the 5G spectrum, Jio aims to connect 100 million households with high-speed wireless internet comparable to fiber optic services.

Jio Telecom to roll out one million 5G cells by December 2023 said Chairman at Reliance AGM 2023

Chairman Mukesh Ambani shared their goals. He mentioned that their telecom division, Jio has set a target to install one million 5G cells, across India by December 2023. Ambani highlighted their dedication to progress.

Key leadership changes at PayU ahead of IPO, Anirban Mukherjee likely to be PayU Global CEO

PayU, the fintech company backed by Prosus is going through some changes, in its leadership team after selling its global payments division to Rapyd. It is expected that CEO Laurent Le Moal, CFO Aakash Moondhra, and other executives will be leaving.

Coforge Limited introduces the Coforge Quasar platform designed to facilitate the development of enterprise AI

Coforge Limited recently introduced Coforge Quasar, a platform powered by artificial intelligence. This transformative platform offers a range of features including, over 100 APIs, a modular architecture, and then 100 pre-built cognitive use cases.

Boxs, a B2B interior design startup successfully raises $1.6 million in funding from Peak XV

Boxs, a startup that is transforming the field of design for businesses has successfully raised $1.6 million, in funding. The investment was led by Peak XVs Surge with participation from Titan Capital and the founders of Zetwerk.

Reliance Jio may launch its fixed wireless access (FWA) device Jio AirFiber at a 20% discount

Reliance Jio, one of India’s telecommunications providers is preparing to unveil a device called Jio AirFiber that is specifically designed for consumers. Anticipated to be launched during the season this device may provide customers with a discount of, up to 20% when compared to alternatives.

Atlassian, Sydney-headquartered software company, plans to set up data centers in India

Atlassian the software company headquartered in Sydney plans to make investments, in data centers located in India. This decision is driven by the country’s flourishing economy and the availability of professionals.

Jio Financial Services debuted on the stock exchanges in August at Rs 265

Jio Financial Services made its entry, into the stock market on August 21st starting at a price of Rs 265, which was quite close to its discovered price of Rs 261.85. Alongside its activities in NBFC and credit markets, the company has plans to venture into insurance, digital payments, and asset management.

Tata Sons planning a £4 billion battery plant in the UK for Jaguar and Land Rover

Tata Sons are taking the initiative to build an EV battery factory, in the United Kingdom. With an investment of £4 billion, they are demonstrating their dedication to transportation and keeping up with the changing trends in the global automotive industry.

Jio Financial Services demerged from Reliance Industries set to be listed on August 21.

Jio Financial Services shares will start trading on August 21st after separating from Reliance Industries. The synergy, between JFS and Reliances telecom and retail sectors gives JFS an advantage. The

China’s property giant Evergrande Group files for bankruptcy protection in a U.S. court.

Amidst the turmoil, in China’s property sector, Evergrande Group, which is facing debt has sought Chapter 15 bankruptcy protection in the United States. This move is about restructuring efforts. The

HDFC announces launch of its life insurance and asset management services at GIFT City.

HDFC Group is broadening its scope by introducing life insurance and asset management services at the Gujarat International Financial Services Centre (IFSC). This expansion includes HDFC International Life. Re well,

California-based content monetization firm InMobi acquires consent managing platform Quantcast Choice

InMobi, a company based in California that specializes in content monetization and marketing technology has bolstered its privacy solutions by acquiring Quantcast Choice, a platform, for managing user consent. This acquisition aims to improve data governance, consent management, and privacy control for publishers who operate on devices and the web. The transition of Quantcast Choice customers and the introduction of the offering, for publishers are expected to happen in the future.

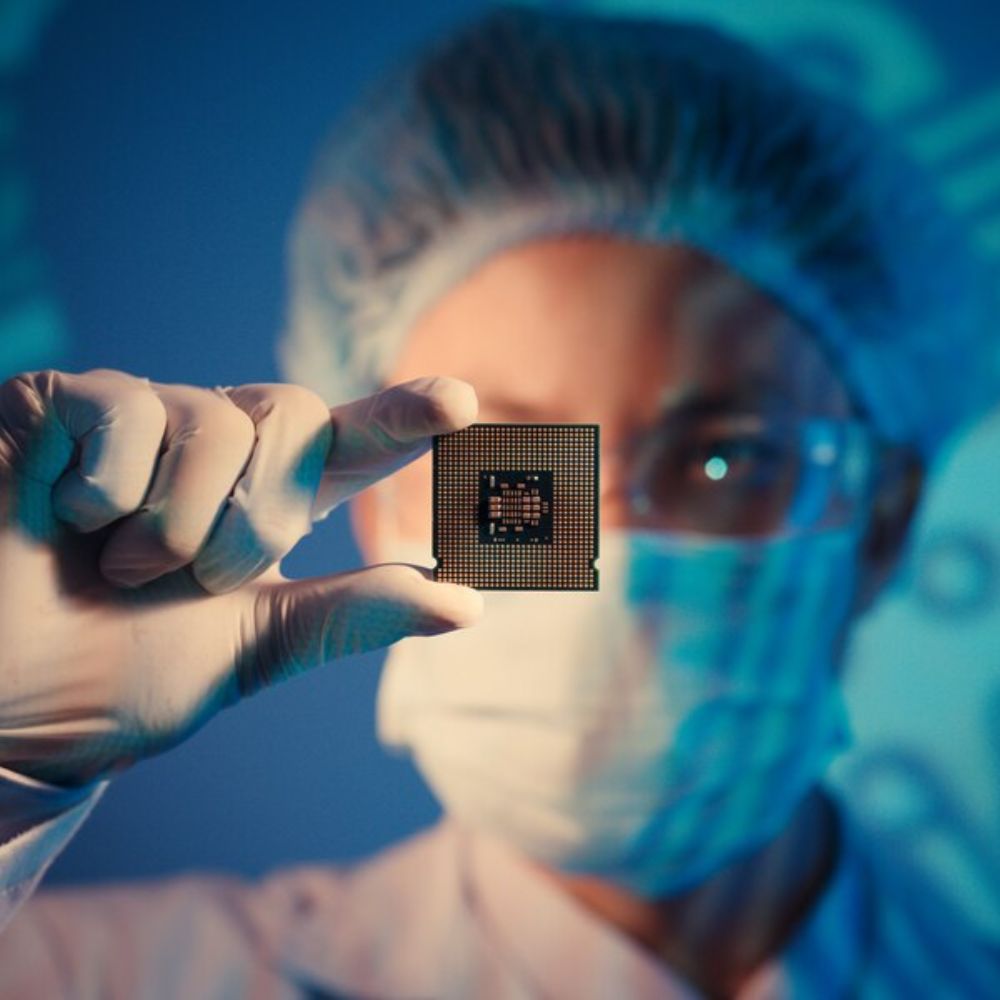

Intel to drop its $5.4 billion deal to acquire chipmaker Tower Semiconductor Ltd as China delays approval

Intel Corporation has decided to terminate its $5.4 billion acquisition agreement, with Tower Semiconductor, a chipmaker. The reason behind this decision is the failure to obtain approval from China. This development highlights the impact of tensions between the United States and China on business deals. As part of the termination, Intel will pay Tower a breakup fee of $353 million.

Occidental Petroleum buys Carbon capturing technology supplier Carbon Eng. for $1.1 bn

Occidental Petroleum has made an investment of $1.1 billion to acquire Carbon Engineering Ltd, a leading company, in air capture (DAC) technology. The objective behind this move is to set up 100 DAC plants that will play a role in addressing climate change by extracting CO2 from the atmosphere for purposes. With the support of grants, Occidental is actively advancing innovation, towards achieving emissions neutrality.

SBFC Finance shares debut at exchanges at a 44% premium over the IPO price

SBFC Finance made a strong entry onto Dalal Street on Wednesday, August 16. The stock was listed at Rs 82 per share, representing a substantial premium of 44 percent compared to its issue price of Rs 57 per share on the National Stock Exchange (NSE). Similarly, it debuted at a premium of 44 percent on the BSE, trading at Rs 81.99 per share.

Logistics service provider Xpressbees acquires courier company TrackOn

Xpressbees, a logistics powerhouse, has acquired New Delhi’s Trackon, marking its entry into the SME courier space. With a nationwide expansion plan and synergistic benefits, Xpressbees aims to leverage its network for growth. The acquisition aligns with their success story, backed by major investments and a diversified service portfolio, promising enhanced customer experiences.

Ranjan Pai, Chairman of Manipal Group is looking to buy a stake in Firstcry after Akash and PharmEasy.

Ranjan Pai, the chairman of the Manipal Group is currently engaged in negotiations to acquire a stake, in FirstCry, an e-commerce platform that focuses on children’s products. It has been

JioCinema forays into Esports; to live stream the official Battlegrounds Mobile India Series

JioCinema and Krafton India have collaborated to live stream the Battlegrounds Mobile India Series (BGIS) 2023. The event will feature “The Grind” phase from August 17th to 20th followed by the finals from October 12th to 14th. With a prize pool of INR 2 Crore, the tournament has attracted, over 2,000 teams highlighting the growing popularity of esports in India.

Open AI faces Bankruptcy amid rising operational costs; falling users

OpenAI, the company behind ChatGPT is at risk of facing difficulties by the end of 2024 if it does not receive funding. The magazine states that there has been a decline in the number of users visiting the ChatGPT website during the half of 2023. In May there were 1.9 billion users. This number dropped to 1.5 billion by July. The combination of losses, which amounted to $540 million last year and high operational costs further exacerbates the challenge, for OpenAI.

Government to start acquiring land for “New Noida”, city to spread over 21000 hectares

Uttar Pradesh plans “New Noida” city to address land scarcity due to growth, offering space for residents, industries, universities, and offices. The masterplan includes GIS technology for efficient development, catering

Lok Sabha passes a bill to approve 28% GST on online gaming and casinos decision

In a significant development, the Lok Sabha has given its nod to amendments in the Central and Integrated GST laws. These amendments mark a substantial shift as they introduce a 28 percent tax on the complete face value of wagers in domains like online gaming, casinos, and horse racing clubs.

2 Adani group firms mulling plans to secure Rs. 1500 crore through bonds

Indias Adani Group is currently, in talks with experts to secure 1,500 crore rupees ($181 million) for each of its divisions through local currency bonds. This effort is part of the conglomerate’s goal to raise a total of 100 billion rupees during this year.

HCL Technologies bags a $2.1 bn deal from Verizon for Managed Network Services

HCL Technologies has secured a $2.1 billion agreement, with Verizon Business to provide managed network services. This deal is expected to have an impact on revenue for the six years starting from November 2023.

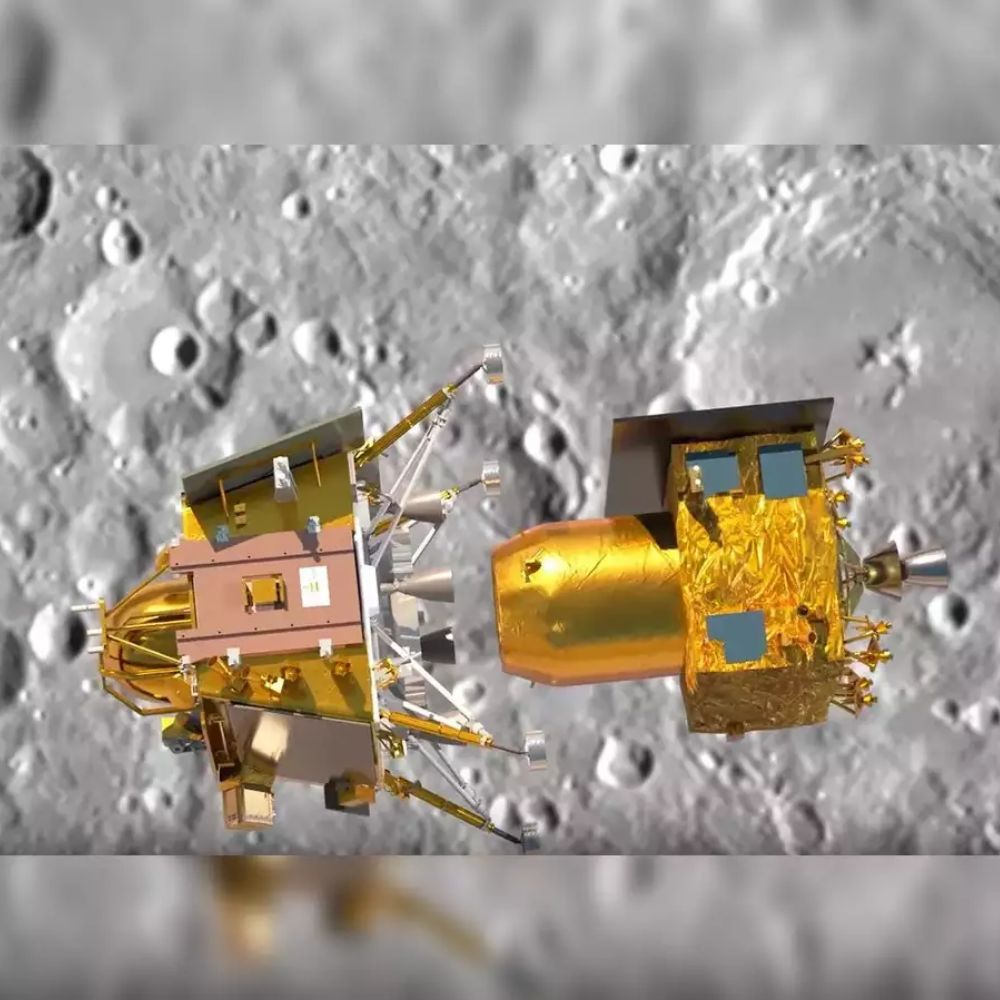

Russia launches first lunar spacecraft in 47 years, touch down on 21st Aug

Russia, after a 47-year pause, successfully launched its latest lunar exploration endeavor on Friday. The aim is to achieve the distinction of making a gentle landing at the lunar south pole, a region thought to contain valuable reservoirs of water ice.

Godrej Consumer to establish a 515 crore manufacturing facility in Tamilnadu

Godrej Consumer Products Limited is set to establish a cutting-edge manufacturing facility in the state, with a substantial investment of Rs 515 crore over the next five years. The company disclosed this development in a filing made on Thursday.

Singapore’s CapitaLand Investment launches $390 mn fund to invest in Indian Business Parks

CapitaLand Investment Limited (CLI) is launching CapitaLand India Growth Fund 2 (CIGF2) an initiative, with a value of S$525 million. The focus of this fund is on acquiring high-quality Grade A business parks in cities across India

Disney+Hostar reports the biggest decline in subscriber base in the June quarter

Disney+ Hotstar, a streaming platform, in India, faced a setback during the June quarter as it experienced a decline of 24% in its subscriber base. This translates to a loss of 12.5 million users. The platform has been witnessing declines mainly due to the loss of broadcasting rights for the Indian Premier League (IPL) and the conclusion of partnerships with HBO. In addition to that the rise of JioCinema, as a competitor and its introduction of content have further contributed to Hotstars decline.

Amazon is in talks with Softbanks’s Arm to join hands ahead of its IPO

Amazon is, among the tech giants that are investing in the IPO of Arm Ltd underscoring the significance of Arms computing capabilities. Amazon Web Services chip, known as Graviton is built on Arms design. Arm is aiming to secure funding in the range of $8 10 billion. Has set its sights on a debut on Nasdaq. The involvement of investors in Arm further strengthens customer relationships making its IPO more appealing as SoftBank Vision Fund works towards recovery efforts. With a pivot, towards high royalty data servers and PCs Arm is positioning itself for growth.

Government to invite bids for strategic sale of HLL lifecare in September

In September the Finance Ministry intends to seek offers, for the sale of HLL Lifecare after receiving approval from the Alternative Mechanism. Minister Bhagwat Kishanrao Karad has confirmed the decision to privatize despite appeals from stakeholders.

The government exploring live-streaming TV channels without the Internet through D2M technology

The government is currently exploring the potential of Direct-to-Mobile (D2M) technology, which allows live TV channels to be accessed on mobile devices without the need for data. Discussions are underway with stakeholders, including telecom operators. However, there are concerns about how D2M could impact data revenue.

Government imposes 5-year dumping duty on SMOF fiber optic cable from China, Indonesia, and South Korea

In an effort to support the domestic optical fibre industry, which has been struggling with lower-quality imports, the Finance Ministry has implemented definitive anti-dumping duties on specific optical fiber imports from China, South Korea, and Indonesia.

ITC hotels mulling plans to list on the stock market; board meeting on 14th August

ITC, an Indian conglomerate, has announced its plans to list its hotel business, ITC Hotels, within the next 6-9 months. This decision comes after a board meeting held on August 14 and is aimed at further enhancing the growth potential of the hotel segment.

Byju’s misses 3rd August deadline set by its creditors to amend the terms of a $1.2 bn debt

Struggling ed-tech giant Byju’s misses yet another debt revision deadline, intensifying challenges amid disputes over a $1.2 billion loan. Lenders sought amended terms, including higher interest and partial repayment, but

TVS Supply Chain Solutions IPO to open on 10th August for Subscription

TVS Supply Chain Solutions Ltd, based in Chennai will soon begin its public subscription period from August 10th to 14th. The company aims to raise around Rs 600 crore through this initiative. Known for its handling of supply chains TVS Supply Chain intends to utilize the funds for repaying its debts. The company has demonstrated growth, in FY23 displaying trends, in both revenue and profit.

Apple’s Q3-: Services sales revenue compensates again for iPhone sales dip

Apple’s Q3 earnings revealed a mixed performance with iPhone revenue dipping to $39.67B from $40.66B last year. However, a robust services sector surged from $19.6B to $21.2B YoY, surpassing predictions. CEO Tim Cook hailed the growth of paid subscriptions and emphasized the company’s commitment to values and innovation.

Concord Biotech IPO opens for public subscription today; GMP at Rs. 325

Concord Biotechs Initial Public Offering (IPO) will be available, for subscription from August 4 to 8. The IPO comprises 2.09 crore equity shares, which are being traded at a premium of Rs 325 per share in the Grey market.

The government restricts the import of laptops, tablets, PCs, and Servers

The recent announcement, by the government restricts the import of laptops, tablets, and computers allowing imports. There are some exceptions though. Individuals can import one item through channels and for research and development purposes up to 20 items per shipment are allowed.

Nykaa CEO Falguni to lead marketing operation after 6 executives quit

Nykaa, a major Indian cosmetics-to-fashion retailer, has seen several key executives, including the Chief Marketing Officer, resign amidst heightened competition in the rapidly growing sector. Nykaa’s founder takes direct oversight,

Prosus-backed Fintech firm PayU gearing up for stock debut next year

PayU, a financial technology company supported by Prosus is preparing to make its debut on the stock exchange. Its estimated value is expected to be $6- 6.5 billion. The company, led by Arvind Agarwal, who previously served as CFO, at Nykaa plans to share its draft prospectus in the year.

Fitch downgrades US long-term foreign currency issuer default rating to AA+ from AAA

Fitch Ratings has recently lowered the US term foreign currency default rating, from AAA to AA+. This decision was primarily influenced by anticipated decline, erosion in governance and the increasing

Ambuja Cements acquires a majority stake in Sanghi Industries at a $729 million valuation

India’s Ambuja Cements is planning to bolster its cement portfolio by acquiring a majority stake, in Sanghi Industries. This strategic move, spearheaded by billionaire Gautam Adanis’s company signifies their commitment to expanding in the sector. Adani’s cement holdings, which include Ambuja and ACC Ltd currently have a production capacity of, over 65 million tonnes throughout India.

Manipal Group’s Dr. Ranjan Pai mulling plans to invest 80-90 mn in ed-tech firm Aakash

Dr. Ranjan Pai, the Chairman of Manipal Group is being seen as a rescuer, for Aakash, an ed-tech company owned by Byjus that is currently facing difficulties. As an investor in Byjus Dr. Pai’s family office is in talks to invest, around $90 million, which would greatly assist the struggling giant and provide some much-needed relief.

EaseMyTrip to pick up majority stake in 3 travel companies

EaseMyTrip, a renowned travel service provider, plans to acquire a 51% stake in three prominent travel companies: Guideline Travels Holidays India, TripShope Travel Technologies, and Dook Travels. The acquisition will be financed through the issuance of EaseMyTrip’s equity shares to the selling shareholders of these firms.

Block deal in real estate firm DLF to be executed by an exiting promotor at a 3% discount

DLF, a known real estate developer is planning to conduct a block deal on August 1st worth Rs 1,086.2 crore. They are offering a 3 percent discount compared to the market price. In the quarter that ended in June 2023, DLF exceeded analysts’ expectations by generating a profit of Rs 526.11 crore. As part of their re-entry, into the Mumbai market, DLF has partnered with Trident Group. Together they plan to launch a project in Andheri West spanning over nine lakh sq ft. The company is investing Rs 400 crore as equity, for this development initiative.

Japan’s chip supplier Disco mulling plans to establish a facility in India

Disco, a supplier of chipmaking devices is contemplating the idea of establishing a center, in India. This center would not provide support to clients. Also, serve as a marketing hub for the semiconductor industry. The fact that major companies like AMD and Micron Technology are investing significantly in India indicates a transformation, in the country’s semiconductor landscape.

Manchester United extends its partnership with Adidas for 10 years at a minimum £900 million cash guarantee

Manchester United has recently extended its partnership, with Adidas for 10 years ensuring a cash guarantee of £900 million ($1.16 billion). This agreement will remain in effect until June 2035

Singapore’s real estate firm AT Capital firm & NBFC Experion Capital makes their first India investment

Singapore-based real estate AT Capital firm and NBFC firm Experion Capital has made its first investment in India by providing ₹200 crores as project finance for Vatika Group’s prestigious luxury residential project, Sovereign Park, located in Gurugram.

Foxconn to sign an agreement with Tamilnadu to set up Rs. 1600 crore plant

Foxconn, an electronics manufacturing company plans to invest an amount of $194.45 million, in India. Through its subsidiary Foxconn Industrial Internet (FII), the company aims to establish a state-of-the-art facility for components in the Kancheepuram district of Tamil Nadu.

Sunil Shetty invests in Pro Panja League; acquires single-digit equity

Suniel Shetty, a known actor and entrepreneur has recently made an investment, in Pro Panja League. This emerging professional arm wrestling tournament is gaining popularity in India. The league emphasizes its roots welcomes participants, from backgrounds, and aims to attract a wide audience through television broadcasts. In its season the league aspires to captivate viewers and establish an online community. The future looks promising for this growing sport.

Indonesia to Impose Limits on Sales of Imported Goods Under $100 to Safeguard Local Businesses

Indonesia to Impose a regulation to safeguard the interests of small and medium enterprises by placing restrictions, on online sales of imported goods valued below $100. This measure will be applicable to both marketplaces and retailers operating on social media platforms. As the country’s e-commerce industry flourished, reaching a value of $59 billion in the year authorities are now working collaboratively to enforce these rules and anticipate potential effects, on the sector.

BPEA EQT to Acquire 60% Stake in India’s Leading Fertility Clinic, Indira IVF

BPEA EQT, a known equity fund, with a focus on Asia, has recently agreed to purchase a significant 60% share in Indira IVF. Indira IVF is India’s leading provider of fertility services. Is considered a leader in IVF cycles. This acquisition values the company at $1.1 billion representing an investment, in the expanding Indian IVF industry.

Nirma to raise Rs 7,000 Crore for Acquisitions; Glenmark Life Sciences is Shortlisted Target

Nirma, a manufacturer of soap and detergent products is looking to secure funding of, up to Rs 7,000 crore. This capital infusion will be utilized for expanding its manufacturing facilities and exploring acquisition opportunities. Glenmark Life Sciences has been identified as one of the companies being considered for bids. The objective, behind this move, is to broaden Nirma’s business portfolio by venturing into the healthcare sector. This decision is supported by Nirma’s performance and strong cash flow generation.

Foxconn is in talks with the Tamilnadu government to set up a $200 mn plant by 2024

Foxconn, the electronics manufacturer is currently engaged in talks, with the government of Tamil Nadu regarding an investment of $200 million to establish a manufacturing plant for electronic components.

Meta’s Facebook touches 3 billion active users says Meta’s latest report

Meta’s recent quarterly report showcases statistics, for its suite of applications, such as Facebook, WhatsApp, Instagram, Messenger, and Threads. These apps collectively boast 3.88 billion active users representing nearly half of the global population actively engaging with Metas platforms. Moreover, Facebook has witnessed a resurgence, in users now reaching a staggering 2.064 billion individuals.

Wint Wealth gets SEBI license as a bond provider platform

Wint Wealth, a fintech startup based in Bengaluru has recently acquired a license from SEBI as a bond platform provider (OBPP). This license enables Wint Wealth to facilitate investments, in bonds for investors. The company has already facilitated investments of INR 1,000 Cr for around 50,000 investors.

Yatharth Hospital IPO opens for subscription from 28-30 July; price band at Rs. 285-300

Investors and analysts, in the pharmaceutical and healthcare sectors are showing interest in Yatharth Hospital IPO. The company has a history of success promising growth projections and strategic plans for expansion making it highly recommended to subscribe to their offering.

Open AI’s ChatGPT android version goes live; India is amongst the first to get access

OpenAI’s ChatGPT android version, the AI chatbot has been. Is now available to users in various countries including India, Bangladesh, Brazil, and the United States. Preorders are also open for nations as part of their expansion plans.

Thales, the largest defense electronics provider in Europe acquires U.S. cybersecurity company Imperva for $3.6 billion

Thales, the defense electronics provider based in Europe is venturing into the field of cybersecurity through the acquisition of Imperva, a U.S. Company for a $3.6 billion. This strategic decision intends to strengthen their activities in cybersecurity expand their focus beyond defense operations and establish themselves as a global contender, in the realm of cyber warfare. The completion of this deal is expected by 2024.

Gift Nifty witnesses record $8.5 billion single day trading on Monday

The NSE International Exchange (NSE IX) has achieved a milestone by trading, more than 214,000 contracts valued at $8.5 billion in GIFT Nifty derivatives. This signifies growth compared to their initial operations. The Connect arrangement has generated interest among investors worldwide providing them with access to a wide range of derivative contracts for 21 hours every day.

Piramal Alternatives planning to raise $1.5 billion to invest in local high-yield companies

Piramal Alternatives, a division of the Piramal Group headed by CEO Kalpesh Kikani has set a target to secure $1.5 billion, for investments, in credit within India’s high-yield companies. Given their history of funds and the rapid growth of India’s economy, they are actively looking for international investors to capitalize on the flourishing market.

Whatsapp and Instagram back up after an hour-long outage affecting thousands

People, on media were relieved when Facebook, Threads, WhatsApp, and Instagram backed up after an hour-long outage affecting thousands. According to Downdetector.com than 14,000 Instagram users experienced issues along, with 7,000 Facebook users, 2,700 WhatsApp users, and 470 Threads users. This is the time Instagram has had an outage in the month but Meta Platforms has not provided any updates or statements regarding the situation.

Twitter rebranding into “X” will cost Elon Musk billions in brand value

Elon Musks’ unexpected choice of Twitter rebranding into “X” and removing the known bird logo and “tweet” terminology resulted in a financial loss with an estimated impact of $4 20 billion, on brand value. As industry experts and branding agencies express their disapproval of this decision the platform now confronts the task of regaining its importance while embarking on objectives, under the “X” name.

Reliance to invest $10 billion in data centers in partnership with Canada’s Brookfield Infrastructure & America’s Digital Realty

Reliance Industries in collaboration, with Brookfield Infrastructure, intends to allocate an amount of 10 billion rupees towards the establishment of data centers within India. This strategic endeavor aims to leverage the increasing need for infrastructure as more individuals join the community.

Motion G; Singapore-based AI-driven generative engineering platform raises $16 mn

Motion G, a company based in Singapore recently secured $16 million, in funding through a funding round led by Episteme Inc. Their goal is to revolutionize the field of engineering by enhancing productivity through the use of machine learning, data science, AIGC, and digital twin technologies.

Bitcoin regains $30,000; traders await Fed’s rate hike decision on 27th July

Cryptocurrency markets, in Asia, saw a mix of movements with Bitcoin bouncing above the US$30,000 support level before pulling while Ether climbed to US$1,900. Among the 10 cryptocurrencies, the Cardanos ADA token showed gains. The U.S. Investors are preparing for earnings reports. Keeping an eye on the rate hike during the Federal Reserves ‘ day meeting. The SEC’s ruling, on Ripple, is expected to face challenges. NFTs and U.S. Equity futures remained relatively stable in trading. The total market capitalization of cryptocurrencies reached US$1.20 trillion, accompanied by increased trading volume.

Twitter bird logo to be replaced with “X” in a phased manner; interim “X” releases today says Elon Musk

After purchasing Twitter for $44 billion Elon Musk has revealed his intention to revamp the platform by replacing its bird logo with an “X”. This strategic move aims to draw in advertisers and boost revenue through the introduction of a subscription service.

Bain Capital acquires 90% of Adani Capital and Adani Housing

Bain Capital, an investment firm based in the United States has recently announced a deal to acquire a 90% majority ownership of Adani Capital and Adani Housing. This agreement involves purchasing all of the investments made by the Adani family in the company with the aim of expanding Adani Capitals’ lending capabilities.

Bain Capital to purchase a majority stake in Adani Capital at Rs. 1500 crore

Bain Capital is currently, at the forefront of the competition to acquire a majority stake in Adani Capital for an amount of Rs 1,500 crore. The Adani Group intends to divest from core businesses and utilize the funds to strengthen its core ventures. Adani Enterprises has received backing from a consortium led by SBI for its PVC project located at Mundra Port. The recent approval from a panel established by the Supreme Court has instilled confidence in Adani’s plans for expanding its business. However, the allegations made in the Hindenburg report have had an impact on share prices. Hindered Adani Enterprises plans, for a follow on public offer.

Clarious ARBL Holding planning to offload its 14% stake in Amara Raja Batteries; shares fall 6%

This anticipated stake sale marks Clarios’ second retreat from Amara Raja in less than two years. In a previous instance, Clarios curtailed its shareholding by 10 percent, executing a substantial

Ashok Leyland secures Rs. 800 crore defense sector orders

Ashok Leyland, a company that specializes in manufacturing automobiles has recently been awarded defense contracts Rs 800 crore. These contracts involve the acquisition of the Field Artillery Tractor (FAT 4X4) and the Gun Towing Vehicle (GTV 6X6). These vehicles will play a role, in the government’s initiatives to promote manufacturing, in the defense sector.

Shark Tank India’s famed Flatheads was acquired by Fashion startup Styched

Youth fashion company Styched has strategically acquired casual sneaker startup Flatheads with the goal of solidifying its position, as a player in the fashion industry. Flatheads is known for its expertise, in sneakers while Styched operates with a unique approach that eliminates waste, inventory, and warehousing. This acquisition will bolster Styched’s sneaker collection. Broaden its reach in the market.

Sheela Foam of Sleepwell Mattresses to acquire Kurlon Enterprises for Rs. 2,150 Cr

In a twist, Sheela Foam Ltd has decided to acquire its competitor, Kurlon Enterprise Ltd in a transaction, at a reduced price of Rs 2,150 crore. This strategic move is aimed at enhancing Sheela Foam’s’ market presence and capitalizing on cost advantages, synergies, and improved access, to materials.

Bain Capital is in advance talks with Adani Capital for acquisition at Rs. 1500 crore

According to reports private equity firms such, as Bain Capital are currently in discussions to acquire Adani Capital, the shadow bank owned by Gautam Adani. Adani is looking to sell off core businesses in order to concentrate on its core operations. Bain Capital is expected to offer around Rs 1,500 crore for the company, which has experienced growth, in its assets under management and has shown financial performance in the fiscal year 2023.

Mufti jeans brand owner Credo Brands Marketing Ltd files DHRP with SEBI for IPO

Credo Brands Marketing Ltd, renowned for its highly sought-after Mufti jeans brand has recently lodged preliminary documents for an initial public offering (IPO) in India. This proposed IPO entails a complete offer for sale by current shareholders and promoters. Noteworthy is the fact that the company commands a substantial market share in the men’s casual wear sector and boasts an extensive network of 1,773 touchpoints nationwide.

Myntra to support and mentor 200 D2C brands under its Rising Stars Program

The Rising STARS program of Myntra seeks to foster the growth of 200 Direct to Consumer fashion and lifestyle brands in India. By providing these brands with valuable brand-building skills, heightened exposure, and strategic support. Myntra enables them to tap into India’s thriving digital market. It is estimated that this market will attract 400 450 million shoppers by 2027 presenting immense opportunities for expansion. Furthermore. The fashion D2C industry is projected to reach a value of $43.2 billion by 2025. With Myntras program. These brands are well-positioned to capitalize on such promising prospects.

India’s UPI is to be available in France soon at the Eiffel Tower site says PM Modi

Prime Minister Narendra Modi has declared the Unified Payments System (UPI) which has achieved great success in India and will now be launched in France. This groundbreaking step aims to provide Indian tourists with the opportunity to make payments in rupees without the hassle of forex cards or cash. UPIs ongoing progress is evident through its recent agreements with Singapore and France. And there are further plans to extend its services to the United States, Europe, and West Asia.

Foxconn in talks with TSMC, TMH to manufacture chips in India after Vedanta JV fallout

Foxconn is currently engaged in discussions with TSMC and TMH Group exploring the possibility of establishing a joint venture in India’s semiconductor sector. After their chip partnership with Vedanta Group

HDFC Bank becomes first to provide interoperability between UPI and CBDC

HDFC Bank, recognized as India’s largest private sector bank has accomplished an extraordinary feat by achieving interoperability between the United Payment Interface (UPI) and Central Bank Digital Currency (CBDC). Thanks

HCLTech to acquire 100% stake in German automotive services company for €251 million

HCL Tech surprises the industry by acquiring ASAP Group, a renowned German automotive engineering services provider for a staggering €251 million. This unexpected collaboration seeks to expand ASAPs cutting-edge automotive technologies on a global scale reinforcing HCLTechs dedication to Germany. With great enthusiasm, both companies eagerly look forward to offering top-notch solutions to the worldwide automotive sector.

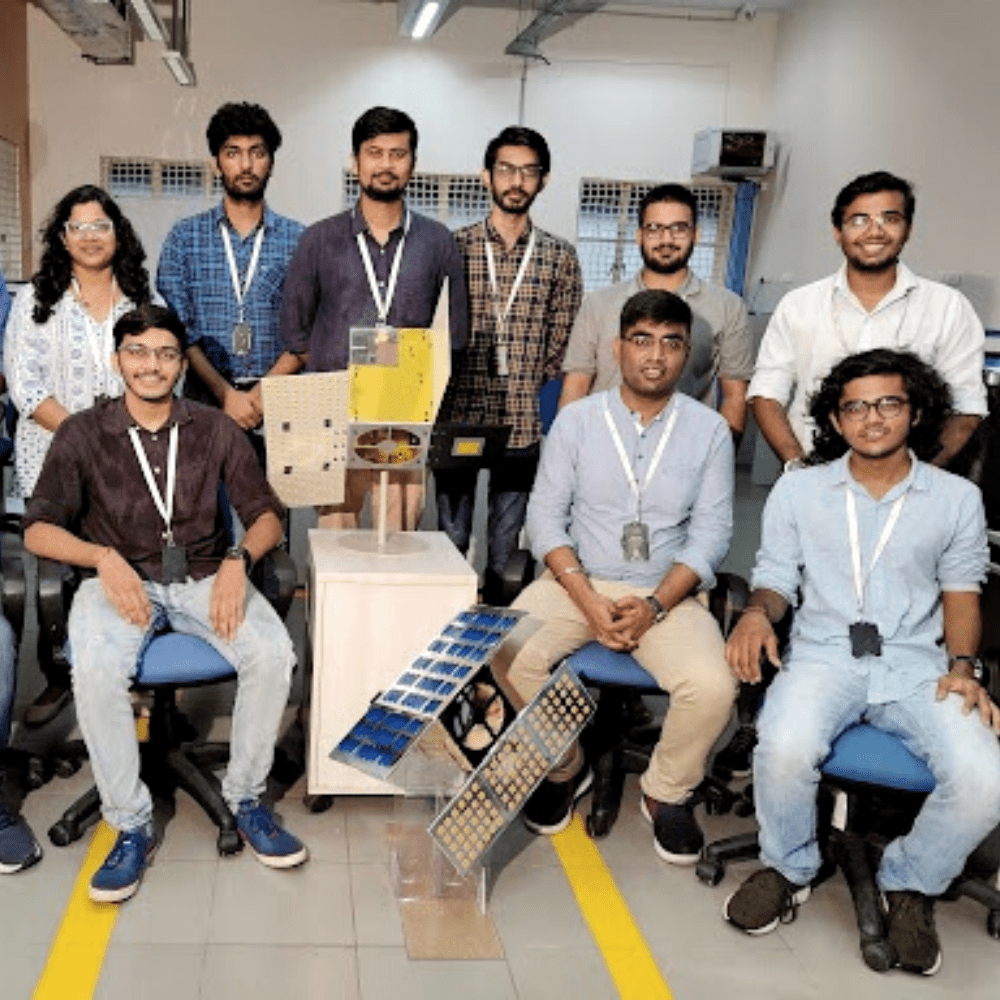

Indian Spacetech startups offering satellite launch services exempted from GST

Minister of State (MoS) for Science and Technology Jitendra Singh emphasized the pivotal role played by the private sector in India’s space economy highlighting that there are now 140 Indian space tech startups operating in India, which is a significant achievement due to the country’s liberalized space policies.

Future Enterprises receives bids from Reliance Retail Ventures, Jindal Group, and GBTL Ltd

Amidst its corporate insolvency predicament, Future Enterprises has received resolution plans from Jindal (India) Ltd, Reliance Retail Ventures, and GBTL Ltd. It is worth noting that the burden of verified

Nazara Technologies; a leading online gaming company sees the minimal impact of a 28% GST decision

With regards to the latest ruling by the GST Council mandating a taxation rate of 28% on online gaming services, Nazara Technologies—a distinguished entity renowned for its expertise in both gaming and esports—confidently states that it foresees minimal impact.

Zepto to become 1st unicorn of 2023 after a $150 million Series E round

Zepto is an Indian startup is on track to become the first unicorn of 2023 in the country. Thanks to an expected $150 million Series E funding round. Led by StepStone Group and supported by Nexus Venture Partners. This funding will elevate Zepto’s valuation to $1.3 billion. The swift commerce delivery startup has garnered recognition for its commitment to delivering groceries within 10 minutes.

Wipro launches AI-ecosystem ai360; to invest $1 billion over the next 3 years in AI solutions

Wipro ai360 represents Wipro’s commitment to an AI-centric ecosystem that seamlessly incorporates AI technology in all its platforms and client solutions. To achieve this Wipro has earmarked a significant $1

Ashneer Grover; Ex Bharatpe MD lashes out at the government over 28% GST on online gaming companies

Ashneer Grover, the former founder of BharatPe. This has raised concerns regarding the Indian government’s recent decision to impose a 28% tax on funds accumulated by online gaming companies. In

Bain Capital and Carlyle Group bids for Adani capital

Sources indicate that Bain Capital and Carlyle Group Inc., both reputed firms, find themselves among potential acquirers eyeing a controlling interest in Gautam Adani’s shadow bank, commonly referred to as Adani Capital. Motivated by a desire to minimize liabilities while increasing focus on existing enterprises, this vital move has been triggered after scrapping their initial public offering plans following detrimental allegations made by short sellers resulting in considerable erosion of market value.

Wadia Group is in talks with investors to form a joint bid for Go First

Amidst ongoing challenges faced by Go First Airlines in resuming their operations, there is a focused effort by the Wadia Group towards finding suitable partners who can assist them in reclaiming ownership. These partnerships may come through joint bids involving financial investors who are presently engaging in discussions with the group after assessing Go First’s airworthiness status thoroughly. Furthermore, it should be acknowledged that former promoters Nusli Wadia and his family retain eligibility for participation in any forthcoming bidding processes related to this venture. Importantly, one must remember that engine issues were the primary reason behind Go First filing for bankruptcy.

Tata Group becomes the first Indian iPhone manufacturing company; deal signup in August

The continuous progress made by Tata Group seems poised for further consolidation with reports suggesting their imminent acquisition of a factory presently administered by Wistron Corp., an esteemed Apple supplier. Pertinently this factory represents a critical component in the intricate assembly procedures associated with iPhones and boasts an impressive valuation exceeding $600 million. Should this arrangement reach fruition Tata would secure their entry into the competitive realm of iPhone production thereby contributing significantly to India’s manufacturing sector. Furthermore. It would serve as a commendable feat for Apple. Allowing them to effectively diversify their supply chain in order to alleviate dependence on China.

UK to allocate 5% of their default pension funds for investment into unlisted startups

The UK government’s proposed reforms were presented by Finance Minister Jeremy Hunt. Seek to unleash a substantial amount of money from pension funds. The goal is to stimulate investments in early-stage companies and ultimately bolster economic growth. Furthermore, these changes aim to enhance pensioners’ returns by giving them the opportunity to invest in unlisted startups.

Netweb Technologies IPO to open up for public subscription on 17th July

Netweb Technologies India Ltd, a renowned provider of computing solutions is scheduled to launch its IPO on July 17. The IPO comprises a fresh issue along with an offer for sale by its existing promoters. Netweb has established itself as a reliable source for a diverse range of computing solutions and has consistently exhibited impressive financial performance. Additionally. Their eligibility for government schemes in India further strengthens their position in the market.

Samsung opens pre-reservation of Galaxy Z foldable at Rs. 2000 on Amazon and Flipkart

Samsung has pleasantly surprised customers in India by making pre-reservations available for the much-awaited Galaxy Z Flip and Fold foldable smartphones. To secure these devices. Customers only need to pay

ChatGPT downloads see a fall of 9.7% in June ‘23 for the first time since the launch

ChatGPT, the AI chatbot that captivated the world’s attention, experienced a decline in website traffic and unique visitors for the first time in June. This data implies a possible saturation of interest and an increasing demand for real-time generative AI. Furthermore, OpenAI’s revenue projections and market competition are also investigated.

Reliance Jio to sign a $1.7 billion contract with Nokia for 5G network equipment

Reliance Jio Infocomm, a prominent telecom operator in India is on the verge of finalizing a significant contract worth $1.7 billion with Nokia for 5G network equipment. Alongside this deal, Jio is also set to strike a $2.1 billion agreement with Ericsson.

Indians for the first time emerged as leading travelers to the United States: IPK Int

India has emerged as the leading source of inbound travelers to the United States, surpassing countries like China, South Korea, and Japan in 2022. To accommodate the growing tourism boom, the US plans to open two new consulates in Bengaluru and Ahmedabad.

Carl Zeiss India planning to invest 250 million euros for its new Vision lens factory in Bengaluru

Carl Zeiss India has announced plans to invest more than 250 million euros in the creation of its largest vision factory in Bengaluru. This state-of-the-art facility is expected to be finished by October 2024 and will bring remarkable advancements in lens production, with a potential sixfold increase. Its daily output alone will reach an impressive 260,000 lenses.

Micron Technology to start building a $2.75 bn semiconductor facility by August; production by 2024 end

Next month. Micron Technology will begin the construction of a semiconductor assembly plant in Gujarat, India. This $2.75 billion project aims to produce microchips that are made in India by late 2024. Supported by the Indian government and the state of Gujarat. This endeavor is expected to generate up to 5,000 direct jobs in two phases. It is noteworthy that this action aligns with the US government’s initiative to encourage American chip companies to invest in India and expand their operations beyond China.

IDFC First Bank and IDFC Ltd merger approved by the board; merger ratio 155:100; bank stocks fall 5%

IDFC First Bank has approved a merger with IDFC Ltd to simplify its corporate structure and ensure regulatory compliance. The merger ratio has been set at 155:100, meaning that for every 100 shares of IDFC held by shareholders, they will receive 155 shares of IDFC First Bank.

JM financial credit fund achieves its first close at Rs. 600 cr; final close at ₹1,500 cr

JM Financial aims to secure a final close of the fund, including co-investments, at around ₹1,500 crores. As a testament to its confidence, the group has invested 10% of the capital as a sponsor commitment into the fund. The fund will primarily provide lending for scenarios where traditional banks face limitations, such as domestic acquisitions or partner buyouts.

Reliance Jio unveils jio Bharat V2 phone at Rs. 999; beta trial starts on 7th July

The V2 phone fully supports UPI payments through JioPay ensuring a seamless digital experience. Moreover, Jio users will gain access to JioCinema where movies, videos, and sports entertainment await their

Rebel Foods; is a cloud kitchen startup planning to enter the Saudi Arabia market

In its relentless pursuit of greatness, Rebel Foods aspires to construct a formidable $100 Mn food delivery empire within the Saudi market over the next three years. As part of this ambitious strategy, the company plans to inaugurate an additional 60 stores in Riyadh alone, while simultaneously expanding its footprint to encompass other prominent cities such as Jeddah, Dammam, and Khobar.

Study abroad platform Leverage Edu secures $40 million in series C funding round

Founded in 2017 by Akshay Chaturvedi, Leverage Edu has established itself as a technology-driven counseling platform offering students a comprehensive one-stop dashboard to navigate their study abroad journey.

NDR Warehousing bags ₹500 crores in funding from Investcorp; planning InvIT as well

NDR Warehousing has taken a leap forward by filing a draft placement memorandum (DPM) with the Securities and Exchange Board of India (Sebi) to secure a hefty ₹1,165 crore through the InvIT. The primary purpose of these funds will be to repay construction-related loans. It is worth noting that this InvIT will be privately listed, signifying a groundbreaking milestone for a warehousing company. NDR Warehousing, a logistics infrastructure company, has struck a remarkable deal, bagging a staggering ₹500 crores in funding from Investcorp, an esteemed investor hailing from Bahrain.

Dream11 wins bid for Indian cricket team sponsorship rights for 358 Cr

In a surprising turn of events, it has been reported that the prominent fantasy gaming platform, Dream11, has managed to secure the lead sponsor rights of the highly revered Indian cricket team for a whopping sum of INR 358 Cr.

Apple Inc. closes above the $3 trillion mark for the first time; the most valuable company globally

This achievement follows a prior instance in January 2022 when Apple Inc. momentarily attained a $3 trillion market cap during intraday trading but narrowly missed sustaining it until the market closed.

HDFC Bank becomes the 2nd largest company in India; the 4th largest bank globally post-merger

In a staggering turn of events, HDFC Bank is set to secure its position as the fourth most valuable bank in the world, propelled by its merger with mortgage lender HDFC. This union will also propel the bank to become the second-largest company in India.

Chinese telecom giant ZTE to supply Rs. 200 cr worth of gear to Vodafone idea

Chinese telecom giant ZTE, which reportedly received government approval, has been granted the opportunity to supply Vodafone Idea (Vi) with optical transmission equipment worth over Rs 200 crore for an extensive network upgrade project.

Reliance Capital lenders approve the acquisition proposal by Hinduja Group

Astonishingly, lenders could potentially recover an impressive sum of over ₹10,000 crores, accounting for approximately 40% of verified claims, under the proposal presented by none other than IndusInd International Holdings Ltd (IIHL) of Hinduja Group.

Upgrad in talks to acquire US-based ed-tech company Udacity at around $100 mn valuation

Upgrad has already made ten acquisitions, including Wolves India and Rekrut India, within the span of two years (2020-2022). The company raised $36.4 million through a rights issue in March 2023 from investors like Temasek and Screwvala. In June 2022, Upgrad secured $225 million in a new funding round, valuing the company at $2.25 billion.

Google to launch an accelerator program for government-backed ONDC

The accelerator program entails Google offering its core infrastructure application programming interfaces (APIs) to ONDC participants as an open-source solution. Moreover, Google plans to provide retail search and generative AI

Epiq Capital successfully closes fund raising for Eqip Capital II with $225 mn in bank

Epiq Capital, founded in April 2016 by the former managing director of Matrix Partners India, Navani, boasts an impressive portfolio including Lenskart, a unicorn in the eyewear industry, Dailyhunt, a

Digital India bill 2023 draft expected in next 15 days; to replace in next 15 days

The much-anticipated Digital India Bill is expected to be unveiled by the government within the next fortnight, according to media reports on Tuesday. This proposed legislation is likely to incorporate provisions that mandate companies to disclose how they utilize user data. Furthermore, companies may be obligated to inform users about the processing of their data, with non-compliance resulting in severe penalties.

Meta launches Meta Quest+ a VR subscription for $7.99 per month

In an astonishing move on Monday, Meta introduced Meta Quest+, a VR subscription service. This service promises to transport users into a realm of immersive experiences by offering two mind-altering games every month; for $7.99 per month!

BSNL and L&T signed an agreement to venture into the 5G private network market

BSNL, assuming the mantle of the official network provider, will work alongside LTTS to co-innovate and introduce private 5G connectivity solutions to the market. This partnership marks a significant milestone for LTTS, as it marks its inaugural entry into the 5G private network space.

Epsilon Advanced Materials to invest $650 million in US-based electric battery unit

Epsilon Advanced Materials (EAM) has made a staggering announcement, revealing its plans to invest a mind-boggling $650 million in the establishment of an exceptional electric vehicle battery components facility within the United States. This visionary company aims to construct a state-of-the-art synthetic graphite anode manufacturing facility, boasting an impressive production capacity of 50,000 tons per annum (TPA). The primary goal of this facility will be to supply high-capacity anode materials, all of which will be produced using innovative green technologies.

Shree Cement shares slump 10% on tax evasion reports

As per sources quoted by the media group it was claimed that Shree Cements had been diverting a substantial amount of Rs 1,200-1,400 crore annually through fraudulent means resulting in significant revenue losses for both the central and state governments. These losses were attributed to what was described as “fake agreements”.

Indian stock indices show a marginal rise during the morning trading session

Somber global cues have largely cast a shadow on market sentiment and encouraged profit-taking across various global markets, including India. It is worth noting that Indian stock indices reached their zenith last week, buoyed by encouraging economic indicators encompassing inflation, GDP, and investment outlook.

Google planning a global fintech operation center in GIFT City; Amazon promises $15 billion investment in India

Google, under Pichai’s astute guidance, unfurls its grand scheme to establish a global fintech operation center in none other than the dazzling GIFT City of Gujarat; Amazon Ceo Andrew promised

Apple to launch the Apple Card in partnership with HDFC Bank

One of the primary reasons Apple may consider launching the Apple Card in India ahead of countries like Japan or European nations is its inability to accept card payments in India. The prevalent payment method for App Store purchases in India is the Unified Payments Interface (UPI) while services like iCloud storage and music rely on card payments. However, recent regulations by the RBI have mandated that third-party websites should not store card details and that all payment data must be stored exclusively on Indian servers.

Adani group stocks witnesses slump as US authorities start scrutiny

Sources reveal that the US Attorney’s Office in Brooklyn, New York, has taken an active interest in this matter. In recent months, they have sent inquiries to institutional investors who hold significant stakes in the Indian conglomerate.

Vedanta planning to sell Tamil Nadu Copper Plant at a Rs. 4,500 crore valuation

As of March 2023, VRL possesses $1.7 billion in short-term investments, encompassing various bank deposits, quoted bonds, and mutual funds. Experts at CreditSites speculate that these investments could be liquidated

Biden Administration to ease Visa norms for skilled worker as PM visits US

Recognizing the need for comprehensive immigration policy reform, the Biden administration has been diligently working to improve visa accessibility for Indians. President Joe Biden aims to forge a stronger bond

Blackstone planning to launch another IPO for its REIT amounting to up to $1 billion

Blackstone has a proven track record of swiftly monetizing its real estate assets in India. In 2019, they launched Embassy Office Parks REIT, and a year later, they listed Mindspace Business Parks REIT in which they held a small stake that was subsequently sold off. The firm has also been preparing its mall portfolio for REIT conversion, successfully listing it this year.

Singapore Soars as World’s Priciest City for Luxury Living: Julius Baer’s Lifestyle Index

Research firm Julius Baer conducted its survey on high-net-worth individuals possessing bankable household assets amounting to $1 million or more, within the timeframe of February to March 2023. In a startling turn of events, Singapore has soared to the pinnacle of the rankings as the most exorbitant city in the world for opulent living.

“Revolutionizing the Skies: Suzuki and SkyDrive Join Forces to Build Flying Cars”

The Japanese automaker Suzuki Motor Corp in a surprising strategic move on Tuesday announced that it has signed an agreement with SkyDrive Inc to start developing “flying cars.” This ambitious partnership will utilize a Suzuki Group factory located in central Japan, serving as the production hub for their upcoming electric vertical take-off and landing (eVTOL) aircraft.

Subsidiary Berkshire Hathaway acquires a stake in five Japanese trading firms

In an intriguing turn of events, Berkshire Hathaway surprised the financial world on Monday by revealing that its wholly-owned subsidiary National Indemnity Company has significantly increased its stake in five prominent Japanese trading firms to an astonishing average of over 8.5%. These notable companies include Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo.

Electric aircraft maker Eve and Blade Air Mobility join hands to expand in Europe

, Eve and Blade Air Mobility have announced an expansion of their partnership, setting their sights on integrating Eve’s highly anticipated flying car into Blade’s extensive European route network. This ambitious endeavor, which kicks off in France, marks another milestone for the companies that have already joined forces to utilize Eve’s electric vertical take-off and landing vehicles in India and the United States.

Airbnb signs MoU with Ministry of Tourism to showcase India’s heritage stays and cultural tourism

This captivating collaboration aims to showcase India’s extraordinary heritage stays and invigorate cultural tourism. As part of the visionary ‘Visit India 2023’ initiative, Airbnb will become an enthusiastic partner to

Asia markets witnessed a decline ahead of China’s loan prime rate decision

Looking ahead Asian investors eagerly await China’s loan prime rate decision scheduled for Tuesday. This follows the recent reduction of key lending rates by the world’s second-largest economy. The outcome of this decision holds significant importance for the financial landscape. In a rather tumultuous turn of events, the Asia markets experienced a predominantly downward trajectory on Monday.

Adani Capital is in talks with financial investors to sell a stake in the firm

As per FY23 financials Adani Capital, its loan book stood at ₹2,690 crore and net profit at ₹90.68 crore. It largely operates out of four business verticals – farm equipment loans, commercial vehicle loans, business loans, and supply chain finance. The lender also has a housing finance arm.

Struggles and Uncertainty Plague Tiger Global’s Fundraising Endeavor Amidst Tech Valuation Woes

Tiger Global, founded in 2001 by the visionary Chase Coleman, gradually emerged as one of the most prolific venture capital investors, providing crucial support to numerous start-ups over the past

“Jan Aushadhi: Affordable Medicine Stores Witness High Sales in Diabetes and Cardiovascular Drugs”

“Government data reveals that Jan Aushadhi, the affordable medicine store in India, experiences significant sales from diabetes and cardiovascular drugs. With over 33% of total sales attributed to these conditions,

Adani Digital Labs acquires an online train booking portal, Trainman

AEL disclosed that its wholly-owned subsidiary, Adani Digital Labs Private Limited, inked a share purchase agreement to obtain a complete stake of 100 percent in Stark Enterprises Private Limited (SEPL), also known as Trainman.

SoftBank Planning Profitable Exits from Paytm and Zomato Amidst Rising Stocks

SoftBank holds an 11.17 percent stake in Paytm and 3.4 percent in Zomato. However, following the news of the potential stake sale, shares of One97 Communications declined by 1.5 percent, trading at Rs 878.50 apiece on the BSE. Zomato’s stock initially opened 0.8 percent higher on June 16 but later leveled off.

“Intel Makes Historic $4.6 Billion Chip Investment in Poland, Unveiling Massive Expansion Plans in Europe”

Intel, with an extensive three-decade-long presence in Poland and an existing workforce of 4,000 employees, cited several factors that propelled their choice of Poland for this momentous venture. They commended

KKR’s subsidiary planning to acquire road infrastructure from PNC infratech in a $1.1 billion deal

According to two insiders, if the transaction is completed, it will become the largest procurement of road projects by the private equity (PE) firm, headquartered in the United States, in

TaxNodes Raises $1.6 Million in Seed Funding to Simplify Crypto Taxation and Compliance

TaxNodes, with its end-to-end solutions, has secured a whopping $1.6 million in seed funding to streamline the intricacies of crypto taxation and compliance. Notable investors from the web3 and wealth

Government Urges E-commerce Firms to Combat “Dark Patterns” Through Self-Regulation

The government calls on e-commerce companies to tackle “dark patterns” by creating a self-regulatory framework. These exploitative practices manipulate consumers online, such as unauthorized cart additions and misleading pricing. If voluntary measures fail, the government may introduce regulations. Education and awareness are key to curbing such practices.

Cabinet likely to approve PM PRANAM scheme in today’s meeting

“PM PRANAM revolutionizes agriculture by reducing chemical fertilizer usage. Incentivizing States and Union Territories, it promotes sustainable farming practices and alternative fertilizers. With estimated savings of ₹20,000 crore and a projected decrease of 45.78 LMT in fertilizer usage, it paves the way for a greener and more prosperous future.”

Blue Dart Announces Appointment of V N Iyer as Group CFO and Sudha Pai as CFO for Blue Dart Express Ltd

Blue Dart Logistics names Sudha Pai as CFO for Blue Dart Express Ltd. and V N Iyer as Group CFO. Iyer brings expertise in aviation finance, while Pai is a qualified cost accountant. The appointments aim to enhance financial leadership and drive strategic objectives in a digital world.

AI Hype Raises Concerns of Tech Bubble Repeat

The surge of capital into the artificial intelligence (AI) sector has drawn parallels to the dot-com era, raising concerns about a potential tech bubble. ESG funds heavily invested in tech are benefiting from AI’s growth, but experts urge caution and recommend selective investment strategies focusing on AI adopters and supporting industries.

ONDC Sets New Retail Order Record Despite Reduced Incentives, Collaborations Drive Demand

ONDC achieves record-breaking retail orders of 30,000 despite reduced incentives, as collaborations between buyer and seller apps boost demand. Food and beverages dominate orders, with grocery purchases also present. Revised

“Philanthropic Billionaire George Soros Hands Over $25 Billion Empire to Son Alex

“Billionaire George Soros entrusts his $25 billion empire to son Alex, highlighting a potentially influential role in US elections. The 92-year-old philanthropist, known for his significant donations to Democratic causes, addresses concerns over a potential return of Donald Trump. Soros’ decision sparks intrigue and speculation about the future of his vast financial and political influence.”

“The Podcast Revolution: Ears Up for a New Era of Conversations”

“Podcasts: Unleashing a Conversation Revolution. From solving crimes to providing platforms for rule-breaking, dive into the immersive world of podcasts. Discover the eclectic range of topics, captivating storytelling, and dedicated

“Twitter’s Payment Revolution: Verified Creators to Get Paid for Ads in Replies”

Elon Musk reveals Twitter’s groundbreaking payment program for verified content creators, offering them compensation for ads within their replies. With an initial payment block of $5 million, the move aims to attract and retain advertisers on the platform. The announcement comes as Twitter faces advertising challenges under Musk’s ownership and prepares for new leadership.

“DigiYatra Facility at Delhi’s IGI Airport’s T3 Offers Contactless Travel with Facial Recognition”

Delhi’s IGI Airport’s T3 (Terminal3) introduces a contactless travel experience with facial recognition through the DigiYatra facility. Passengers can now register in just one minute by scanning their boarding pass and face, eliminating the need for a mobile app. The initiative aims to provide hassle-free and seamless travel while enhancing security and saving passengers valuable time.

“Zomato Removes Controversial World Environment Day Ad After Backlash and Allegations of Caste Discrimination”

Foodtech giant Zomato faces backlash and accusations of caste discrimination for its ad featuring actor Aditya Lakhia. The controversial World Environment Day ad, highlighting plastic waste recycling, was taken down after users criticized it on social media. Zomato has a history of marketing controversies, adding to a trend of public disputes among Indian startups.

“India’s First Pod Taxi Project Receives Green Light for Noida International Airport to Film City Route”

“Uttar Pradesh’s PPP Bid Evaluation Committee has approved the groundbreaking project for India’s inaugural pod taxi system, connecting Noida International Airport and Film City. Tenders are set to be issued soon for the elevated corridor, which will feature 12 stations and an estimated cost of Rs 671 crore.”

“Odisha Government Approves Rs 3,457 Crore Investment Proposals, Promises Job Creation”

Odisha government greenlights investment proposals worth Rs 3,457 crore, generating employment for over 14,000 individuals. The approvals, granted at the State Level Single Window Clearance Authority (SLSWCA) meeting, include projects in sectors such as metal downstream, pharmaceuticals, food processing, cement, textiles, IT, and ESDM. Odisha cements its position as a top investment destination.

“Transformation and Growth: Tata Group’s Strategic Shifts in the Last Year”

Discover how Tata Group, one of India’s largest conglomerates, has undergone transformation and growth through strategic shifts in the past year. From restructuring its organization to embracing digital innovation, strengthening sustainability efforts, and ensuring supply chain resilience, Tata Group has adapted to the evolving business landscape. Explore key milestones such as the acquisition of Air India, the launch of the Nexon EV, and Tata Steel becoming debt-free. Witness how Tata Group is poised to lead in its chosen markets.

WhatsApp to Introduce HD Photo Sharing Feature, Allowing Users to Send High-Definition Images

WhatsApp is reportedly introducing HD Photo Sharing Feature allowing users to send high-definition photos. The feature, currently rolling out to Android and iOS beta versions, lets users choose the quality of the images they share. While minor compression still occurs, the update preserves the original dimensions of the photos.

Lionel Messi Chooses Inter Miami Over Lucrative Saudi Arabia Deal

Lionel Messi has chosen to join Inter Miami in Major League Soccer, turning down a lucrative $400 million deal from Saudi Arabia. The move strengthens partnerships with Apple and Adidas while dealing a blow to Saudi Arabia’s sports ambitions. Miami prepares to host the World Cup as Messi ventures outside Europe for the first time.

OpenAI CEO Sam Altman visiting India, Clarifies GPT5 Training Status

OpenAI CEO Sam Altman has revealed that the company is not currently training GPT5, the successor to GPT4, stating that there is still much work to be done. Altman emphasizes the need for safety audits and cautions against the rapid advancement of AI technology, addressing concerns raised by researchers and executives.

“Thyssenkrupp AG’s marine arm and Mazagon Dock to Collaborate on Indian Navy Submarine Project, Expanding Military Equipment Sources”

European manufacturer, Thyssenkrupp AG’s marine arm and Mazagon Dock Shipbuilders Ltd. will jointly build submarines for the Indian navy, signaling India’s efforts to diversify its military equipment sources. The collaboration aims to reduce reliance on Russia and counter China’s assertiveness. Germany supports this move to bolster its strategic partnership with India and supply modern military gear.

Meta Launches ‘Meta Verified’ Service in India, Expanding Subscription Bundle for Facebook and Instagram Accounts

Social media giant Meta has launched its ‘Meta Verified’ service in India, extending verification features for Facebook and Instagram accounts. The subscription bundle offers impersonation protection, government ID verification, and account support. Priced at INR 699/month for iOS and Android users, Meta aims to expand access and tap into India’s vast social media market.

“Cleantech Startup Proklean Technologies Raises $4M in Funding, Sets Sights on Global Expansion”

Chennai-based cleantech startup Proklean Technologies secures $4M in funding from Raintree Family Office, fueling its R&D efforts and hiring initiatives. The funds will aid the company’s expansion into new markets,

Capillary Technologies Acquires Tenerity’s Digital Connect to Boost Loyalty Solutions

Capillary Technologies bolsters loyalty solutions with the acquisition of Tenerity’s Digital Connect. The Bengaluru-based SaaS startup aims to strengthen its presence in the US and European markets by incorporating Digital Connect’s reward ecosystem. Capillary now offers a comprehensive suite of end-to-end intelligent loyalty solutions, cementing its position as a leader in the industry.

Union Cabinet Approves Rs 89,047 Crore Revival Package for BSNL, Including 4G/5G Spectrum Allotment

The Union Cabinet has approved a third revival package for BSNL worth Rs 89,047 crore for BSNL, a debt-ridden telecom company in India. The package includes equity infusion for 4G/5G spectrum allotment, increasing BSNL’s authorized capital. The government aims to transform BSNL into a stable telecom service provider focused on providing connectivity in remote parts of the country.

IKIO Lighting IPO Receives Substantial Investor Interest, Oversubscribed 3.61 Times

IKIO Lighting’s IPO generates buzz, oversubscribed 3.61 times, with strong investor demand. LED solutions provider seeks to raise Rs 350 crore for debt repayment, new facility setup, and corporate purposes. A diverse customer base and integrated manufacturing infrastructure contribute to investor enthusiasm.

“Balasore Incident and Kavach: India’s Automatic Train Accident Protection System”

“Learn about Kavach, India’s Automatic Train Protection (ATP) system, developed to prevent train accidents caused by human error. With its advanced technology and comprehensive safety features, Kavach aims to monitor and control train speed, ensuring safe operations.

SEC Seeks Asset Freeze and Repatriation in Binance Case

SEC Seeks Asset Freeze and Repatriation in Binance Case: The Securities and Exchange Commission (SEC) urgently seeks to halt Binance’s U.S. platform, freezing assets and repatriating customer funds. Alleging fraud and improper conduct, the SEC’s filing targets Binance’s founder and entities involved, aiming to safeguard assets and prevent evidence tampering.

India Holds Back Tailor-Made Incentives for US-based electric car manufacturer Tesla

Indian government refrains from providing tailor-made incentives to Tesla, the US electric car manufacturer, but states have the freedom to offer concessions. Tesla is showing interest in building a complete supply chain in India. Currently, imported cars as completely built units attract customs duties ranging from 60% to 100%.

SEC Files Lawsuit Against Coinbase, Alleging Unregistered Broker and Exchange Activities

SEC Files Lawsuit Against Coinbase for alleged unregistered broker and exchange activities, demanding a permanent halt. Coinbase’s shares fell 12% after the lawsuit, following a 9% drop due to charges against Binance. SEC claims Coinbase violated securities laws, while the company argues for transparent legislation instead of litigation

“2070 Health Receives $30M Investment to Transform Indian Healthcare”

India-based healthcare venture studio, 2070 Health, secures a substantial $30 million investment from W Health Ventures. The funding will drive innovation in healthcare, accelerating the development of groundbreaking companies that aim to make high-quality healthcare more accessible and affordable for one billion Indians.

Lentra Raises $27 Million in Extended Series B Round Led by MUFG Bank and Dharana Capital

Cloud-lending firm Lentra raises $27 million in an extended series B round led by MUFG Bank and Dharana Capital, bringing their total funding to $87 million. Lentra aims to empower lenders globally with its loan management system and expand its presence in Southeast Asia and the US.

Morgan Stanley Anticipates Temporary Earnings Dip for S&P 500 Companies in 2023, Followed by Strong Rebound in 2024

“Morgan Stanley predicts 16% drop in S&P 500 profits in 2023, followed by a strong rebound in 2024 due to accommodative Federal Reserve policy. Wall Street Bank anticipates earnings to

Byju’s takes Legal Action Against TLB Lenders, challenges debt- repayment acceleration

Byju’s Battles TLB Lenders in Court, Takes on Redwood: Edtech giant Byju’s challenges the acceleration of a $1.2 billion loan, files a complaint and disqualifies Redwood. Amidst allegations, funding rounds, and delayed filings, the company remains resolute in its fight for fair treatment and seeks an amicable resolution.

Apple Unveils New Mac Lineup: Introducing MacBook Air 15, Mac Studio, and Mac Pro, along with the Powerful M2 Ultra Chip

“Apple Unveils New Mac Marvels: MacBook Air 15, Mac Studio, and Mac Pro, Powered by Game-Changing M2 Ultra Chip! Experience brilliance with a 15.3-inch liquid retina screen, Thunderbolt ports, and Dolby Atmos sound. M2 Ultra combines two chips for unrivaled performance. Get ready to revolutionize your Mac experience!”

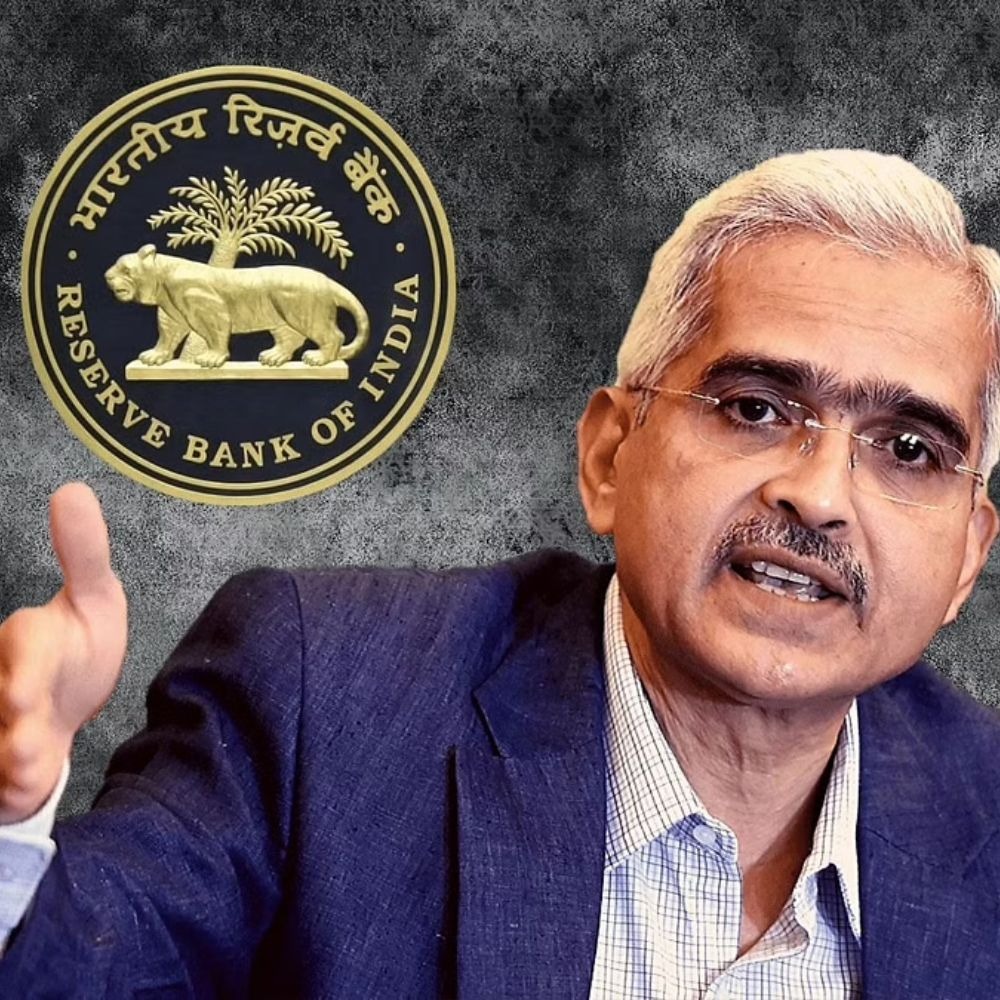

Reserve Bank of India Monetary Policy Meeting Likely to Maintain Repo Rate at 6.50% as GDP Growth and Inflation Improve

Reserve Bank of India Monetary Policy Meeting Likely to Maintain Repo Rate at 6.50%, as indicated by a poll of economists. Factors contributing to this decision include higher-than-expected GDP growth, easing retail inflation, and the scaling down of rate hikes by central banks in advanced countries. The RBI’s focus on liquidity management and concerns about the impact of the monsoon on food inflation also play a role. Market participants are eagerly awaiting the RBI’s comments on these matters.

Saudi Arabia Announces Unilateral Oil Cut to Boost Crude Prices, Uncertain Demand Outlook Persists

Saudi Arabia takes unilateral action to reduce oil supply, aiming to boost crude prices after previous OPEC+ cuts failed. Concerns over uncertain fuel demand persist due to economic weakness in the US and Europe, as well as China’s slower recovery. The decision reflects Saudi Arabia’s commitment to transparent and fair production targets. Lower oil prices have benefited global consumers, but the market remains uncertain about when the global economy will regain its thirst for fuel.

IndiGo set to Finalize Deal for 500 Airbus A320 Jets, Poised to Make History in Aviation Industry

IndiGo, India’s largest airline, is set to make aviation history with a potential deal for 500 Airbus A320 jets, surpassing previous records. The estimated $50 billion agreement, along with talks for wide-body jets, highlights the airline’s expansion plans amidst a rebound in India’s travel market. Find out more!”

Byju’s Plans $40 Million Quarterly Interest Payment on Troublesome $1.2 Billion Loan

Discover the latest update on Byju’s, India’s most valuable startup, as Byju’s Plans $40 Million Quarterly Interest Payment on Troublesome $1.2 Billion Loan. Learn about the challenges faced by the ed-tech firm, its negotiations with creditors, and the potential consequences of default. Stay informed with this important financial news.

Tata Group to Invest Rs 13,000 Crore in Gujarat for Lithium-Ion Cell Manufacturing Facility

Tata Group plans to invest Rs 13,000 crore in Gujarat to establish a lithium-ion cell manufacturing unit with an initial capacity of 20-gigawatt hours. The move aligns with India’s push for electric mobility and aims to meet the growing demand for lithium-ion batteries.

US Stocks Rose on Friday as the Labor Market Shows Signs of Moderating Wage Growth, Easing Rate Hike Concerns

US stocks climbed higher as a labor market report showed slower wage growth, easing fears of a rate hike. The Nasdaq surged to a 13-month high and marked its best winning streak since January 2020. Unemployment rose, indicating easing labor market conditions.

IRDAI Transfers Sahara India Life Insurance Business to SBI Life Insurance

IRDAI transfers Sahara India Life Insurance’s business to SBI Life due to financial and governance issues. SBI Life will assume the policy liabilities of SILIC, ensuring a smooth transition for its policyholders. SILIC’s deteriorating financial position and failure to comply with regulations necessitated the transfer.

Janus Henderson downgrades Investments in PharmEasy’s Parent Company, API Holdings to $2.7 billion

Janus Henderson downgrades investments in PharmEasy’s parent company, API Holdings, to $2.7 billion, less than half its September 2021 valuation. Other investors, including Neuberger Berman, have also reduced their investments

“Chennai’s Apollo Hospitals Plans to Raise $200 Million by Selling Stake in Apollo HealthCo”

During the quarter, Apollo 24/7’s Gross Market Value (GMV) exceeded expectations, reaching ₹1,630 crore compared to the anticipated ₹1,500 crore. Chennai’s Apollo Hospitals plans to raise approximately $200 million in

Unified Payment Interface (UPI) payments in May touched Rs.14.3 trillion in terms of value; a 2% rise compared to April

The rise comes at a time when the government is pushing to bring tax collection across various segments under digital payment. In March 2023, the figures stood at 8.68 billion

RIL to launch Ajio Street, a new marketplace for low-priced, longtail fashion items

Under the zero-commission model, the platform would not charge sellers any commission. RIL to launch Ajio Street, a new marketplace for low-priced, longtail fashion items. Further, the e-commerce platform will

Reliance Industries taps Hitesh Sethia; McLaren Strategic Ventures as CEO

Jio Financial “will be a technology-led business, delivering financial products digitally by leveraging the nationwide Omni channel presence of Reliance’s consumer businesses,” said Mukesh Ambani in a statement last year

Union cabinet gives nod to purchase of 70 HTT-40 trainer aircraft from HAL

The HTT-40 is a turboprop aircraft, designed to have good low-speed handling for better training effectiveness. This fully aerobatic, tandem-seat, turbo trainer has an air-conditioned cockpit, modern avionics, hot refueling,

Dallas and Hyderabad-based VC firm DVC announces first close of INR 350 Cr India fund.

The fund has so far invested in five homegrown enterprise tech startups over the past 12-14 months. These include upskilling platform Disprz, anti-money laundering startup IntelleWings, transaction monitoring platform VuNet,

Material provider Brick&Bolt secures $10Mn in Series A funding