With the introduction of UPI Autopay on the platform, the company aims to extend the convenience of UPI to subscription-based purchases, as well as enable local developers to grow their subscription-based businesses on Google Play, Agarwal added.

Amid the ongoing controversy around Google’s Play Store billing policy, the tech giant has introduced UPI Autopay as a payment option for subscription-based purchases on Google Play in India. Introduced under UPI 2.0 by NPCI, UPI Autopay helps customers make recurring payments using any UPI application that supports the feature.

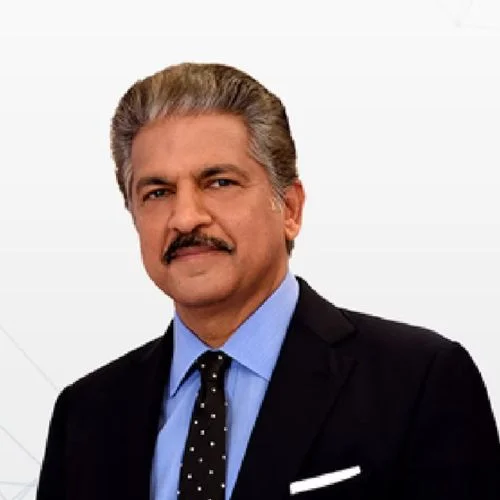

“We are always looking at adding popular and effective forms of payment around the world to ensure people can pay for apps and in-app content conveniently,” Saurabh Agarwal, Head of Google Play Retail & Payments Activation – India, Vietnam, Australia & New Zealand, said.

With the introduction of UPI Autopay on the platform, the company aims to extend the convenience of UPI to subscription-based purchases, as well as enable local developers to grow their subscription-based businesses on Google Play, Agarwal added.

With UPI Autopay, users need to tap on the payment method in the cart, select “Pay with UPI”, and then approve the purchase in their supported UPI app after selecting a subscription plan for purchase.

The move comes days after the Competition Commission of India (CCI) imposed a fine of INR 936 Cr for abusing its dominant position with respect to its Play Store policies. After its investigation, the CCI concluded that app developers were compulsorily required to use Google Play Billing System (GPBS) for Google Payments Terms of Service-Seller (IN) (for IAPs) (IAPs) and app sales.

Meanwhile, the Reserve Bank of India’s (RBI’s) new rules for storage of card details came into effect from October 1. Under the new rules, only the card network, the card issuing bank and the end user will know the actual card details. Merchants, payment gateways/ payment aggregators, and acquiring banks have to use tokenized data and cannot store card details.

According to industry experts, tokenization will have an impact on subscription-based services, especially in the short term. The launch of UPI Autopay is timely as many users have also complained of failure of their recurring payments.

It is to be noted that UPI recorded 731 Cr transactions in October 2022 – a 7.8% month-on-month (MoM) growth from September 2022 when it registered 678 Cr transactions. The transaction value also increased 8.52% MoM to INR 12.11 Lakh Cr from INR 11.16 Lakh Cr. PhonePe, Google Pay, and Paytm together held more than 95% share of the UPI market in October 2022.