Walk into any Indian home, office, or industrial area, and chances are spotting a Havells product quietly doing its job. Havells India Ltd has become part of the everyday life of India’s infrastructure. What makes this journey remarkable is not just its growth but also its consistency, decades of disciplined execution, brand building, and timely innovation.

Against the backdrop of rising infrastructure spending, demand for housing facilities is expanding, and energy efficiency is becoming a national priority. So, Havells has positioned itself at the point of power, sustainability, and bright living to facilitate these needs.

The Origin Story of Havells India Ltd

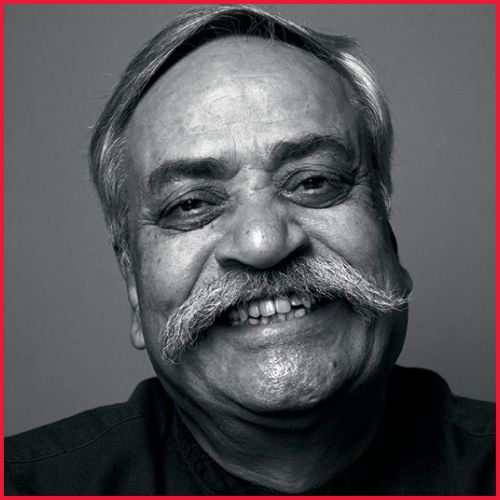

Havells’ story began in 1958 when Qimat Rai Gupta, founder of Havells India Ltd, acquired a small electrical goods company in Delhi, which has now turned out to be a complete integrated electrical equipment manufacturer.

The turning point for the company came in the 1990s, when it aggressively focused on manufacturing quality, brand ownership, and nationwide distribution of its products. Initially known for switchgears, Havells has expanded organically into cables, wires, lighting, fans, and other consumer appliances, and has built a diverse product portfolio.

Later in 2017, through a strategic integration with Lloyd Electric, Havells entered the large consumer appliances category, strengthening its presence in other home appliances such as ACs and washing machines.

Company Name: Havells India Ltd

Founded in: 1958

Headquarters in: Noida, Uttar Pradesh

Chairman & Managing Director: Anil Rai Gupta

Manufacturing Units: 14+ across India

Market Capitalisation: More than ₹80,000 crore (approx)

Employees: Over 10,000

Havells’ Key Milestones

| Year | Achievements |

| 1958 | Havells began as a trading business |

| 1992 | Shift from trading to the manufacturing of products |

| 2007 | Acquisition of Sylvania, a global lighting brand |

| 2017 | Acquisition of Lloyd Consumer Durables |

| 2020-24 | Expanded into premium appliances and ESG-focused |

Havells Vision in the Market

Under the leadership of Anil Rai Gupta, Chairman and Managing Director of Havells, the company adopted a professional management approach, technology-driven manufacturing, and a consumer-first approach. Its long-term vision has been a significant factor in balancing growth with profitability, making it a trusted business model.

Havells India Ltd Business Model

Havells has a substantial domestic market share across multiple categories and export business with over 50 countries, including the Middle East, Africa, Europe, and Southeast Asia. The company operates on a ‘vertically integrated business model,’ which prioritises quality, control, and scalability.

What is a Vertically Integrated Business Model?

Unlike its competitors, Havells strategically invests in its own manufacturing facilities. The company handles its own manufacturing and distribution, from raw materials to retailers. This strategy allows a tighter control over:

- The quality of products

- Cost efficiencies

- Speed to the market (from manufacturing to the market)

- Customisation for Indian household needs

Havells Innovation Strategy

Innovation remains central to Havells’ competitive strategy. The company gives priority to R&D and invests in good capital to focus on:

- Energy-efficient products

- IoT-enabled smart solutions

- Aesthetic designs that meet modern homes

Distribution and Retail Network in the Market

Havells India Ltd is one of the deepest electrical distribution networks in India, with over 7,000 distributors and 100,000+ retail representatives.

The company integrates:

- Traditional retail channels

- Exclusive brand stores and outlets

- Modern trades

- E-commerce platforms

These seamless commerce practices and diversified route-to-market reduce dependency risks and increase reach.

Havells India Ltd Strategic Insights

(Image Source: Industry Buying)

Havells as a Growth Engine

Havells places its primary focus on emotional marketing, often resonating with people by offering aspirational products rather than commoditised ones. The family-centric, aspirational storytelling has transformed electrical goods into everyday lifestyle products. Its iconic campaigns, like “Shock Laga?”, are a plus point in reshaping its electrical segment.

Made in India Advantage

Over 90% of manufacturing is in India, reducing the risk of foreign exchange fluctuations and supply disruptions. Instead, it enables cost efficiency, control over quality, faster innovation, and resilience in the supply chain.

Premiumisation Strategy

Havells is shifting consumers from commercialised products to design-led premium offerings, which significantly boost margins. It also includes the opening of exclusive brand outlets, modern trade, e-commerce platforms, and other leveraging strategies.

Product Diversification

Havells reduces fluctuations by operating across B2C and B2B categories and balancing both infrastructure exposure with evolving consumer demands.

Industry analysts project India’s electrical equipment market to grow at a 9%–10% CAGR in revenue over the next five years, driven by housing, electrification, and infrastructure. According to the industry analysts, Havells’ balance sheet strength and execution capability are long-term positives.

Havells Revenue Streams and Products

(Image Source: Indian Retailer)

Havells revenue is a mix of different consumer and industrial categories, such as:

- Electrical Consumer Durables (ECD)

This category is of high-margin and high-volume, driven by urbanisation and housing growth. It includes products such as:

- Fans

- Air conditioners

- Water heaters

- Kitchen appliances

- Personal grooming products

- Switchgear and Industrial Products

This product category serves in infrastructure, real estate, and industrial projects. It gets benefits from India’s economic cycle and gains from:

- Power distribution upgrades

- Smart city projects

- Renewable energy installations

- Lighting and Fixtures

From LED bulbs to architectural lighting, Havells transitioned early into this category to maintain its relevance in a competitive market. This transition occurred due to increased pricing pressure on traditional lighting.

- Cables and Wires

Havells is among the top two in India’s organised cables and wires market, and generates a good amount of revenue from this segment, especially from the construction and power projects. This segment benefits from:

- Infrastructure spending

- Real estate revival

- Industrial electrification

- Lloyd Consumer Appliances

Air conditioners and washing machines under the Lloyd brand helped Havells significantly expand its market.

| Products | Approx Revenue Share (FY2024) |

| Electrical consumer durables | 40 – 45% |

| Cables and wires | 30 – 35% |

| Switchgears | 15 – 18% |

| Lighting | 5 – 7% |

Havells Financial Performance

Havells India Ltd has delivered a remarkable double-digit compound annual growth rate (CAGR) in revenue over the last decade. The company’s revenue was supported by its premiumisation and expansion in volume.

Products Profits and Margins

The operating product margins remain resilient because of:

- Brand power in pricing and consumer strategy

- Backward integration

- Optimisation of costs

Market Cap and Net Worth

As of FY2024, Havells had a market capitalisation exceeding ₹80,000 crore and became India’s most valuable electrical equipment company, reflecting strong investor confidence in its governance standards.

Havells vs Competitors

Here is how Havells stands out in the market because of its:

- Strong brand recall

- Wide product portfolio

- Distribution in depth

- Consistency in innovation

The factors above are the main reasons consumers prefer Havells over other brands. Here are the major competitors of Havells India Ltd:

- Anchor (Panasonic)

- Schneider Electric

- Polycab

- Bajaj Electricals

Today, Havells is listed on the BSE and NSE and is part of the NIFTY 50, reflecting its growth, governance standards, and investor confidence.

Challenges and Risks of Havells Business

Some of the significant challenges and risks faced by Havells are:

- Price and raw-material instability, such as copper and aluminium, can impact margins.

- Intense competition in both the domestic and global markets keeps the pricing pressure high.

- Fluctuations in the demand. Consumer durables are often sensitive to interest rates and economic sentiment.

Havells Business Benefits

Even with specific challenges, here are a few significant benefits:

- Havells has a strong market position, and only a few Indian electrical brands command the reliability and trust that Havells does.

- Strong supply chain and integrated operations ensure the company’s growth and scalability.

- Havells focuses on innovation-driven designs, efficiency, and technology, which remain core to its strategy.

Havells Future Plans

Looking forward, the growth outlook of Havells is:

- Expansion into premium, innovative products, such as smart switches, energy-efficient appliances, and connected homes, is a key focus area.

- Sustainability and focus on the Environmental, Social, and Governance (ESG), to reduce carbon footprint, increase renewable energy usage, and enhance water management.

- A growth strategy for exports in emerging markets remains a significant opportunity to expand the business.

- Digital transformation in data analytics, automation, and AI-driven demands is growing across operations.

Conclusion

Havells India Ltd is no longer just an electrical equipment manufacturer. Instead, it is a consumer-centric, innovative, and ready-for-the-future enterprise. Its availability of multiple revenue streams, substantial brand equity, and disciplined capital allocation position it well to benefit from India’s long-term growth story.

For investors, competitors, and industry observers, Havells demonstrates how an Indian company can grow through sustainable initiatives while remaining profitable and relevant in the market.

FAQs

Q1. What is the operating business of Havells India Ltd Model?

A: Havells’ business operates in electrical consumer durables in both the residential and industrial markets.

Q2. How does Havells generate its revenue?

A: The company’s revenue comes from electrical consumers.

Q3. What makes Havells stand out from the competition?

A: Its vertically integrated manufacturing, brand recall, broad network dealing in the market, and other factors set it apart.

Q4. What is the future of Havells in the market?

A: Premiumisation, innovative products, expansion in exports, sustainability product initiatives, and others are the key drivers of Havells’ future.

Q5. Is Havells financially strong?

A: Yes, Havells is a financially strong company by maintaining a low debt ratio, substantial revenue, and healthy profitability.