Systematic Investment Plan (SIP) is an apt financial planning mechanism that assists you to generate and produce wealth, by speculating small amounts of money every month, over a while. Investing at an early stage of life lets you experience the benefits and advantages of two effective strategies, rupee cost averaging and the power of compounding. A systematic Investment Plan (SIP), is an excellent way of investing in mutual funds regularly and systematically. A SIP works on the central rule of investing regularly, empowering you to build wealth over time. Under SIP, you can invest a fixed sum every quarter, month, or week as per your suitability.

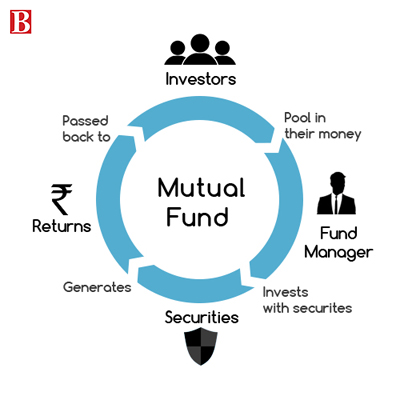

SIP is a very reliable method to invest in mutual funds. If you invest in a mutual fund lump sum, contingent on the market condition, you could cease paying a very high price for a mutual fund. To dodge this, one should invest in mutual funds when the markets are not exceeded. This entails a good understanding of the markets. This concludes as timing the market.

A person need not worry about timing the market when investing via SIP. In SIP, you fund a small amount of money every month. In some months, the price will be huge while in some months, the price will be low. If you contemplate the long term, the price you pay will be an aggregate of high and low. Therefore, you will not pay a large or exceeded price for the mutual if you invest via SIP. This is described as rupee cost averaging.

Systematic Investment Plans (SIP) in mutual funds have grown widely in recent years. Particularly, after amicable inflows via SIPs since June 2020, the month of March observed a flood in inflows. According to the Association of Mutual Funds of India (AMFI), inflows into MFs via SIPs endured at Rs 9182 crore in the month of March.

One can withdraw money from a mutual fund scheme anytime as it is unrestricted. SIPs can proceed at the same time. As well as it may diverge from the grown balance. Fund houses usually follow the FIFO (First In First Out) order for withdrawals. So the units funded first can be withdrawn. Withdraw in advance as much as likely to dodge paying Capital Gains Tax (15% if withdrawn earlier in the year).

Many people heeded a deterioration in their income due to the expansion in covid-19 cases last year. Many lost their jobs. At such times you can delay SIPs for a few months. You can restart your SIPs once your cash flow position has expedited. For this, you require to fill a form. It has various options which assist you to pause the investment flow. You can pause SIPs for 3-6 months regulating what you want. The maximum time granted now is 6 months. You can invest a similar fund in SIPs that are already running.

Like huge investments, your SIP payments are subjected to Capital Gains Tax Lock Inns. Currently, all investments in an equity-linked savings plan are secured for three years. This also pertains to your SIPs. If you want to withdraw the amount secured by ELSS all your SIP instalments can be taken only after the fulfilment of three years of lock-in.