The securities market in India has undergone remarkable changes in the past. Thanks to the economic reforms of 1991, dematerialization revolution, reduced tax slabs and various other initiatives, the National Stock Exchange is the 8th largest stock exchange in the world in terms of market capitalization. On one hand, there is an exponential growth in the number of investors and an increased investor confidence, not only of retail investors but also of foreign portfolio investors and qualified institutional investors, increased volatility and risk of capital losses poses a great threat to all the investors. Hence, mutual funds act as a one stop solution to cater the needs of risk averse investors.

Investing directly in the share market needs knowledge, learning about the market, companies, and global indicators. A common man might not have adequate knowledge of all these attributes. So investing through mutual funds might be the best alternative to investing in the stock market.

Table Of Contents

- What is Mutual Funds

- Framework of mutual Fund

- Types of Mutual Funds

- Top Mutual Funds in India

Conclusion

What is a Mutual Fund?

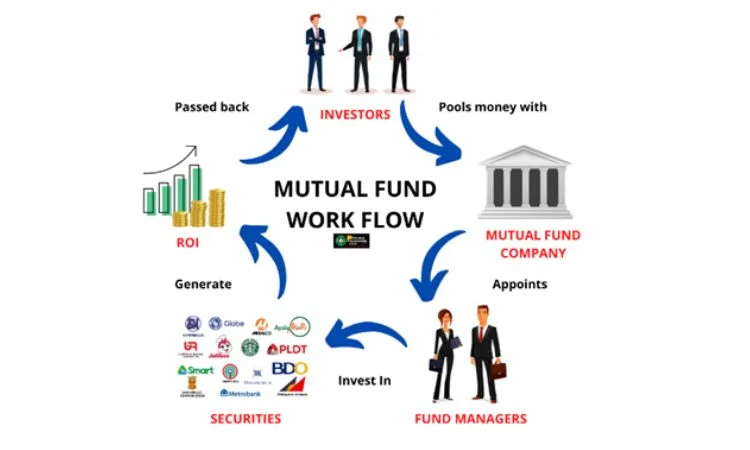

Mutual funds create a pool of funds generated from a number of investors to invest in securities like stocks and debts. Over a period of time, any returns generated out of such investments are distributed amongst the investors. As a token of security, the investors are issued unit certificates. The investors have the choice to either transfer, retain, or redeem these units depending upon the time of fund.

In other words, Mutual fund means a fund established in the form of trust to raise money through sale of units to the public under one or more schemes for investing in securities, including money market instruments.

Framework of Mutual Fund

Essentially, there are 4 key components in a mutual fund

1. Asset Management Company

An asset management company is a company which manages the assets or funds of the mutual fund. It formulates schemes, raises money against the issue of units etc.

2. Trustee

A trustee is a member of the board of trustees who holds the property of mutual fund trust for the benefit of unit holders. He maintains a fiduciary relationship with investors that is a relationship based on trust and confidence. He has the administrative power over the fund and can be an individual, company or bank. He acts as custodian of securities.

3. Sponsor

Sponsor is the person who establishes the mutual fund. As per SEBI rules, sponsors shall have at least 40% stake in mutual funds. He should have at least 5 years of experience as a fund manager with experience in handling funds of value of at least 5000 crore rupees.

4. Unit holders

A unitholder is an investor who owns the units issued by trust like a real estate investment trust or a master limited partnership. The securities issued by a trust/mutual fund are called units and investors in units are called unitholders.

Types of mutual fund

Broadly mutual funds can be classified into one time investment and systematic investment plan or SIP. As the name suggests, one time investment involves investment of a lump sum amount. On the other hand, under SIP a specified amount is invested every month and returns are compounded depending upon stock market returns. However, the unitholders have diverse financial interests and needs like regular return, capital appreciation, and hence, mutual funds can also be classified as

1. Income oriented mutual fund: It primarily offers fixed income to investors. Naturally the main securities in which the investments are made by such funds are fixed yielding ones like bonds.

2. Growth oriented mutual funds: These funds offer growth potentialities associated with investment in the capital market. Hence, with a view to satisfy the growth needs of investors, they primarily concentrate on the low risk and high yielding spectrum of equity scripts of the corporate sector.

3. High growth schemes: It is an investment in high risk and a high return with a high degree of capital appreciation generating securities in which aggressive investors are willing to invest.

4. Tax saving schemes: These schemes offer tax rebates to investors under tax laws as prescribed from time to time. For example: Equity linked savings schemes and pension schemes.

5. Hybrid mutual funds: These funds cater to both the investment needs of prospective investors-namely fixed income as well as growth orientation. Therefore, the investment target of these schemes are a judicious mix of both the fixed income securities like bonds and debentures and also sound equity scrips.

Top Mutual Funds in India

Groww: Groww is an investment platform that allows users to invest in the stock market, derivatives, and other segments through its platform. In 2023, GRoww has overtake Zerodha becoming the top active users stock broker platform in India.

Fisdom: They also provide wealth management services which provide wealth management services to users without any cost. Company has more than 1 million active users and revenue of around $2.39 million in F.Y 2021.

Rupee Vest: Rupee Vest provides hassle free and user friendly investing options to the investors to invest in top mutual funds and stock markets

ET money: ET money is a Times of India Group which offers financial products services such as mutual fund investments and detailed research for the users. The app also offers investing research, insurance and SIP plans

Funds India: Funds India provides the best experience to users for investing in mutual funds with investment advisors based on detailed research.

Orowealth: The startup was founded by Nitin Agrawal, Vijay Kuppa, Yogesh Powar and Swati Agrawal in 2019. Oro wealth provides users a friendly platform to invest in all types of mutual funds and segments of stock markets.

Jama : Jama provides users an opportunity to invest in best and top return giving mutual funds with detailed research.

Mutual Fund Wala: Company offers more than 2000 schemes of mutual funds to invest in. Mutual fund Wala provides users with an investment plan to invest in mutual funds based on different parameters.

Nivesh: Nivesh provides different opportunities to invest in Mutual funds based on your requirement . The company helps lower tier city population to invest with ease and partnership with local distributors in a strategy of Nivesh. In the future the company is planning to add insurance and digital gold to its offering for users.

Scripbox: The startup is based in Bangalore and provides wealth management using technology and data. The company offers a calculator tool to plan one’s financial goal and returns

The top mutual fund startups allow investors to invest directly in top mutual funds in India. Every startup has its own offerings and ancillary services provided to users. The startup has grown and is increasing the number of customers and active users of their platforms.

Conclusion-Where to invest?

Today’s investor is stuck in the dilemma of where to invest? On one hand there are a plethora of conventional investment options with guaranteed return like pension plans, gold, etc. while on the other hand there are new investment options with higher return like stock market investments, commodities market, futures and options etc.

Mutual funds cater to all needs. It provides higher return to investors as fund managers who are industry experts invest money into the market and it enables small investors to invest in high value, stable securities through pooling

of funds. Hence, the quite optimistic mutual fund industry which is expected to reach 918.54 trillion by the end of financial year 2024 will be fueled by growing inclination towards SIPs and saving culture among people.