Source: business-standard

Investing in India has come to the forefront, beyond just the financial sector or wealthy individuals who have the ability to invest. As digital platforms have become accessible and available, integrating mobile apps, digital KYC, and the availability of information to invest, salaried employees, freelancers, small business owners, and even students are now regularly investing.

With rising costs associated with inflation, improved lifestyles, and increased longevity, it is not enough simply to save money; the money invested in a traditional savings account will continue to decrease in value over time. This is why it is important to learn how to invest in Systematic Investment Plans (SIPs), equities (stocks), and mutual funds; investing has become an essential skill of modern living.

The goal of this step-by-step investment guide for the year 2026 is to help both new investors and working professionals learn to invest simply and clearly. You do not need to have a finance background to understand this guide; you will, however, need to have the motivation to take action.

Step 1: Define Clear Financial Goals Before You Invest

Every successful investment plan starts with a clear “why.” Investing without goals often leads to confusion, panic selling, or unrealistic expectations.

Understanding Financial Goals

Financial goals differ from person to person, but they usually fall into three broad categories:

- Short-term goals (1–3 years): Emergency fund, travel, gadgets, marriage expenses

- Medium-term goals (3–7 years): Buying a car, starting a business, and higher education

- Long-term goals (10+ years): Retirement, children’s education, wealth creation

Each goal needs a different investment approach, which is why blindly copying others’ portfolios rarely works.

Step 2: Assess Your Risk Appetite and Investment Time Horizon

Risk is not about how much you want to earn; it’s about how much volatility you can tolerate without panic.

Types of Risk Profiles

- Conservative investors prioritize capital protection and steady returns

- Moderate investors seek a balance between growth and stability

- Aggressive investors accept short-term volatility for higher long-term gains

Your age, income stability, family responsibilities, and time horizon determine your risk profile. In 2026, understanding this is crucial because markets are influenced by global interest rates, technology disruption, and geopolitical factors.

Step 3: SIPs 2026 – The Most Reliable Way to Start Investing

Source: tatacapitalmoneyfy

Systematic Investment Plans (SIPs) continue to be the most popular investment method in India and for good reason.

Why SIPs Work So Well

SIPs allow you to invest a fixed amount regularly, usually monthly, into mutual funds. This method reduces market timing risk and builds long-term discipline.

Key advantages of SIPs in 2026:

- Affordable entry (starting from ₹500 per month)

- Rupee cost averaging, which lowers the average purchase cost

- Power of compounding over long periods

- Ideal for salaried individuals and beginners

Smart SIP Strategy for 2026

Instead of trying to predict market highs and lows:

- Start early and stay invested

- Increase SIP amounts annually (Step-Up SIP)

- Focus on consistency, not short-term returns

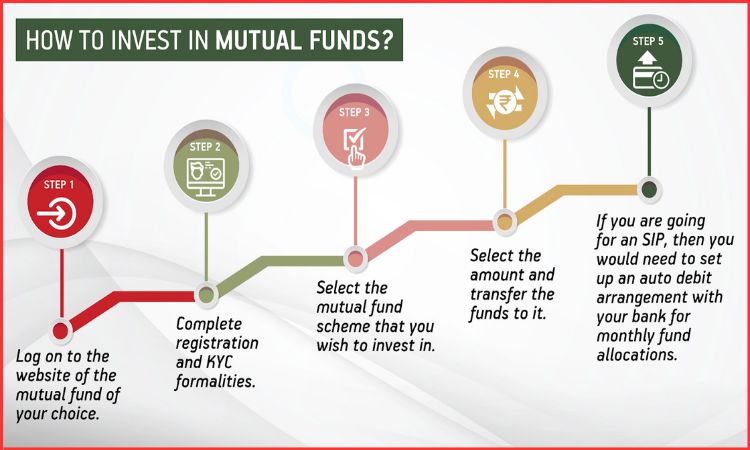

Step 4: Mutual Funds 2026 – Choosing the Right Fund Types

Source: mutualfund.adityabirlacapital

Mutual funds pool money from multiple investors and invest across assets, making them suitable for those who want diversification and professional management.

Major Mutual Fund Categories Explained Clearly

| Fund Type | Purpose | Risk Level |

| Equity Funds | Long-term wealth creation | High |

| Hybrid Funds | Balance between growth & stability | Medium |

| Debt Funds | Capital preservation & steady income | Low |

| Index Funds | Market-linked passive investing | Medium |

| Thematic Funds | Sector-focused exposure | High |

In 2026, index funds and low-cost equity funds are gaining traction due to transparency and lower expense ratios.

Also Read: Mutual Fund Investing in India 2026

Step 5: Stocks in 2026 – Direct Equity Investing with Discipline

Source: fity.club

Direct stock investing offers higher return potential but requires patience, research, and emotional control.

How to Approach Stock Investing Safely

Rather than chasing trending stocks or social media tips, focus on:

- Companies with strong fundamentals

- Consistent revenue and profit growth

- Ethical leadership and good governance

- Long-term relevance of the business

Promising Sectors to Watch in 2026

- Renewable energy and clean tech

- Banking and financial services

- Healthcare and pharmaceuticals

- Technology and AI-driven companies

- Infrastructure and manufacturing

Beginners should limit stock exposure initially and gradually increase it with experience.

Step 6: Asset Allocation – The Backbone of Risk Management

Asset allocation is the process of spreading investments across different asset classes to reduce risk.

Sample Asset Allocation Models for 2026

| Investor Type | Equity | Debt | Others |

| Conservative | 30% | 60% | 10% |

| Moderate | 50% | 40% | 10% |

| Aggressive | 70% | 20% | 10% |

This balance ensures that even if one asset underperforms, others can support overall returns.

Step 7: Mistakes Investors Must Avoid in 2026

Many investors lose money not due to bad markets but due to emotional decisions.

Common mistakes include:

- Investing based on rumors or social media advice

- Panic selling during market corrections

- Ignoring diversification

- Frequently switching funds

- Investing without an emergency fund

Staying calm and disciplined often matters more than market knowledge.

Step 8: Tax Planning and Investment Efficiency

Good investing is incomplete without tax planning. Reducing tax outflow increases real returns.

Tax-Efficient Investment Options

- ELSS Mutual Funds for tax savings under Section 80C

- PPF and NPS for retirement planning

- Long-term equity holding for favorable capital gains taxation

Aligning investments with tax rules improves overall financial efficiency.

Conclusion

Investing in 2026 is not about finding shortcuts or “quick wins.” It is about building a structured, goal-oriented investment plan that grows steadily over time.

By combining SIPs for discipline, mutual funds for diversification, and stocks for growth, investors can create wealth without unnecessary stress. The key lies in starting early, staying consistent, and continuously learning.

FAQs

Q1. Is 2026 a good year for first-time investors?

Yes. With improved access to financial tools and information, 2026 is an excellent time to start investing systematically.

Q2. How much should beginners invest every month?

Start with an amount that feels comfortable. Even small monthly investments can grow significantly over time.

Q3. Should I invest in stocks if I am new to investing?

Beginners should start with mutual funds and gradually explore stocks once they understand market behavior.

Q4. How long should I stay invested to see good returns?

Long-term investing (10+ years) offers the best chance to benefit from compounding and market growth.

Q5. How often should investments be reviewed?

A yearly review is sufficient unless there is a major financial or life change.