Source: CNBC TV18

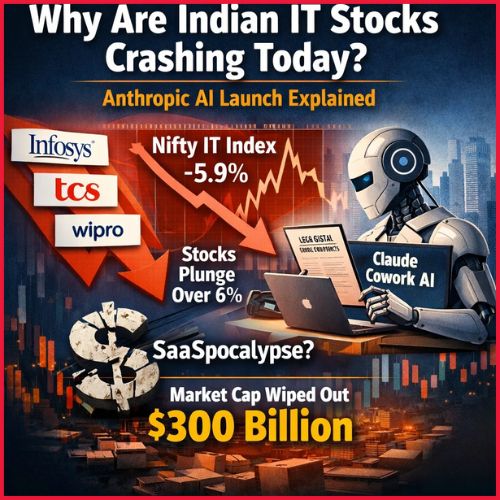

The Indian IT sector, long considered the backbone of the global digital economy, faced a brutal reality check this week. On Wednesday, February 4, 2026, investors watched in shock as industry titans like Infosys, TCS, and Wipro saw their share prices plunge by as much as 6%. This wasn’t just a minor market correction; it was a sector-wide meltdown triggered by a single announcement from the US-based AI powerhouse Anthropic.

The Catalyst: From Chatbots to “Digital Employees”

The panic stems from the launch of 11 new “agentic” plugins for Claude Cowork. Unlike previous AI updates that focused on simple chat or coding assistance, these plugins transform Claude into a domain expert capable of executing complex, multi-step workflows autonomously.

The most disruptive feature is a specialised legal plugin that automates contract reviews, NDA triage, and compliance tracking. By moving from a “model provider” (the engine) to the “application layer” (the actual work), Anthropic is now directly competing with the service-based business models that Indian IT firms have relied on for decades.

Why the Market is Calling it a “SaaSpocalypse.”

The term “SaaSpocalypse” began trending on Wall Street earlier this week as software giants like Salesforce, Adobe, and ServiceNow saw their valuations crater. The fear is simple: if an AI agent can navigate a CRM, draft a legal brief, and manage data analysis for $20 a month, the premium “per-seat” pricing of traditional software and the “per-hour” billing of IT consultants become obsolete.

Key Market Data (Feb 4, 2026):

- Nifty IT Index: Plunged 5.9%, its steepest fall in nearly a year.

- Persistent Systems: Led the crash, dropping over 7.5%.

- Infosys & TCS: Both behemoths shed over 6% in intraday trading.

- Global Impact: Nearly $300 billion in market cap was wiped out globally in 24 hours.

The “Anti-AI Trade” Under Threat

For the past year, many analysts labelled Indian IT as an “Anti-AI Trade,” a safe haven where human oversight and legacy system maintenance would protect companies from automation. However, Anthropic’s use of the Model Context Protocol (MCP), which allows AI to “talk” directly to enterprise data, has shattered that narrative.

Investors now worry that the “human-in-the-loop” model, which provides millions of jobs in India, is being bypassed. Brokerages like Jefferies have already begun reducing their exposure to the sector, citing a permanent shift in how global corporations allocate their tech budgets.

The Survival Strategy: Adapt or Vanish

While the sell-off was “violent,” some industry veterans argue the market is overreacting. They point out that AI agents still lack the “enterprise-grade” accountability and security that firms like TCS provide.

However, the message for 2026 is clear: The “outsourcing” era is ending, and the “integration” era has begun. For Indian IT to regain its footing, it must stop selling man-hours and start selling AI-managed outcomes.