In the most recent dispute, MEMG Family Office, led by Ranjan Pai, filed arbitration proceedings against Byju in March for allegedly failing to return $42 million in loans through a pre-arranged transfer of certain shares in Byju’s group firm, Aakash Education. An arbitrator has requested that some shares of a group entity not be sold, according to a private order. The edtech company has been dealing with allegations of mismanagement, and CEO Byju Raveendran’s net worth has dropped dramatically as a result. Byju’s, previously India’s hottest company valued at $22 billion, is now worth approximately $250 million.

In the most recent dispute, MEMG Family Office, led by Ranjan Pai, filed arbitration proceedings against Byju in March for allegedly failing to return $42 million in loans through a pre-arranged transfer of certain shares in Byju’s group firm, Aakash Education.

Byju’s, an edtech firm, broke the conditions of $42 million loans and was directed by an arbitrator not to sell some shares of a group firm, according to a private order, the latest blow for the company, which is already facing mismanagement claims.

Byju’s was India’s largest startup until 2022, when it was valued at $22 billion, but its fortunes have dwindled amid an auditor exit, regulatory probes, and requests from investors to fire CEO Byju Raveendran for mismanagement. The company, which is currently valued at roughly $250 million, denies any wrongdoing.

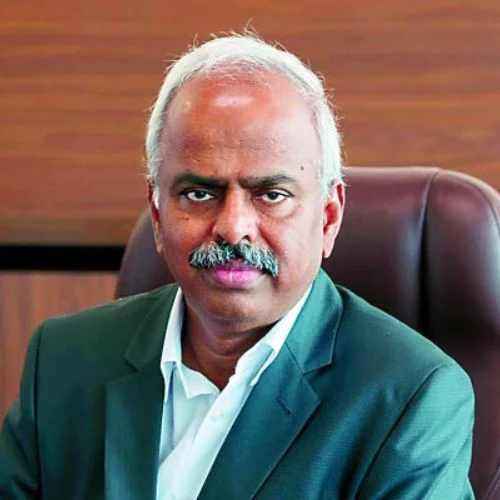

In the most recent dispute, MEMG Family Office, run by Indian billionaire doctor Ranjan Pai, filed arbitration proceedings against Byju in March for allegedly failing to return $42 million in loans through a pre-agreed transfer of certain shares in Byju’s group firm, Aakash Education.

According to the April 4 judgment, an arbitrator appointed under the norms of the Singapore International Arbitration Centre has ordered Byju’s not to sell 4 million shares of Aaaksh, which amounted to a 6% stake in the company last year under the loan agreement.

A “case of breach of the loan agreement” has been established, according to Ritin Rai, the emergency arbitrator, in his order, which Reuters is reporting for the first time.

Byju’s did not return a request for comment. According to a source close to Byju, the order is not detrimental to the company, and the company is in discussions with MEMG to settle the issue.

During the arbitration proceedings, Byju’s claimed it was unable to secure the requisite authorization from certain investors in time to transfer the shares to MEMG, according to the order.

Byju has also been unable to pay employees in recent months because it is unable to access newly raised funds owing to a legal battle with some of its investors, Raveendran stated in an internal memo last month, according to Reuters.

In February, Byju’s US branch filed for Chapter 11 bankruptcy in a Delaware court, alleging liabilities ranging from $1 billion to $10 billion.