The demerger was to transform the multi-sector conglomerate structure of the company into two separate sector-focused – financial services and pharmaceuticals — listed entities and command leadership positions in those sectors.

Piramal Enterprises (PEL) has received shareholders’ approval for the proposed demerger of its pharmaceuticals business and simplification of the corporate structure. They supported the move with a whopping 99.99% votes. The company received the shareholders’ nod at a court-convened meeting held on Tuesday, PEL said in a regulatory update.

The demerger was to transform the multi-sector conglomerate structure of the company into two separate sector-focused – financial services and pharmaceuticals — listed entities and command leadership positions in those sectors. The demerger follows the group’s acquisition of DHFL for Rs 34,250 crore, which was completed in September 2021.

Earlier in October 2021, PEL received board approval for a scheme of arrangement between the company, Piramal Pharma (PPL), Convergence Chemicals (CCPL), Hemmo Pharmaceuticals (HPPL), PHL Fininvest (PFPL) and their respective shareholders and creditors.

According to the contours of the agreement, the pharmaceuticals business would be demerged from PEL and consolidated under Piramal Pharma. Post the demerger, Piramal Pharma would be listed on NSE and BSE.

The two operating subsidiaries — Hemmo Pharma (focused on peptide Active Pharmaceutical Ingredients development and manufacturing capabilities) and Convergence Chemical (setup for development, manufacturing and selling speciality fluorochemicals) — will be merged with Piramal Pharma to create a consolidated listed pharma entity.

Further, the non-banking financial company PHL Fininvest will be merged with PEL to create a large and listed NBFC. The merged housing finance company, including the DHFL acquisition, will become a wholly-owned subsidiary of PEL. The company would become a listed NBFC, focusing on retail and wholesale financing, while Piramal Pharma would become a listed pharma company offering a portfolio of services.

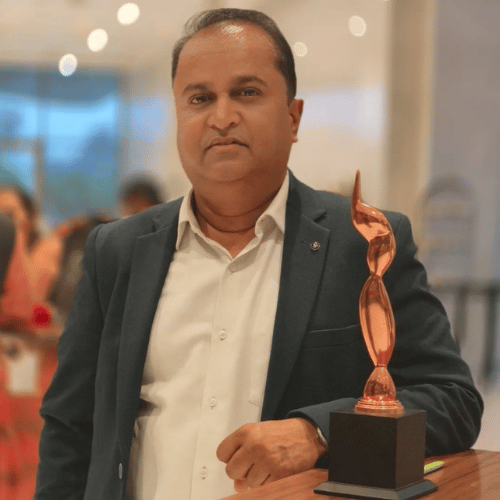

In June this year, Piramal Group chairman Ajay Piramal said its proposed demerger was on track and was expected to be completed by the third quarter of this financial year.