Healthcare insurer Niva Bupa has announced a corporate agency partnership with IDFC First Bank to provide best-in-class health insurance solutions to its banking customers.

Vikas Sharma, head of Wealth Management & Private Banking, at IDFC First said, “Our Bank’s advanced digital capabilities combined with Niva Bupa’s best-in-class health insurance solutions will enable us to deliver an exceptional proposition to our customers. The partnership will empower the two institutions to serve customers better and help them lead healthier lives. Niva Bupa is known for introducing some of the most innovative health insurance benefits across the industry. Their ability to design and launch products for different customer segments will help us offer customized offerings to our customers depending on their requirements and healthcare needs.”

Niva Bupa and IDFC Bank are collaborating to create a powerful digital platform that provides seamless customer onboarding and a superior customer experience. Niva Bupa has developed InstaInsure, an exclusive digital app that provides an intuitive health insurance purchasing experience and streamlines the enrollment process. IDFC Bank customers also benefit from services such as pre-approval of cashless applications within 30 minutes and access to more than 9,100 premium hospitals nationwide.

IDFC FIRST Bank takes a digital approach and serves its customers through an intuitive, user-friendly, and modern mobile app that complements its state-of-the-art online banking platform and nationwide branches, ATMs, and credit centers.

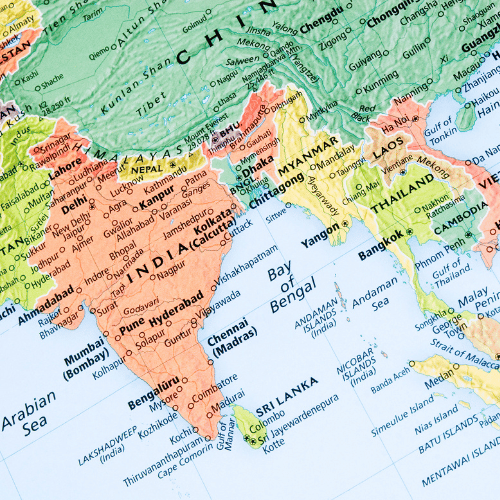

Krishnan Ramachandran, MD & CEO, of Niva Bupa Health Insurance, said, “We are excited to join hands with IDFC Bank, our first bank partnership of this financial year. This partnership is well aligned with our growth plans charted for the business for this fiscal and will enable us to expand our reach to provide quality healthcare solutions to the bank’s customers. We are confident that our wide portfolio of indemnity and group health insurance products and services, will be able to address the growing healthcare-related concerns of the bank’s varied customer segments across regions.”