Fintech solutions provider NextGen is partnering with Sa-Dhan, an association of microfinance institutions, to facilitate digital payments for mobile phone users in the microfinance industry.

According to a joint statement released on Sunday, the partnership is designed to help millions of mobile phone users make digital payments within the microfinance ecosystem.

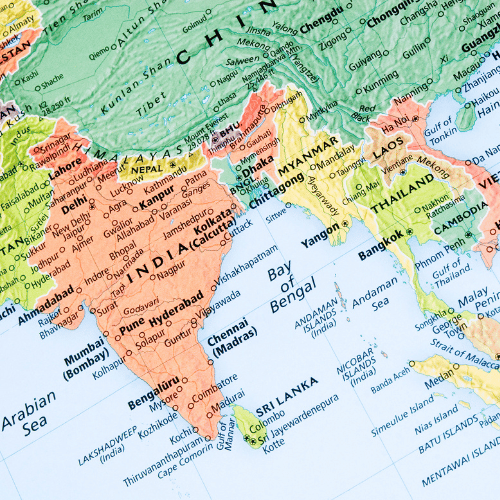

Microfinance Institutions (MFIS) are located in more than 600 districts in India and there is a need to adopt technology-based solutions to reduce transaction costs for these institutions and facilitate access to finance in tier 2 and tier 3 urban/rural areas. The report stated.

“In order to enable this solution, we must target the whole gamut of feature-phone users there is an immediate need for a cohesive digital EMI collection solution to reduce their overall operational costs through the non-smart/feature phone segment,” said Taron Mohan, founder, NextGen.

Through the partnership, beneficiaries of the MFI ecosystem will receive many additional benefits, including an interface to apply for UPI, banks and wallets, bill payment systems, personal and corporate remittances, microcredit, and insurance.

“Digitisation in collections in the microfinance sector has been a great challenge as most of the MFI clients do not possess smartphones. The association with NextGen will help in developing a new payment and collection system by using feature phones with the technological intervention being provided by them,” Sa-Dhan CEO Jiji Mammen said.

MFI has approximately 45 million individual beneficiaries, most of whom use mobile phones. Sa-Dhan is an RBI-approved self-regulatory body of microfinance institutions with approximately 150 members.