Source: ET Infra

Jet Airways was the pride of Indian aviation in the early 2000s because of its luxury and global reach. However, after a few years, the airline collapsed due to poor management, financial difficulties, and rising debt. Later, in 2020, Murari Lal Jalan offered hope by rescuing Jet Airways with his vision in partnership with Kalrock Capital. Explore the brave yet turbulent journey of Jet Airways by its saviour, Murari Lal Jalan.

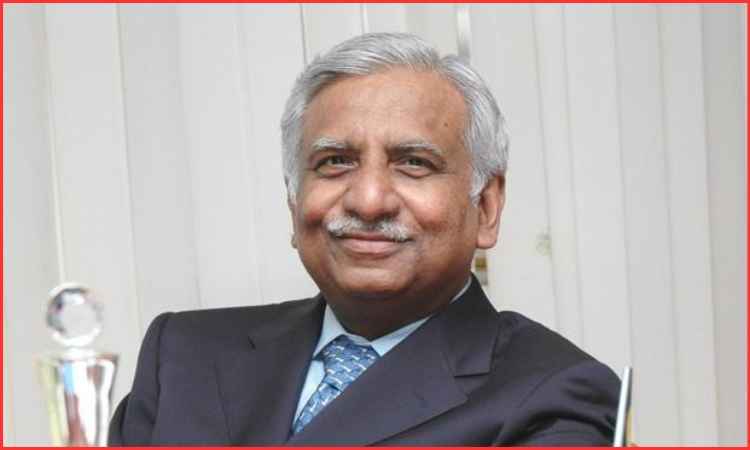

The UAE-based Entrepreneur: Murari Lal Jalan

Murari Lal was born in Ranchi, Jharkhand. He manages a diversified portfolio of businesses, including real estate, mining, trading, construction, FMCGs, travel and tourism, and many more, with a net worth of over $138 million as reported in 2019. Even after venturing into several businesses and striving to revive Jet Airways, Murari has been a mystery to be solved.

Murari Lal’s Entrepreneurial Journey

- Paper Trading: In the 1980s, Murari started working as a trader for established manufacturers such as JK Paper and Ballarpur Industries in Kolkata. Afterwards, he took control of his family’s paper trading business and gained success. Later in 2003, to expand his business, he acquired Kanoi Paper and Industries and rebranded it as Agio Paper.

- However, in 2010, Murari got a setback as he received a lawsuit from government agencies against his paper trading business, for violating pollution in the country. Thus, he suspended the production of business and ventured into various other industries.

- Healthcare: In 2015, Murari acquired Dr Naresh Trehan and the Association’s Health Services by investing INR 75 crores through a secondary share sale transaction. He then also planned to establish a hospital in Dubai but was not able to execute it in the future.

- Agio Image Group: Murari then moved to the UAE to venture into new sectors. He became the chairman of the Agio Image Group, which sells and distributes photographic and consumer products of well-established companies like Sony, Panasonic, and Konica.

- Real Estate: Murari has been significantly investing in the development of Uzbekistan’s capital, Tashkent. He also chairs the real estate company, ‘MJ Developers’, which is spread across countries like Russia, Brazil, and India. It has been significantly contributing to the infrastructural development of various cities like Namangan and Bukhara.

- Aviation: Murari, in collaboration with Kalrock Capital, tried to re-establish the renowned Jet Airways. The consortium invested around $12 million in the revival plan of Jet Airways and also got approval from NCLT, DGCA, and the Union Ministry. However, due to failure in achieving the financial commitments, the Supreme Court liquidated the assets of the Airline and closed the company.

Establishment and Growth of Jet Airways

Source: Mint

In 1993, Naresh Goyal established Jet Airways with 4 Boeing 737 aircraft on lease. It quickly became a leading Indian airline company operating both domestic and international flights by offering high-quality services and a modern fleet. For over 25 years, it served numerous destinations in India, Europe, the Middle East, Southeast Asia, and North America.

In 2007, Jet Airways acquired Air Sahara for INR 14.5 billion and rebranded it as JetLite, a low-cost carrier and a full-service airline. Then in 2008, they joined hands with their competitor, Kingfisher Airlines, for code-sharing on domestic and international flights, the Frequent-flyer Program [FFP], and sharing crew and ground handling equipment. On 8 May 2009, they also launched Jet Konnect as a low-cost brand.

In 2010, Jet Airways became the largest airline in India with a passenger market share of 22.6%. In March 2012, they merged JetLite into Jet Konnect and started offering business-class seats. In 2014, Jet Konnect was fully merged with Jet Airways, making it the third full-service airline in India after Air India and Vistara. Eventually, in February 2016, they became the second-largest airline in India after IndiGo, with a 21.2% market share.

The Downfall: Bankruptcy and Legal Charges

Source: The Economic Times

In the second quarter of 2018, Jet Airways reported a negative financial report with a loss of INR 1323 crores. Noticing the irregularity, in September 2018, the Income Tax department surveyed the Delhi and Mumbai offices of Jet Airways and accused them of financial misappropriation. In March 2019, Jet Airways’ nearly one-fourth of inventory was grounded due to unpaid lease amounts. Hence, on March 25, 2019, Mr Naresh Goyal and his wife Anitha Goyal stepped down from the board of directors.

Charges of money laundering and foreign exchange violations were filed against Naresh. In 2023, he was also accused by Canara Bank of defrauding the amount of INR 538.62 crore. Subsequently, the Enforcement Directorate [ED] started detaining and questioning Naresh and arrested him in September 2023 for using company funds for personal expenses. Anita also got arrested in November 2023 and was bailed out due to health problems. In November 2024, Naresh was also granted permanent medical bail for his cancer treatment by the Mumbai High Court.

Consequences of the Downfall

On 17 April 2019, Jet Airways suspended all flight operations after lenders refused an INR 4 billion emergency funding request, and its membership with the International Air Transport Association [IATA] was also suspended. On 17 June 2019, lenders of Jet Airways decided to refer the company to the National Company Law Tribunal [NCLT] for bankruptcy with a debt amount of $1.2 billion.

Jet Airways was already facing insolvency proceedings in the Netherlands after failing to pay two creditors. Therefore, NCLT allowed cross-border insolvency proceedings; hence, the ‘Dutch Trustee’ collaboratively worked with the ‘Resolution Professional of India’. The closing of Jet Airways affected 20,000 employees and indirectly more than 60,000 people. Therefore, the National Aviators’ Guild [NAG] appealed to the Civil Aviation Minister, Suresh Prabhu, to help the employees of the company.

However, in 2020, the Enso Group tried rescuing the airline with the Russian Far East Development Fund by discussing a controlling stake from its committee of creditors but failed.

Murari Lal’s Bet on reviving Jet Airways

Source: Mint

In 2020, Murari Lal, the UAE-based entrepreneur and Kalrock, an asset management firm of the Fritsch Group, purchased Jet Airways with a vision to restart its air operations after their lenders approved the resolution submitted by them. The resolution plan included the aim to restart operations, along with resuming both domestic and international flights. In June 2021, NCLT approved the revival plan, and in 2022, the Union Home Ministry also granted security clearance to Jet Airways.

An official statement communicated that: ‘The Consortium’s vision was to regain lost ground and set new benchmarks for the airline industry with the tag of being the best corporate full-service airline operating on domestic and international routes. The Jet 2.0 hubs will remain in Delhi, Mumbai, and Bengaluru like before. The revival plan proposed to support Tier 2 and Tier 3 cities by creating sub-hubs in such cities. The new management’s vision for Jet 2.0 was inclined towards increasing cargo services to include dedicated freighter service, an underserved market for Indian carriers. Given India’s position as a leading centre for global vaccine manufacture, cargo services have never been more required.’

On 5 May 2022, a test flight was conducted to prove operational efficiency, and then other testing of flights was completed to achieve the air operator certificate from the Directorate General of Civil Aviation [DGCA]. The new owners focused on leveraging the brand’s strong customer connections with plans supporting Tier 2 and Tier 3 cities by connecting sub-hubs and introducing dedicated freighter services to address India’s increasing cargo needs.

However, revival faced some delays due to the COVID-19 pandemic, financial challenges, and leadership transformation. But with hope and vision, the new owners did not take a step back, and in September 2021, Jet Airways’ shares surged by 5%. Jalan and Kalrock’s consortium invested an additional $12 million to revive Jet Airways by 2024.

However, the consortium failed to pay overdue employee salaries and fulfil other financial commitments outlined in the revival plan. The Supreme Court determined that, with persistent failure and financial distress, liquidation was the only way to organise the distribution of financial debt. Thus, on November 7, 2024, the Supreme Court ordered the liquidation of Jet Airways and ended the chapter of Jet Airways’ comeback efforts.

Conclusion

Jet Airways’ story is among the ambitious stories, where the rise and fall work in a loop. It fell due to poor management, billion-dollar debt, and poor financial management. Murari Lal and the Kalrock consortium gave hope with their bold vision and investments to revive Jet Airways, but the Supreme Court’s verdict closed the chapter of its comeback. However, it shows the significance of efficient management, leadership, and strong finances in startups as well as in well-established businesses.

FAQs

Q-1: Who is Murari Lal Jalan?

Ans. Murari Lal Jalan is a UAE-based entrepreneur known for his real estate business ‘MJ Developers’ with a net worth of over $138 as reported in 2019.

Q-2: Who is the founder and owner of Jet Airways?

Ans. Jet Airways was founded by Naresh Goyal and is currently owned by Kalrock Capital and Murari Lal Jalan.

Q-3: What is the current status of Jet Airways?

Ans. After the Supreme Court’s judgement in November 2024, Jet Airways is under liquidation.

Q-4 Why was Naresh Goyal granted interim bail?

Ans. Naresh was suffering from a life-threatening condition, neuroendocrine tumours and thus was granted bail on medical grounds for his treatment.

Q-5 Who is the King of Aviation in India?

Ans. Naresh Goyal was often referred to as the ‘King of Aviation’ in India.

Q-6 Who are the competitors of Jet Airways?

Ans. Jet Airways faced competition with IndiGo, SpiceJet, Air India, and Vistara in the domestic sector, while Emirates and British Airways were its international competitors.

Q-7 When did Naresh Goyal serve on the board of the International Air Transport Association [IATA]?

Ans. From 2004 to 2006, Goyal served on the board of IATA and was re-elected in 2010 until June 2016.