LIC’s shares fell to their fresh 52-week low on the NSE on June 20 as the investment banker’s research wing initiated coverage on the stock with an ‘outperform’ rating

JP Morgan India, one of the 10 book-running lead managers of Life Insurance Corporation of India’s record-breaking initial public offering, feels that the market’s treatment of the country’s largest life insurer has been unfair.

The shares of LIC fell to their fresh 52-week low of Rs 650 on the National Stock Exchange on June 20 as the investment banker’s research wing initiated coverage on the stock with an “outperform” rating and a price target of Rs 840 a share.

Shares of the life insurer have tanked more than 30 percent since its listing on May 17, driven by concerns over its growth, perceived volatility in its embedded value and concerns over competition from private sector players.

“LIC’s new business value is only 1 percent of its policies in force. Therefore, with 99 percent of value from old policies, we see the 0.75 times P/EV (price-to-embedded value) as unduly harsh, even assuming no growth,” JP Morgan India’s research wing said in a note.

The brokerage firm said that LIC has picked up growth recently and expects the same to trend at 6 percent on an annualised basis over the current and next two financial years.

“The improved ability of agents post re-opening should drive growth. In the last four months, LIC’s retail premium is growing faster than industry (+32% y/y) and is above 2019 level,” JP Morgan said.

The brokerage firm is of the view that higher consistency in disclosure of embedded value going ahead could help trigger re-rating in the stock.

“In our view, LIC would need to show consistency in EV which would signal accuracy on assumptions used,” the brokerage house said.

Brokerages such as Macquarie Securities India and Emkay Global Financial Services, on the other side, have remained neutral on the life insurer despite meaningful correction in the stock price since their initiation of coverage and represent the scepticism around the company’s prospects.

Macquarie initiated coverage on the stock in May with a “neutral” rating, saying that the ability to sell high-margin non-par products—as opposed to par products that provide policyholders a significant share of policyholder’s surplus— will require a change in the mindset of the organization and its agency force, “which could be LIC’s biggest challenge in our view”.

LIC’s shares are currently trading 34 percent below Macquarie’s price target for the stock of Rs 1,000 per share.

Brokerage firm Emkay Global Financial initiated coverage with a “neutral” rating, arguing that LIC was an “elephant that can’t dance”.

“LIC’s valuation on price-to-embedded value appears cheaper when compared with listed private players; this is justified by the fact that LIC adds merely 1.0-1.5 percent of EV each year from VNB, as against around 8-11 percent in the case of private life insurers,” Emkay Global said in a note in early June.

While all three brokerages which have initiated coverage on the stock agree that LIC’s fair value lies close to one time its one-year forward embedded value even though their estimates for embedded value differ, market participants remain far away from that valuation.

As per JP Morgan, investors are valuing the stock at merely 0.75 times its estimate price-to-embedded value.

At 12.05 pm, shares of LIC managed to recoup all of their losses and rise 0.6 percent to Rs 658.50 on the NSE but still lacked the enthusiasm portrayed by its former investment banker.

-

Top 12 Green Energy Companies in India

The escalating global energy consumption underscores a pressing need for sustainable solutions, as projections indicate a manifold increase in global energy demand in the forthcoming decades. India, positioned as the

-

Fixed Deposits Offering Up to 9% p.a. – Is It the Time to Book FDs or Wait for More Hikes in India?

In an ever-changing financial landscape, fixed deposits (FDs) have long been a favourite investment choice for Indians seeking safety and guaranteed returns. As the economy recovers from the recent turbulence,

-

One Stop for Hair Dreams: The 1 Hair Stop Success Story

Richa and Raina

-

8 Ways To Use Black Flooring To Give Your Home A Bold Appearance

Black tile flooring, especially the Black marble tiles is the perfect choice if you want to create a statement in your house. Classic black flooring provides drama and sophistication in

-

How to Start Your Mutual Fund SIP Journey

When it comes to investment, mutual funds have gained more popularity in the past few years. Starting a SIP can help in securing the future. Mutual fund SIP as an

-

Tesla Supplier, Hota will build its first US factory in New Mexico

Hota Industrial Mfg. Co (1536.TW), a Tesla supplier, announced on Wednesday that it would invest $99 million to develop its first facility outside of Asia in the U.S. state of

-

Biden and Lula to launch workers’ rights initiative

Senior U.S. officials have announced that U.S. President Joe Biden and Brazilian President Luiz Inacio Lula da Silva will start an effort on Wednesday to enhance the rights of working

-

Former Qantas CEO Alan Joyce receives a nearly 900% compensation increase, but his bonus is reduced due to pending lawsuits.

Former Qantas Airways CEO Alan Joyce departed the firm with an 872% salary rise, citing long-term incentives that had been due for years. However, the corporation said that it had

-

For Indian graduates under 25, the unemployment rate is around 40%

According to a survey issued by Azim Premji University, despite India’s rapid economic development, the jobless rate among graduates under the age of 25 reached a staggering 42 percent post-Covid.

-

The Derma Co crossed the Rs 350 crore annual revenue mark in the June quarter

The parent company of the direct-to-consumer (D2C) brand Mamaearth, Honasa Consumer Ltd, said that during the second quarter of 2016, The Derma Co’s annual sales rate surpassed the Rs 350

-

For Indian users, WhatsApp partners with Razorpay and PayU to offer in-app shopping

New features that will improve the user experience for businesses have been revealed for WhatsApp. Users in India may now make payments via the app thanks to a partnership between

-

Netcracker and Google Cloud: Advancing Telecom with Generative AI Collaboration

Netcracker Innovation reported today that it is working with Google Cloud to propel the utilisation of generative man-made intelligence innovation (GenAI) in the telecom business. By joining Netcracker GenAI Telco

-

DAZN Enhances Reach in Italy via HOTBIRD Satellite Delivery by Eutelsat.

Leading Sports Entertainment Platform DAZN has signed a long-term agreement with Italian video specialist Provider, EI Towers, to supplement their substance conveyance to homes across Italy through the HOTBIRD satellites

-

National Warning Day: Everbridge and Vodafone’s Collaborative Effort to Ensure Safety in Germany

Everbridge, Inc. (Nasdaq: EVBG), the worldwide Leader in Critical Event Management (CEM) and public Warning programming arrangements, today declared the fruitful testing of Germany’s cross-country crisis alarming System yesterday, September

-

Yatra Online’s IPO to open for public participation on September 15

Yatra Online Limited, based in Gurugram is preparing to release its offering (IPO) on September 15th. The IPO comprises an issue size of Rs 602 crore and an offer, for

-

List of Startups acquired by Swiggy

Going to your favourite restaurant, but hate to wait on the table for your delicious food? Want to eat some crispy, spicy street food without going out? Order it on

-

Successful Business Model of HDFC Bank

Indian Banking System has shown an immense outbreak even post-pandemic. Indian banking Index, Bank Nifty was around 25000 in the Covid hit 2020 and today Bank Nifty is trading at

-

Let Us Check Out the Brands Endorsed by Ranveer Singh

When a celebrity promotes a product or a brand, it garners a lot of popularity and revenue to the company. The most important part of celebrity endorsement is that it

-

PayPal offers solid foundations for secured online payments

The digital system of the modern economy holds online payments as a crucial part of the process. We are now blessed with several companies that have been remarkably handling our

-

New to Flickr? Read this article to know more about it

When we see the beautiful artistry of the internet, the creativity of several photos and videos amaze us all. But behind the mastery of such art, lies the artist who

-

Meet Purniema Krishnan- Empowering inclusive leadership with expertise in architecture

Time teaches us the purpose of our lives and how important we keep valuing our presence. Along the way, there comes multiple challenges that sometimes maybe break us down. But

-

Meet Mahesh N.R. The entrepreneur embracing leadership diversity with effective team building

There is a fine line between a boss and a leader and yet it is capable of evoking deep thoughts. We live in a society that often reminds us of

-

Meet Shivaz Rai- The eyes and ears of innovation tailored with leadership prowess

We are all the living testaments of digital transformation, where society is undergoing rapid economic shifts. Are we ready for artificial intelligence or it can be disruptive for our common

-

Meet Avkash Goyal- Empowering business diversity with impeccable leadership abilities

When you search the reason behind why the world needs leaders, it might take you through a deep meaning of life. Without leaders, the civic structure is just a foundation

-

Shankar Sharma shares ‘investing knowledge’ ahead of Brightcom Group’s board meeting.

After the Securities and Exchange Board of India (SEBI) issued an interim order on Brightcom Group, citing concerns about the firm’s preferential offer, Shankar Sharma and 21 other shareholders of

-

Reliance Capital offloads 45% stake in listed subsidiary Reliance Home Finance for Rs 54 crore.

Reliance Capital has made a move by selling 45% of its subsidiary, Reliance Home Finance for Rs 54 crore. This sale will help the company in its efforts to recover

-

GDP Growth In Q1 Reached A Four-Quarter High Of Nearly 8%.

However, economists anticipate that growth will drop in the remaining quarters of this fiscal year. Strong domestic demand, an improvement in the services sector, and the government’s focus on capital

-

Reliance Retail Ventures, Owned By Mukesh Ambani, Plans To Raise Rs 3,048 Billion For Warehouse Invit.

A minimum of 25% of the trust’s units will be held by Reliance Retail, with the remaining units being distributed to new investors. Reliance Retail Ventures Ltd., the retail division

-

Goldman Sachs Group sees India IT growth picking up in the medium term; coverage begins

According to Goldman Sachs, the pent-up demand for IT services and the effects of using generative artificial intelligence (AI) technology are driving revenue growth for Indian IT industry enterprises. Even

-

Power Transmission & Distribution Business of L&T Construction Acquires Orders.

The business has been given the go-ahead to build a 220kV Gas Insulated Substation and related Transmission Lines in the United Arab Emirates by a reputable service provider to the

-

Tineco Reveals the Creative Pure One Station at IFA 2023: Reclassifying Cleaning Greatness.

Tineco Gets back to IFA with an Astonishing Setup of State of the art Advancements: Presenting the Unadulterated One Station, the Floor One S7 Combo, the Floor One S7 Steam,

-

BOC Aviation of Singapore and IndiGo Sign Financing Agreement for 10 Airbus Aircraft

According to BOC Aviation, all 10 of the CFM LEAP-1A-powered aircraft are expected to be delivered in 2023. Officials announced on Wednesday that the largest airline in India, IndiGo, and

-

Genius Plastic Recycling Line for Latin America Ensures Less Than 3% Moisture Content After Drying.

A prominent reusing industry pioneer with nearly fifty years of involvement, Genius Hardware has as of late presented its new plastic washing reusing line for the South American market. The

-

Investors look to Nvidia’s earnings as US stocks rally wobbles

Bullish investors are hopeful that Nvidia’s earnings release on Wednesday can revive the sputtering recent advance in U.S. markets. The S&P 500 has increased by 14% this year, with the

-

The success story of Sahil Barua, CEO and Co-Founder, Delhivery, is inspiring

Building a business demands patience and resilience which is often witnessed with the passage of time. While there are a lot of things to look into a business, creating a

-

BostonGene: AI-based molecular and immune profiling for treatment selection

BostonGene enters the scene. This US-based biotechnology firm carries out studies and clinical trials and has created cutting-edge biomedical software to analyze patients for cancer and assist in recommending the best course of therapy.

-

AICTE Works With Jio Institute To Launch A Faculty Development Programme In Artificial Intelligence And Data Science.

The joint endeavour intends to provide senior faculty and academic leaders with a thorough grasp of AI and Data Science while simultaneously placing a strong emphasis on the moral ramifications

-

Jio Financial Services demerged from Reliance Industries set to be listed on August 21.

Jio Financial Services shares will start trading on August 21st after separating from Reliance Industries. The synergy, between JFS and Reliances telecom and retail sectors gives JFS an advantage. The

-

Myntra and Cultfit founder Mukesh Bansal in talks with investors to raise $50 mn for GenZ fashion-focused venture

Mukesh Bansal, known for his role, in creating Myntra and Cultfit is ready to bring a wave of change to the world of high-end fashion for the younger generation. Working

-

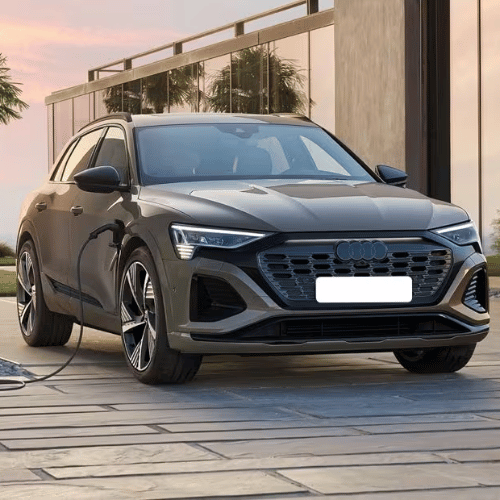

Germany-based Audi introduces Audi Q8 e-tron in India after its global debut.

Audi, the luxury car manufacturer has recently introduced its newest creation, the Audi Q8 e-tron, in India. This remarkable unveiling comes shortly after its introduction a few months back. The

-

Telangana-based spices & flour manufacturer Srivari Spices and Foods lists with 147% premium.

Srivari Spices and Foods based in Telangana had an entry, into the stock market despite a market correction. This was driven by demand for its public offering (IPO) and strong

-

China’s property giant Evergrande Group files for bankruptcy protection in a U.S. court.

Amidst the turmoil, in China’s property sector, Evergrande Group, which is facing debt has sought Chapter 15 bankruptcy protection in the United States. This move is about restructuring efforts. The

-

On August 19, a redesigned orange Vande Bharat train is set to debut.

On August 19, brand-new orange Vande Bharat trains are scheduled to depart from Chennai’s Integral Coach Factory. The new train is anticipated to include a number of ground-breaking safety and

-

TAQA is considering investing $2.5 billion in Gautam Adani’s power company.

According to an article in the Economic Times, Abu Dhabi National Energy Company PJSC (TAQA) is considering investing up to $2.5 billion in Indian billionaire Gautam Adani’s power company. On

-

Flipkart launches an in-app fashion platform for Gen Z called Spoyl

Flipkart, the leading e-commerce company has recently introduced Spoyl, a fashion hub, within their app that specifically caters to the needs and preferences of Generation Z. With a range of

-

Over 600,000 Skoda automobiles are exported from the Chakan facility.

On Thursday, Skoda Auto Volkswagen India Pvt Ltd (SAVWIPL) announced that the number of vehicles exported from the company’s Chakan factory in Pune had surpassed 600,000. The Volkswagen Group, a

-

Dr. Agarwal’s Health Care raises $80 million from Temasek and U.S.-based TPG.

Adil Agarwal, the CEO, with a vision at the helm of Dr. Agarwals Health Care, is leading efforts to achieve growth. The goal is to increase their number of hospitals

-

Promoters Of INOX Wind Invest Rs 500 Crore Through Block Sales To Pay Off Debt.

Inox Wind Block Deal: The company stated in a filing that this action represents a significant step towards financial stability. Inox Wind Ltd (IWL), a developer of wind energy solutions,

-

JioCinema clocked 3,000 Cr minutes of watch time of Bigg Boss OTT Season 2.

JioCinema, which is supported by Reliance achieved success with, over 10 crore viewers and more than 3,000 crore watch minutes during the second season of Bigg Boss OTT. This accomplishment

-

Sales of Samsonite increased by 38% in India.

Samsonite, a manufacturer of luggage, reported a roughly 38% increase in sales in India during the first half of 2023, which is a clear sign that the travel boom is

-

Bill Bowerman: The Legacy of the Co-Founder Of Nike

Bowerman stands synonymous to hardwork, perseverance, patience and excellence. In his victorious career, he achieved 4 NCAA titles and competed sixteen times in the top 10 list in his nation.

-

Startup Evenlabs creates celebrity voices for you

ElevenLabs tweeted about an increase in cases of voice cloning since the tool’s launch. The startup also asked Twitter users for feedback on how to stop replicating voices. Did celebrities

-

Byju’s employees speak up about the difficult working conditions there.

Byju claim that the company uses predatory and exploitative working conditions and dishonest sales techniques, such as profiling, chasing, and forcing prospective students from less privileged backgrounds to purchase its

-

Upgrade to Android devices

Description: Android is about to introduce completely new features for smartphones and smartwatches. The new Features include a reading mode, digital car key-sharing, and more. These features will be accessible

-

The Interesting Fact About Big Boy Toyz Business Model Lies Here

Being affluent can sometimes be considered a privilege, but sometimes be welcoming as a token of hard work. When we experience the fruits of our efforts, there is always an

-

10 Best Delhi-Based Public Relations Agencies

Public Relations Specialists typically deliver speeches and attend conferences and community activities. Thanks to the character of their work they travel tons. They add high-stress environments, typically organizing many events

-

Top 10 Eyeglass Brands in India 2024: Elevating Style and Vision in the Dynamic World of Fashion

In this dynamically changing world of fashion, eyeglasses have gone beyond just vision aid; nowadays they express one’s personality. The most important function occupied by eyeglasses is from vision defects.

-

Meet Mohammed Umar M- Devoting to the Society With Holistic Creativity and Philanthropy

Leaders are the future of the society and it depends highly on the perspective towards humanity. For some success can be aligned with wealth, for others it might equate to

-

Meet Parth Limbasiya- Effective Leadership and True Testament of Discipline and Resilience

The success of an individual usually has a path filled with hurdles and failures. There will always be a time when the individual will hit their back against the wall.

-

Apple Decides Against Advanced Display for New iPad Air to Keep It Affordable

Apple is all set to launch its next generation iPad Air tablets soon. There was speculation that the new iPad Air may come with a better display like the premium