Source: magzter

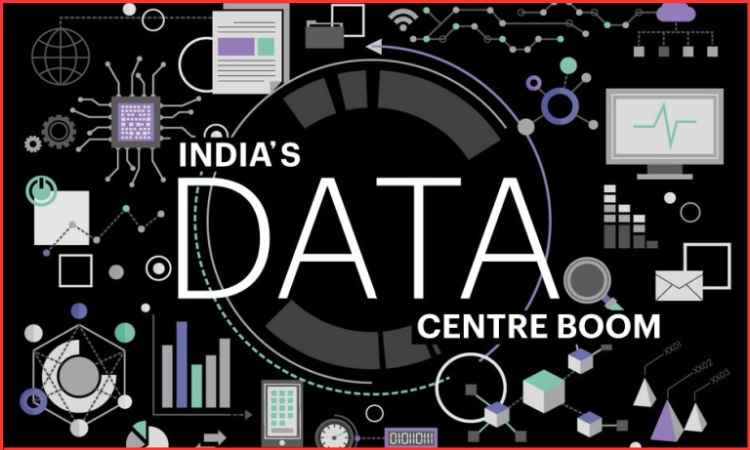

The India data center market is experiencing a remarkable transformation, driven by the country’s rapid digital adoption and massive internet user base. With over 850 million internet users, booming e-commerce, widespread UPI transactions, and a strong government push for digitalization, India is fast becoming one of the world’s most attractive hubs for data center investments.

From cloud computing and artificial intelligence to streaming platforms and online payments, almost every digital activity today relies on data centers. These facilities serve as the backbone of digital infrastructure, ensuring smooth storage, processing, and security of enormous data volumes.

Market Overview

The data center market in India is advancing at a speed never experienced previously. In just a few years, India has moved from being a small player to one of the most attractive data center investment markets globally.

| Indicator | Current Status (2023) | Future Projection |

|---|---|---|

| Market Size | USD 5–6 billion | USD 15 billion by 2030 |

| Installed Capacity | ~870 MW | 2,500 MW by 2027 |

| Internet Users | 850+ million | 1 billion by 2030 |

| Global Ranking | Top 10 | Top 5 by 2030 |

Key Growth Drivers

Source: kashmirdespatch

1. Rising Digital Consumption

India has one of the largest populations of internet and smartphone users in the world. Due to video streaming, mobile payments, online education, and social media, an average Indian consumes more than 20 GB of data every month.

For example, India is processing over 10 billion UPI transactions every month. Each transaction generates a demand for data storage, security, and real-time processing. This indicates that the Indian way of life is increasingly digital-centric, driving demand for data centre growth in India.

2. Government Initiatives

The government is promoting the digital ecosystem, which positively affects the data center industry in India.

- Digital India aims to provide digital access to every citizen and increase the use of online services.

- Data Protection Act 2023: Requires sensitive user data to be stored within India and creates a need for local data centers.

- Draft National Data Centre Policy: identifying incentives such as affordable land and power supply support and improved lead times needed for project approvals.

These initiatives are attracting capital and boosting investor confidence, further strengthening the Indian data center market.

3. Cloud and 5G Growth

Businesses are shifting their IT systems and applications to the cloud, increasing storage and processing demand on a larger scale. The increase in 5G technology rollout suggests we anticipate an increase in demand for smaller edge data centres (a smaller facility close to the user), for which lower response time (latency) is critical in time-sensitive applications such as online gaming, streaming high-definition video, and future technologies such as autonomous vehicle scenarios. The cloud computing market is directly pushing data center growth in India.

4. Domestic and International Investments

The data center industry in India is receiving huge financial commitments, and global tech giants and domestic companies are making material investments.

- International players like Amazon Web Services (AWS), Microsoft Azure, Google Cloud and Oracle have committed billions of dollars towards the data center infrastructure in India.

- Domestic companies like AdaniConnex, Yotta Infrastructure and Reliance Jio are also building world-class, immediate-future, large-scale data centers around India.

This strong combination of domestic and international investment is leading to the emergence of one of the most developed data centre markets in India.

India’s Strategic Advantages

1. Geographical Location: India is located between Europe, the Middle East and Southeast Asia, which makes it a natural digital bridge where international data traffic can flow. For example, international internet submarine cables that connect continents often land in India. Thus, India can accommodate not only domestic users but also serve the world.

2. Cost Advantages: One of India’s biggest strengths is its cost advantage. The cost of building and operating a data center in India is less than that in to US, Singapore, or Japan. The cost of construction, electricity and manpower is much lower. This attracts both domestic and international investors because they can save money while still getting high-quality infrastructure.

3. Talent Availability: India is known globally for its strong IT industry and large pool of skilled professionals. The country has a young workforce that is skilled in IT, cloud, and data management. These individuals are capable of handling advanced infrastructure and maintaining global standards. The availability of talent is another reason why India stands out as a credible location.

4. Strong Urban Centers: Cities like Mumbai, Hyderabad, Chennai, and Bengaluru already have a strong digital footprint and physical infrastructure. They have a strong foundation of internet cables and power supply, as well as many technology companies. These cities have also become prime clusters for data centers because they can support the massive demand for storage, processing, and connectivity.

Major Industry Players

| Category | Company | Key Highlights |

| International Tech Giants | Amazon Web Services (AWS) | Plans to invest USD 12.7 billion by 2030 in India. |

| Google Cloud & Microsoft Azure | Expanding data centers in Mumbai, Hyderabad, and Pune. | |

| Oracle | Operating multiple cloud regions in India for enterprise clients. | |

| Indian Market Leaders | AdaniConnex (Adani + EdgeConnex JV) | Developing 1 GW capacity, focusing on renewable energy. |

| Yotta Infrastructure (Hiranandani Group) | Built Asia’s largest data center in Navi Mumbai. | |

| Reliance Jio | Leveraging telecom strength with cloud and data services. |

Global Comparison: India vs Other Data Center Markets

- Singapore – Mature hub but limited by land and energy constraints.

- Indonesia – Growing market but smaller scale and limited talent.

- UAE – Strong government support but high operating costs.

In contrast, the India data center market offers scalability, cost efficiency, and abundant talent, making it a stronger long-term player.

Challenges in the India Data Center Market

1. High Power Usage: Data centers require huge amounts of electricity to keep them operational 24/7. The sustainability considerations in India regarding their power usage are troubling, since most of the power that India generates presently comes from coal. Without more renewable energy use, the environmental impact will be high.

2. Cooling Requirements: The heat in India increases the cost of maintaining the system. Cooling systems consume almost 40% of total energy consumption, and when located in some cities with extreme heat, the cost of cooling increases even more.

3. Policy Uncertainty: Investors usually expect clear, long-term rules. Any sudden change of land, tax or compliance policy makes it much riskier to invest a significant amount and therefore slows down development.

4. Infrastructure Gaps: Not all regions have stable electricity or high-speed internet. While big cities are better equipped, smaller cities still face power cuts and weak connectivity, which limits growth.

5. Cybersecurity Risks: As more critical data is stored locally, threats of cyberattacks rise. Building strong security frameworks will be essential for global trust.

Future Outlook: From New Emerging Market to Global Leader

- Green Data centers: powered by renewable sources that can further reduce carbon footprints.

- AI-focused workloads: hyperscale centers can facilitate greater processing power by utilizing advanced GPU technologies.

- Edge and Hyperscale balance: while Tier-2 cities will receive smaller edge facilities, metros will house large hyperscale centers.

- Integration with Global Ecosystems – strengthening India’s role in international cloud networks.

If India addresses energy sustainability, cooling efficiency, and regulatory clarity, it could evolve from an emerging market into a global leader in digital infrastructure.

Conclusion

The India data center market is at a defining stage. With a booming internet economy, supportive policies, and multi-billion-dollar investments from both domestic and global players, India is transitioning from being a digital consumer to a digital infrastructure powerhouse.

The key will be to balance growth with sustainability, strengthen regional infrastructure, and prepare for next-generation technologies like AI and 5G. If achieved, India will not only meet its domestic digital needs but also emerge as a global hub for data centers in the coming decade.

FAQs

Q1. What factors are contributing to the rapid growth of the India data center market?

The rapid growth of the data center market in India is due to a combination of rising levels of digital consumption, the trend of cloud computing adoption, the rollout of 5G, and also government policies requiring storage of data and servers within the country.

Q2. How is the India data center market different from others in Singapore or the UAE?

India allows for cost-effectiveness and access to a much larger talent pool. Additionally, the adoption of digital technology appears to happen faster in India than in other regions. However, Singapore has more mature infrastructural opportunities than India.

Q3. What challenges does the India data center market face?

High power consumption, cooling costs, regulatory uncertainties, infrastructure gaps, and cybersecurity risks.

Q4. What are some ways India is dealing with sustainability?

India is adopting renewable energy solutions, looking for hybrid power sourcing, and implementing more energy-efficient cooling technologies.

Q5. What role will AI and 5G have in shaping India’s data center industry?

AI workload requirements and low-latency applications that rely on 5G will create demand for high-scale or hyperscale data centers and edge data centers throughout India.