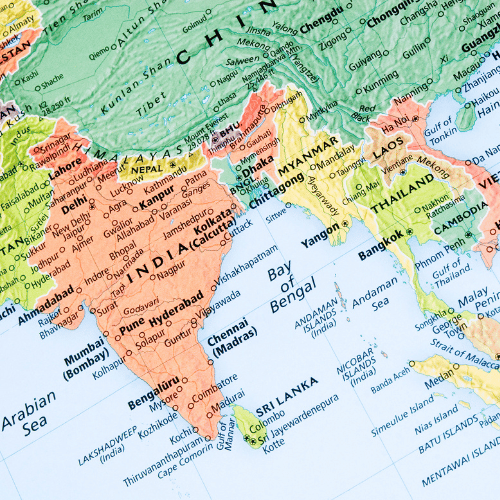

India and Nepal have agreed to strengthen financial cooperation between the two neighbouring countries. A new digital payment system allowing direct online fund transfers from India to Nepal will soon be inaugurated. This will benefit citizens and businesses of both nations by facilitating easier cross-border monetary transactions.

The new measures were announced during a meeting between Nepal’s Ambassador to India, Shankar Sharma, and officials of the Reserve Bank of India last week. Some key points discussed were:

- Nepali citizens with bank accounts in India can now send up to Rs. 2 lakh (Indian Rupees 200,000) per transaction to Nepal without any limits on the number of transfers. This is a significant increase from the previous limit.

- Indian residents visiting Nepal will be permitted to carry out remittances of up to Rs. 50,000 per transaction, with an annual limit of 12 such transactions. Earlier only Rs. 5000 could be carried for payments during visits.

- Most importantly, a new digital payment system linking Unified Payments Interface (UPI) of India with National Payments Interface (NPI) of Nepal is ready for inauguration. Called the UPI-Nepal Clearing House Limited (NCHL), it will facilitate seamless online fund transfers between the two countries.

- Transactions through UPI-NCHL can be done from anywhere at any time via smartphones, eliminating the need to physically carry cash across borders. This will boost convenience and transparency of financial dealings.

The move comes after the RBI updated its regulations governing transactions with Nepal last December. It aims to promote greater financial inclusion and mobility of funds between friendly neighbours.

In June 2023, the NPCI International Payments Limited of India had signed a pact with Nepal Clearing House Limited to develop this cross-border digital payment infrastructure between their respective UPI and NPI networks. The upcoming launch of UPI-NCHL is a result of that collaboration.

Experts say this will open up new opportunities for businesses, migrant workers and ordinary citizens on both sides. Digital payments will see a big boost as it becomes more convenient to pay for imports/exports and services online without currency conversion hassles. Remittance costs may also reduce over time.

Overall, by facilitating financial cooperation through banking and digital technologies, India and Nepal aim to strengthen their economic partnership and people-to-people links. The launch of UPI-NCHL marks a new phase in easy and secure monetary dealings between the two nations.