Source: msn

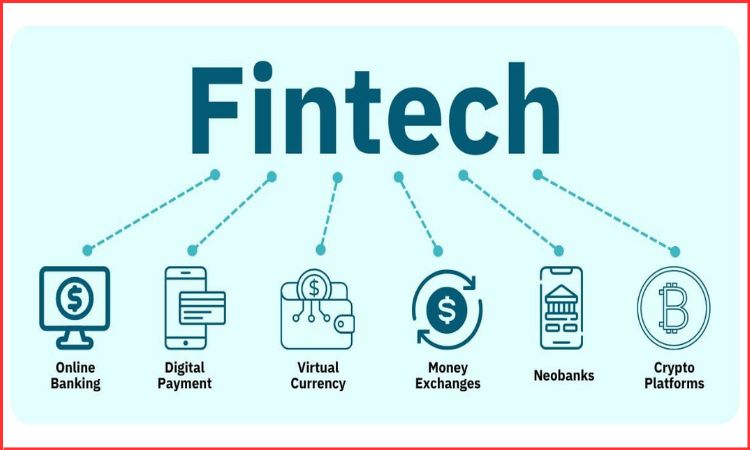

The financial technology industry in India has rapidly changed within the past decade, and new companies have been created offering services such as borrowing, insurance and investment. Many of the new companies are what we refer to as “FinTech.” Navi, a startup founded by Sachin Bansal, who is also the co-founder of Flipkart, has developed a different focus to be more geared towards providing an easier, faster, and more trusted experience for customers when looking for financial services. Navi embodies a new generation of companies emerging in India, where entrepreneurs utilize technology to create and make money through their businesses and focus entirely on providing customers with a better overall experience.

This article explores Sachin’s vision behind Navi, the company and its success, as well as how both have been built together over time and what impact, in the future, the two have made in the digital financial space in India.

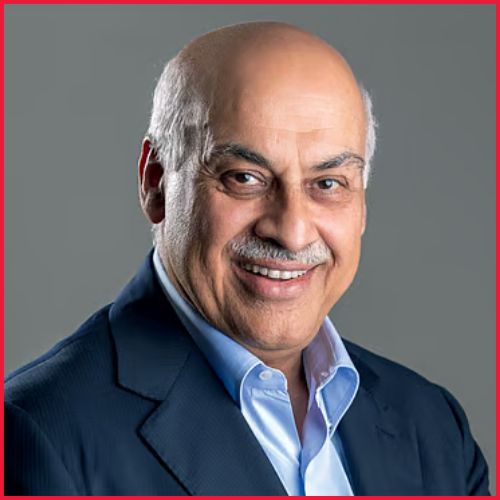

Who Is Sachin Bansal? The Entrepreneur Behind Navi

Sachin Bansal, too, is a proud tech entrepreneur of India because of his contributions to flipkart.com online shopping and helping people shop like never before in India, growing over seventeen billion dollars in revenues. He was soon after the purchase of Flipkart into the online space of America, reversing the ease of shopping in India and many thought he would slow down as a result of this great success. But what Bansal is interested in is addressing one of the largest and most complex financial accessibility problems in India.

As he was observing, He realised that there were millions of people who had high smartphone penetration and good internet services and are trying to connect to the financial services industry. Unfortunately, the process for getting a loan or understanding insurance products was cumbersome and complicated (for example, many people simply didn’t understand how much they’d have to pay for an insurance product), and in many cases, due to a lack of transparency, it wasn’t clear how to compare these different services. This lack of financial access was the basis of his overall concept of creating a computer-first financial services business that could simplify everyday financing, banking, and insurance.

What Is Navi? Understanding the Navi Fintech Company

Navi is a digital financial services company that offers financial products through a technology-driven, mobile-first platform. Navi’s focus is on removing the burden of paper in the financial industry, shortening the time for approvals, and creating an unparalleled user experience.

Core Offerings of Navi

- Personal Loans

- Home Loans

- Health Insurance

- Mutual Funds

- Micro-Lending & Credit Solutions

Navi’s core competency is its ability to use technology to create an all-digital process where a user can complete the onboarding process, provide their KYC information, and receive an approved loan without having to leave the app.

Navi Company Overview

| Aspect | Details |

| Founder | Sachin Bansal |

| Founded | 2018 |

| Industry | Fintech / Digital Financial Services |

| Headquarters | Bengaluru, India |

| Key Products | Loans, Insurance, Mutual Funds |

| Target Users | Urban & semi-urban digital users |

Why Sachin Bansal Started Navi: The Core Vision

Source: bwdisrupt

The primary objective of Navi is to create a financial services environment that is accessible to the masses. The founder, Sachin Bansal, believes that the process of securing credit and even insurance should not rely on an individual completing lengthy applications or having to visit different locations. Technology has enabled providers of financial services to assess risk more accurately, lower expenses, and make faster decisions about whether or not to extend credit.

Navi is designed for those customers who value transparency and speed when it comes to obtaining financial products. Navi is committed to being a leading customer-centric fintech organization through the provision of clear pricing and fast loan approvals.

Navi’s Business Model: How the Company Makes Money

Navi follows a simple yet scalable fintech business model.

Revenue Streams

- Interest income from loans

- Insurance premiums

- Asset management fees from mutual funds

- Cross-selling financial products

Instead of relying heavily on intermediaries, Navi leverages in-house technology and data analytics, allowing it to keep costs low and margins sustainable.

How Navi Uses Technology to Scale Fast

The company’s rapid growth can largely be attributed to the utilization of technology. Navi employs data analytics and algorithms to measure creditworthiness and provides a much more accurate means of judging creditworthiness compared to traditional credit scoring systems. By utilizing this methodology, Navi can serve consumers who are potentially entering into the financial services market for the first time but are nonetheless in a position to repay their debts.

Automation has also played a key role in expediting business processes. For example, processes that used to take days (e.g., the approval of loans) can now be completed in a matter of minutes. This has provided Navi with a considerable advantage over the vast number of fintech firms in the Indian marketplace. Navi has also invested heavily in the security of their customers’ data through the use of secure digital formats.

Navi’s Growth Journey: From Startup to Fintech Leader

Navi has steadily grown since its inception in an extremely challenging and competitive marketplace. This growth has not simply been due to aggressive marketing but rather a combination of solid leadership, product clarity and an increase in the demand for www.digital_financial_services.

Navi has differentiated itself from a multitude of other loan application and fintech startup companies based on the emphasis placed on user trust and the manner in which it communicates with its users transparently. Users have commented on how the lack of hidden fees and a very simple user experience help cultivate their trust over time, leading to repeat usage and organic growth.

Challenges Faced by Navi and Sachin Bansal

Fintech companies and other types of financial service providers, such as banks, face complex regulatory, operational and market hurdles. Navi has had to fulfill numerous compliance requirements with respect to regulations while simultaneously providing speed and innovation. Furthermore, there has been intense competition from banks and fintech companies.

Sachin Bansal’s guidance has been instrumental here. Navi has achieved stability, growth and resiliency by utilizing a strong governance framework and making responsible lending decisions through the use of data.

What Makes Navi Different from Other Fintech Companies?

Unlike many fintech startups that focus on one product, Navi offers a full financial ecosystem. Its differentiation lies in:

- End-to-end digital journey

- Founder-led long-term vision

- Focus on transparency

- Strong technology backbone

Impact of Navi on India’s Fintech Ecosystem

Source: mpost

Navi has made it easier for regular people to understand and access financial services. By using a digital approach to simplify the use of loans, insurance, and investments, Navi has opened the door for more people to explore these options without the uncertainty that often comes with them.

This has helped to contribute to India’s overall objective of achieving Financial Inclusion and Digital Adoption while also helping shape the way that many modern Fintech companies approach Product Design.

Future of Navi: What Lies Ahead?

In the coming years, Navi will likely strengthen its position across multiple Financial Segments as Technology continues to evolve and Digital Adoption further grows. Navi’s ability to continue expanding will ultimately depend on its ability to deliver Quality and Trust while continuing to grow.

Navi has the potential to be a well-known brand in Indian Financial Services under the continued leadership of Sachin Bansal and a strong Technology Infrastructure.

Conclusion

Navi’s success in the Fintech Space is a result of good leadership, Technology, and Strong Customer-Centric Focus in Product Design. Sachin Bansal demonstrated his ability to identify large-scale problems and address them through long-term thinking during his journey from Flipkart to Navi.

Navi represents the future of how Indians will interact with money in a Digital World.

FAQs

1. Is Navi a bank or an NBFC?

Navi operates as a fintech company with NBFC-backed lending and regulated financial entities.

2. Who founded Navi?

Navi was founded by Sachin Bansal, the co-founder of Flipkart.

3. What makes Navi different from other fintech apps?

Its focus is on transparency, speed, and long-term trust rather than short-term growth.

4. Is Navi safe for loans and insurance?

Yes, Navi follows regulatory guidelines and uses secure digital systems.

5. What is Navi’s long-term goal?

To become a trusted, full-stack digital financial services platform for Indian consumers.