The stock market in India is one of the most diverse spaces for business and attracts stakeholders with a lot of expectations. The interesting method of generating profit and losses has been something to research for all new investors.

In India, there are thousands of people who keep an eye on relevant investors in the stock market. These stock market investors portray a kind of mindset and perspective toward a stock that instills insight into several strategies.

We have to consider that the way these investors make a profit out of the stock market is a tremendous source of inspiration. Let us get into some more details about some of the top investors in the stock market in India. We will be able to understand how the investment structure of these investors helped them bag a lot of profit.

Rakesh Jhunjhunwala-

Rakesh Jhunjhunwala one of the renowned stock market investors in India recorded a net worth of about $5.8 billion. His portfolio and holdings include Titan, Metro Brands Lts., Agro Tech Foods, and several others. Rakesh Jhunjhunwala was often called the ‘Indian Warren Buffett’.

By 2022, Rakesh Jhunjhunwala’s investments increased to about Rs. 31,883 crores. Unfortunately, Rakesh Jhunjhunwala passed away on August 14, 2022. The Indian stock market witnessed a tremendous loss of an icon. Back in 1985, the billionaire business tycoon had about Rs. 5,000 to invest. Reports indicate that in 2022, Rakesh’s holdings in Titan were worth about Rs. 11,000 crores.

Rakesh Jhunjhunwala along with his associates holds about 32 stocks. In his career, Rakesh Jhunjhunwala had been a successful investor. But he had also been chairman and board of directors for several companies.

In 2021, Rakesh Jhunjhunwala invested about $35 million to acquire a 40% stake in Akasa Air. Akasa Air was co-founded by Rakesh Jhunjhunwala to provide an inexpensive air travel experience to customers.

Radhakishan Damani-

Radhakishan Damani has a net worth of about $20.4 billion. His portfolio and holdings include United Breweries Ltd., 3M India Ltd., Avenue Supermarts, and many more. Radhakishan Shivkishan Damani is an investor, whose assets are worth billions of dollars and comes from Bikaner.

Radhakishan Damani also founded DMart and is a staunch investor in the Indian stock market. His net worth accounts for about Rs. 161,356 crores. All the investments of Radhakishan Damani are managed by his finance firm, that goes by the name, Bright Star Investment Ltd.

Radhakishan Damani was ranked as the 98th richest individual in the world in 2022. Their expertise in the stock market elevates Damani with his business strategies which ultimately gave him great results.

In 2021, Damani’s stock grew from about Rs. 157.65 crores to Rs. 322.65 crores. Such phenomenal growth occurred at a time when the war between Russia and Ukraine hit the Indian stock market. Radhakishan Damani’s experience gave good profits to him and also his stakeholders.

Azim Premji-

Azim Premji has a net worth of about $9.8 billion with a portfolio that includes companies like Wipro Ltd., Balrampur Chini Mills Ltd., and many more. Azim Premji is a very well-reputed investor and billionaire in India.

Being an engineer, Azim Premji is well-known for his devotion to the growth of Wipro. Mr. Premji also built PremjiInvest which looks into several private equity investments along with investments by venture capitals. Azim Premji gave a huge portion of his wealth to charity but before that was one of the richest businessmen in India.

Azim Premji also signed the ‘Giving Pledge’ that was inspired by Warren Buffett and Bill Gates to devote a portion of their wealth towards philanthropy. In 2020, Azim Premji donated about $70 million to several charitable organizations.

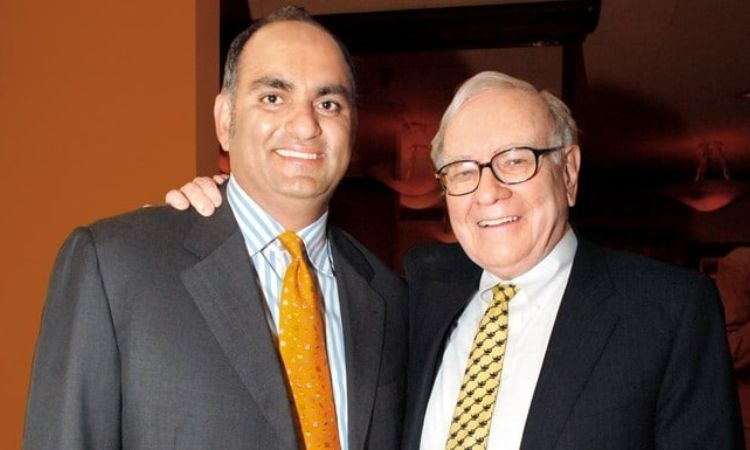

Mohnish Pabrai-

Mohnish Pabrai has a net worth of about $148.3 million with a portfolio that includes Edelweiss Financial, Rain Industries, and Sunteck Realty. Mohnish Pabrai is highly influenced by Warren Buffett.

Mohnish also founded Pabrai Investment Funds in 1999. Since then reports indicate that the firm returned a profit figure of around 517%, which is magnificent. The strategy applied by Pabrai Investments is more driven towards low-risk and high-valued stocks. Investments are towards companies that have good financials and fewer downsides.

Mohnish Pabrai has about three stocks that are valued at about Rs. 1,875.9 crores. Philanthropy is a crucial part of Mohnish Pabrai and in order to contribute something back to society, he and his wife set up Dakshana Foundation which helps students from rural and semi-urban regions to succeed in competitive exams like JEE.

Vijay Kedia-

Vijay Kedia has a net worth of about $96.7 million and has a portfolio with Tejas Networks Ltd., Vaibhav Global Ltd., Elecon Engineering Company, and several others. Vijay Kedia is famously called, the ‘Market Master’ who is an expert investor from Kolkata. Vijay has been in the stock market since he was just 19 years of age.

The strategy of investments of Vijay Kedia is termed SMILE which stands for Small Investment, Medium experience, Large aspirational value, and Extra Large when comes to market potential.

Vijay deeply researches the management of a company before he makes any investments. He tries to understand how the company functions under the operations led by the management team.

Vijay considers one of the best strategies for investment is to wait longer to get more benefits. From 2000 to 2022, Vijay Kedia’s share witnessed a growth of about 47,150% as per reports. This tells about the far-sighted capability of Vijay Kedia.

Nemish Shah-

Nemish Shah has a net worth of about $216 million and has a portfolio that includes Lakshmi Machine Works Ltd., EID Parry (India) Ltd., Bannari Amman Sugars Ltd., and several others.

Nemish Shah has a similar approach to Warren Buffett and is one of the finest stock investors in India.

Nemish Shah also co-founded ENAM in 1984 which works as a broking entity. The group played a crucial role when it came to some important IPOs in India. Nemish goes towards those companies which elevated their values by bolstering product usage.

His stakes in Asahi India and many others tripled in just a few years. With the help of Nemish Shah, the Investment Research of India was created. Doll

Dolly Khanna-

Dolly Khanna has a net worth of about $74.4 million and has a portfolio that includes Chennai Petroleum Corporation Ltd., Polyplex Corporation Ltd., Sharda Cropchem Ltd, Monte Carlo Fashions Ltd., and many more. Dolly Khanna is based in Chennai and has expert supervision over the stock market.

Dolly buys stocks that are not so popular and experiments with her options. Dolly Khanna added Monte Carlo Fashions to her portfolio which gathered quite some discussions in the market. Reports indicate that Dolly Khanna holds about a 1% stake in Monte Carlo. It includes about 3,69,032 stocks.

Ashish Kacholia-

Ashish Kacholia has a net worth of about $234.2 million and has portfolios like Barbeque-Nation Hospitality Ltd, NIIT Ltd., and several more. He founded Lucky Investment Managers and is considered one of the most expert stock investors in India. Currently, Ashish Kacholia acquired a multi-bagger stock called Best Agrolife that increased to about 5,000% in just 5 years.

Reports indicate that Ashish bought about 3,18,000 shares, each costing about Rs. 940.88, of Best Agrolife. The pattern followed by Ashish is very interesting as it delves into in-depth company’s progress and sustainability in depth. The perspective of the stock market is very tricky, as it poses a lot of uncertainty. This is not a place to make a choice that is not backed by relevant data.

The journey of a successful investor comes with two pivotal cases that include careful observation tailored by a precise investment strategy and diversification of stocks. In the stock market, there will be losses, but the Indian stock market has enough room for learning and growing.

Frequently Asked Questions-

- Who is considered the king of the stock market?

Ans– Warren Buffett is the king of the stock market of the world.

- Who is called the Big Bull of India?

Ans– Rakesh Jhunjhunwala is the Big Bull of India.

- Who has the largest portfolio in India?

Ans– Rakesh Jhunjhunwala has the largest portfolio in India which is worth about Rs 31,833 crore.

*All of the above images are taken from Google.