Reserve Bank of Indian (RBI) Governor, Shaktikanta Das said on Wednesday that the next financial crisis will occur due to private cryptocurrencies. He further added that crypto has no “underlying value” and poses the risk for macroeconomic and financial stability.

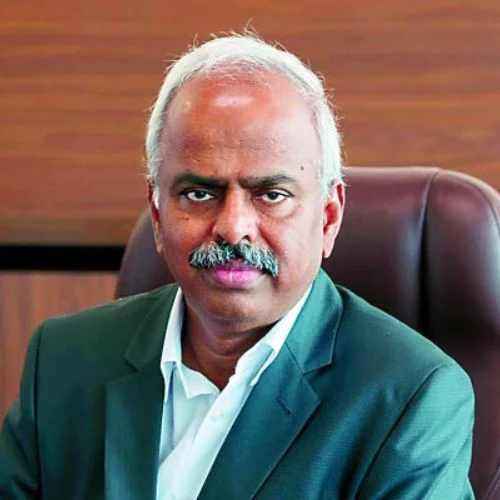

“Cryptocurrency has certain huge inherent risks for our macroeconomic and financial stability, and we have been pointing it out,” Shaktikanta Das said at the Business Standard BFSI Insight Summit.

Das also pointed out the latest FTX meltdown which has caused a wipeout of about $40 billion from the market.

“After the episode of Cryptocurrency FTX, I don’t think we need to say anything more” were his words.

RBI has always held its view about private cryptocurrencies saying that they are a threat to stability and are much more in usage than they should be. To combat the situation RBI is planning to launch its own currency.

The Reserve Bank of India announced that they would be coming up with their own Central Bank Digital Currency (CBDC) known as the “Digital Rupee”. From 1st of November, the central bank began their project of India’s very own digital currency famously known as Digital Rupee for the market.

T Rabi Sankar, RBI Deputy Governor, recently said that whatever information available about digital currency is misleading and called for building all related rules on a clear understanding of what digital currencies are and what they are supposed to do.

Das also explained the significance of digital currency and how UPI is different from CBDC. While UPI is a whole system, CBDC is a currency. Another point he made was that while UPI involves the intermediation of banks, CBDC is like currency notes.

The RBI chief also said that digital currency offers automatic sweep-out and sweep-in facility that will allow the users to withdraw the currency easily and also to drop it back in your account whenever needed.