Life insurance is one of the most misunderstood yet important factors for securing long-term financial stability. In India, where financial literacy is still evolving, taking the right step to secure your life can make a world of difference. Max Life Insurance, now known as Axis Max Life Insurance Limited, stands out as a key life insurance player in the market. Let’s simplify Max Life Insurance for first-time buyers in India.

What is Max Life Insurance?

Max Life Insurance is India’s leading life insurance company that provides a wide range of life insurance and investment-linked products. Initially, it was established as a joint enterprise between Max Financial Services Limited and Axis Bank, combining life insurance expertise with a strong banking distribution network.

But today, it operates all over India through:

- Extensive agency and partner distribution networks.

- Thousands of branches and sales locations.

- A broad suite of life and retirement insurance products.

To better understand Max Life’s positioning, it’s important to view it within the broader evolution of India’s life insurance sector.

Max Life Insurance in India

The life insurance sector in India has undergone a rapid transformation over the past two decades. The market has experienced competitive growth alongside the dominant public insurer, such as LIC (Life Insurance Corporation of India), but with liberalisation, private participation has been allowed since 2000.

The growth of life insurance in the market has traditionally lagged behind the global benchmark, but has shown a steady uptick in consumer awareness and product adoption. In the recent regulatory move, raising the Foreign Direct Investment cap in the insurance sector to 100% is expected to further open the sector to global capital and expertise.

Within this ecosystem, Max Life Insurance has evolved into one of India’s most trusted private life insurers and is now rebranded as Axis Max Life Insurance.

Max Life Insurance Company’s Financial Outlook

| Metric | FY 2024–25 | Growth Status |

| Gross Written Premium | ₹33,223 crore | +13% YoY |

| Assets Under Management (AUM) | ₹1,75,072 crore | +16% YoY |

| Shareholders Profit after Tax | ₹406 crore | – |

| Solvency Ratio | 201% | Above regulatory requirement |

| Claims Paid Ratio | 99.65% | Industry leading |

| Individual Adjusted First Year Premium | ₹1,553 crore | +23% YoY |

| AUM (Q1 FY26) | ₹1,83,211 crore | +14% YoY |

Data source from: Axis Max Life Insurance

These figures highlight Axis Max Life Insurance’s strong balance sheet, sustained premium growth, and solvency well above regulatory requirements—key indicators for first-time buyers evaluating insurer reliability.

Finances and Growth

- The company has demonstrated consistent growth in its premium income, assets under management, and embedded values, which indicates its strong strategies for the company’s expansion and increase in customer acceptance and policy adoption.

- Max Life Insurance maintains its financial stability well above the mandated minimum of 150%, reflecting its reliability.

- One of the key trust indicators for policyholders is the claim paid ratio, which is the highest in the industry at 99.65% for FY24.

Max Life Insurance Plan: What does it offer?

Max Life Insurance offers plans that meet everyone’s needs. The major product categories are:

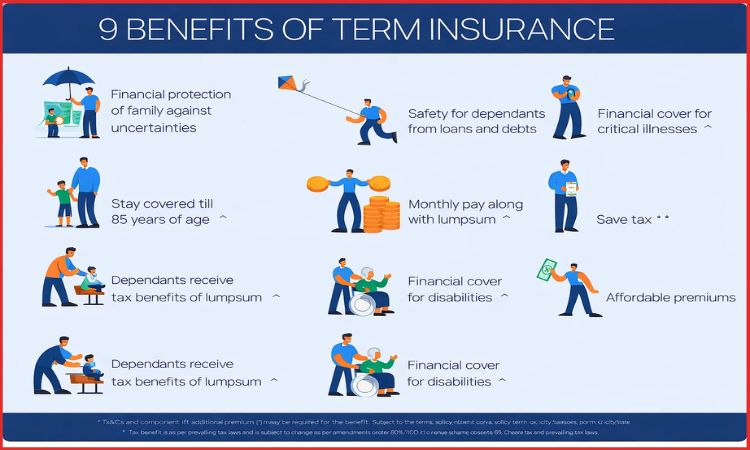

Term Insurance

This is a pure life protection plan. It offers financial cover at an affordable price to meet the family’s financial demands and fulfil its needs in case of untimely demise.

Its key features are:

- High sum assurance at relatively low cost.

- Flexible policy terms like short- and long-term coverage, depending on needs.

- Options to increase or decrease the coverage.

For young professionals and newlyweds, term life insurance policies serve as a financial safety net, that covers major liabilities such as home loans, education costs, and daily living expenses.

Endowment and Saving Plans

This is an insurance plan with a savings component. It is designed for long-term goals like retirement or education. This plan pays on policy maturity or to the nominee in the case of death during the policy term.

Its key features are:

- Guaranteed maturity benefits

- Periodic bonuses, depending on the plan structure

- Fixed premium payment schedule

- Suitable for low-risk investors

This plan is ideal for conservative investors who are looking for capital protection and insurance coverage for long-term plans, such as home purchasing or education funding. Returns are stable, and funding plans typically offer lower returns than market-linked products.

Unit Linked Insurance Plans

This is an investment-linked insurance plan that offers market-linked returns, along with life cover. It allows policyholders to choose among multiple fund options based on risk tolerance.

Its key features are:

- Options to switch between equity and debt funds

- Long-term wealth creation potential

- Partial withdrawals after the lock-in period

- Tax benefits under the income tax laws

It is ideal for individuals with long-term investment plans with moderate to high risk tolerance, as returns often vary with the market activities.

Pension and Retirement Plans

This plan primarily focuses on retirement security through structured payments. This plan typically collects savings during working years and converts them into annuities after retirement.

Its key features are:

- Immediate annuity options

- Guaranteed income streams

- Flexibility in payout frequency

- Protection against longevity risk

With increasing life expectancy and limited social security coverage in India, structured retirement planning has become essential now.

Child Plans

This plan focuses on future education and the financial security of children, even in the absence of earning parents.

Its key features are:

- Maturity benefits with education

- Premium benefit in case of parents’ demise

- A balanced mix of protection and investment

These plans help parents safeguard their children’s aspirations against unforeseen or unexpected financial disruptions.

Max Life Insurance Company Profile

- Brand Position and Market Reach: Axis Max Life Insurance consistently ranks among the top private life insurers in India, supported by both the Max Group Legacy and Axis Bank’s distribution network.

- Reliable Claims: A claim paid ratio close to 100% is a strong indicator of trust and customer confidence in the company.

- Financial Performance: The growth in assets under management, premiums, and embedded values reflects the company’s financial performance and resilience.

- Operational Metrics: High persistence ratios of the company indicate that customers stay with the insurer over time, which is a key factor of customer satisfaction.

Max Life Insurance for First-Time Buyers in India: Things to Consider

First-time buyers should prioritise term insurance for pure protection before exploring savings or investment-linked products:

- Complexity of products: Major products such as Unit Linked Insurance Plans or long-term savings plans can be complex for beginners or first-time users. It is necessary to understand fees, charges, and lock-in periods before investing.

- Quality distributions: The insurance advice quality varies across agents. Hence, it is essential to always verify credentials and seek second opinions before purchasing or making a decision.

- Market Risks: Some policies, like investment-linked policies, carry market risks, where returns are not guaranteed. It is important to review the terms & conditions before making a decision.

- Competition: LIC and other private insurers continue to aggressively innovate and compete for market share. Thus, competition in the market is increasing, which makes it difficult for customers to choose the correct one.

Max Life Insurance Benefits

Certainly, there are benefits of choosing Max Life Insurance, such as:

- Strong financial health, stability, and growth in assets under management. A healthy financial stability ratio reduces the risk of financial stress during economic downturns and helps ensure policyholder benefits remain protected throughout the policy term.

- High industry-leading claims in the settlement reliability ratio give confidence. It indicates strong underwriting discipline, a transparent process, and payouts with no disputes.

- Wide distribution reach across urban and rural India. This ensures easy access to policies in different regions, improved policy services, and a wider reach beyond metro cities.

- A wide range of products and policies that cover all the major life goals and needs, like flexible payment options, multiple payout structures, and tools that manage policies digitally.

Max Life Insurance Future Outlook

The future of Max Life Insurance in India looks promising. For Axis Max Life Insurance, a continued growth in the assets under management and customer base over the next decades seems likely, if momentum sustains:

- Regulatory reforms, such as an increase in foreign access, boost capital and product innovation.

- A rise in the awareness of financial stability is expanding financial awareness and the need to secure one’s future.

- Digital adoption of insurance plans is improving its access to and the servicing of insurance policies.

Conclusion

Axis Max Life Insurance is a credible, growing life insurance option for first-time buyers. The company has solid finances, a high claim performance ratio, and strong brand roots. However, with careful consideration of policies, a thorough understanding of products, and a focus on meeting financial goals, one can carefully purchase or invest in a suitable plan.

India’s life insurance penetration remains below the global average, creating significant scope for expansion, but with today’s informed and careful choices, it can provide financial security and peace of mind for tomorrow.

FAQs

Q1. Does Max Life Insurance offer an online purchase policy?

A: Yes, an individual can buy or manage Max Life Insurance policies online through its website or apps.

Q2. Are returns guaranteed on Max Life Insurance policies?

A: For non-investment plans like term insurance, returns are not applicable. On the other hand, for savings or investment-linked plans such as ULIPs, returns depend on market performance. But returns are not guaranteed.

Q3. How to choose the right Max Life Policy?

A: Identify financial goals, understand premiums, benefits, lock-in terms, and risks before buying, seek professional help if necessary, then choose the right policy.

Q4. Is Max Life Insurance trustworthy?

A: Axis Max Life Insurance demonstrated industry-leading claims settlement ratios of 99.65% in FY24, with strong financial stability metrics and consistent growth.