The morning after the Union Budget is usually a time for digestion, but for the Indian markets, it felt more like a hangover. On Monday, the Reserve Bank of India (RBI) was forced to step in as the Indian Rupee (INR) flirted with an all-time low, teetering near the 91.98 mark against the US Dollar.

While the government’s fiscal roadmap prioritised manufacturing, the lack of “big bang” reforms and an unexpected tax hike on equity derivatives left investors feeling cold.

The Great Recovery: RBI to the Rescue

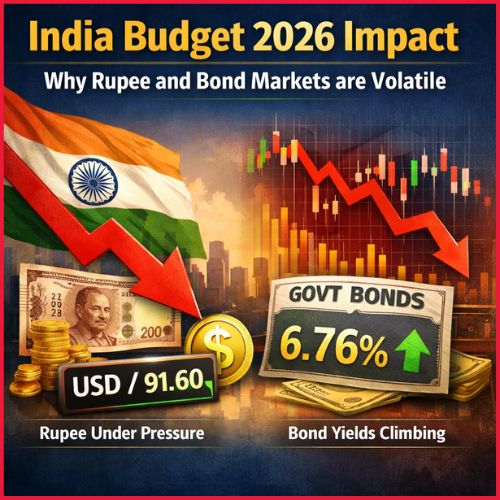

The Rupee was on a downward spiral early Monday, mainly due to disappointed sentiment following Sunday’s special trading session. However, aggressive intervention by the RBI successfully pulled the currency back from the brink, stabilising it at 91.60, a 0.4% gain from Friday’s close.

Despite this tactical win, the road ahead looks bumpy. Market analysts, including Michael Wan from MUFG, suggest that the Rupee may continue to underperform through 2026. The consensus? The budget played it safe, sticking to “tried and tested” formulas rather than the bold shifts needed to decouple the INR from global volatility.

Why Are Investors Spooked?

It wasn’t just the currency feeling the heat; the entire financial ecosystem saw a shift in momentum. Several factors contributed to the cautious atmosphere:

- Borrowing Concerns: A higher-than-expected government borrowing estimate sent the 10-year benchmark bond yield climbing to 6.76%, its highest point since early 2025.

- STT Hike: An unexpected increase in the Securities Transaction Tax (STT) on equity derivatives dampened stock market bulls.

- Manufacturing vs. Reform: While the budget leaned heavily on manufacturing, the absence of aggressive, pro-business reforms left international investors wanting more.

- Global Volatility: A broader “risk-off” sentiment swept through Asia, with the MSCI Asia (ex-Japan) index dropping nearly 2.5% amid fluctuating precious metal prices.

Market Performance Snapshot

Currency (INR/USD):

- Trend: Sharp recovery after hitting record-low territory.

- Key Level: Stabilised at 91.60 after nearly touching the 91.98 mark.

- Change: Gained 0.4% on Monday following the RBI’s aggressive market intervention.

Government Bonds:

- Trend: Significant yield spike due to higher-than-expected borrowing targets.

- Key Level: The 10-year benchmark yield rose to 6.76%.

- Context: This marks the highest yield level since early 2025, reflecting investor anxiety over fiscal deficit targets.

Equity Benchmarks:

- Trend: Tentative recovery after a volatile weekend.

- Change: Domestic stocks climbed between 0.2% and 0.4% on Monday.

- Context: This follows a bruising Sunday session in which markets tumbled 2% in response to the surprise hike in the Securities Transaction Tax (STT).

Regional Landscape (Asian Markets):

- Trend: Broad downward pressure across the continent.

- Currencies: Most Asian currencies slipped between 0.1% and 1%.

- Equities: The MSCI Asia (ex-Japan) index fell nearly 2.5%, weighed down by global “risk-off” sentiment and metal price volatility.

The Outlook for 2026

For businesses and importers, the volatility is a reminder that the “India Story” still faces significant external and internal headwinds. As global markets remain on edge, the RBI’s ability to defend the currency will be tested repeatedly. For now, the focus remains on whether the manufacturing push can provide the long-term growth needed to offset short-term fiscal jitters.