Over the next five years, India is considering spending 600 billion rupees ($7.2 billion) to offer subsidised loans for small urban dwellings, according to two government sources.

The program will likely be implemented by banks in a few months, in time for important state elections later this year and the mid-2024 general elections. In order to control inflation before elections, the South Asian nation slashed the cost of cooking gas for households by roughly 18% last month.

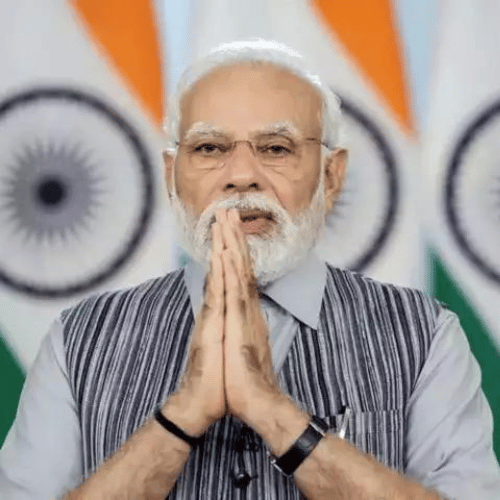

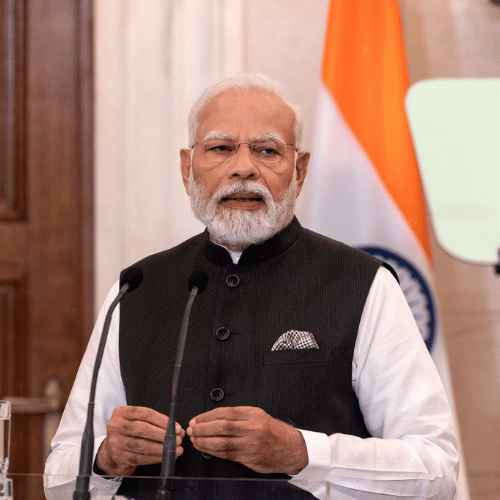

The idea was unveiled by Indian Prime Minister Narendra Modi in a speech in August to commemorate the nation’s Independence Day, but its specifics were not previously known. The government will begin deploying electric buses for urban transportation throughout 100 cities in the following six months, according to ministry officials. 10,000 e-buses were just approved for deployment by the Cabinet.

The program will provide a 3-6.5% annual interest subsidy on loans up to 0.9 million rupees. According to the sources, the planned scheme will be available for housing loans under five million rupees that are taken out for a 20-year term.

“The beneficiaries’ housing loan accounts will be immediately credited with the interest subvention. The suggested plan through 2028 is almost complete and needs federal Cabinet approval, according to a government official.

The program may help 2.5 million low-income urban loan applicants, but the amount of subsidised credit would depend on the demand for such dwellings, the official added.

In his speech in August, Modi had stated that “we are coming up with a new scheme in the coming years that will benefit those families that live in cities but are living in rented houses, or slums, or chawls, and unauthorised colonies.” We will provide them with a reduction in interest rates and bank loans if they want to build their own homes, he had stated. This will enable them to save thousands of rupees.

The officials declined to give their names since the scheme is still being finalised.

The Ministry of Housing and Urban Development and the Ministry of Finance did not respond to emails received by Reuters requesting a response.

No particular lending goals have been given to lenders, but two bank officials indicated that a meeting with government representatives is soon to be scheduled.

The move, they added, might assist in enhancing lending in the affordable housing part of the home loan portfolio, as banks have already begun to identify beneficiaries.

The government has previously provided interest discounts to low-income borrowers in urban areas. A comparable program that approved 12.27 million dwellings operated from 2017 to 2022.