Source: Planify

The Indian financial markets are witnessing a stark divergence between stock price and core business strength. On February 02, 2026, Five-Star Business Finance Ltd saw its shares tumble to a fresh 52-week low of Rs. 431.05, marking a sharp 5.13% intraday drop.

This slide is not just a daily blip; it represents a two-day losing streak that has pushed the stock below every major moving average (5-day through 200-day). For investors and industry watchers, the question is simple: Is this a falling knife to avoid, or a fundamentally sound company trading at an irrational discount?

The Numbers: A Year of Decoupling

While the Sensex has managed a modest 3.84% gain over the past year, Five-Star Business Finance has plummeted by 41.77%. After peaking at Rs. 850.45, the current valuation feels like a different reality.

The catalyst for this recent dip appears to be a “flat” December 2025 quarterly report. In a market hungry for explosive growth, “steady” often gets punished. This lack of immediate momentum led to a Mojo Grade downgrade to “Sell,” fueling the technical sell-off we are seeing today.

The Silver Lining: Strong Fundamentals Meet Low Valuation

Strip away the stock ticker’s red ink, and the business looks remarkably healthy. Five-Star is not a company in operational distress. Instead, it boasts:

- Robust Growth: A compound annual growth rate (CAGR) of 30.74% in net sales and 30.59% in operating profit.

- Capital Efficiency: A steady Return on Equity (ROE) of 16.3%.

- Institutional Backing: Professional investors aren’t jumping ship just yet. Institutional holding stands at a massive 67.68%, suggesting that those with the most data still believe in the long-term story.

With a Price-to-Book value of 2 and a PEG ratio of 1.7, the stock is trading at a significant discount compared to historical sector averages. Essentially, profits grew by 7.7% last year while the price fell off a cliff, a classic “value gap” that contrarian investors often look for.

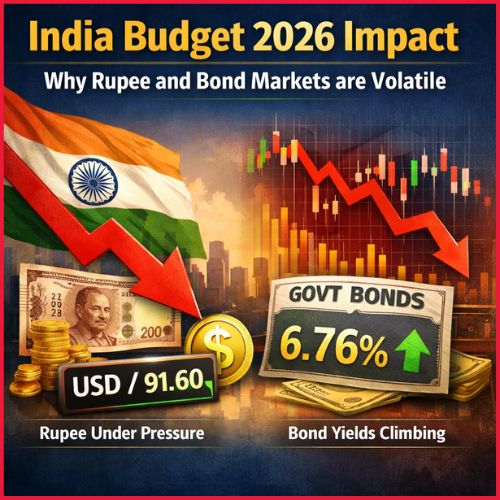

Broader Market Pressure

Five-Star isn’t alone in its struggle. The broader market sentiment is currently “cautious.” The Sensex opened down 167 points today, and major indices like the S&P BSE FMCG also hit yearly lows. The entire NBFC (Non-Banking Financial Company) sector is feeling the squeeze as the Sensex hovers below its 50-day moving average.

The Verdict for Business Leaders

The decline to Rs. 431.05 is a milestone that reflects high market anxiety and a demand for better quarterly earnings. However, the juxtaposition of high institutional ownership and 30% CAGR profit growth suggests that the company’s internal engine is still humming.

For the strategic investor, the current “52-week low” might be less of a red flag and more of a “clearance sale” on a fundamentally sound financial institution.