The Singapore Indian Chamber of Commerce and Industry (SICCI) has advised Small and Medium Enterprises (SMEs) operating within the city-state to utilize the PayNow-UPI linkage to facilitate business transactions with their counterparts in India. This recommendation was made in order to simplify the payment process for these transactions. SICCI is a business association that represents the interests of the Indian business community in Singapore.

They have encouraged SMEs to take advantage of this payment platform to enhance their operational efficiency when conducting business with Indian enterprises. By utilizing the PayNow-UPI linkage, SMEs will be able to streamline their payment processes, which will ultimately result in cost savings and improved cash flow management.

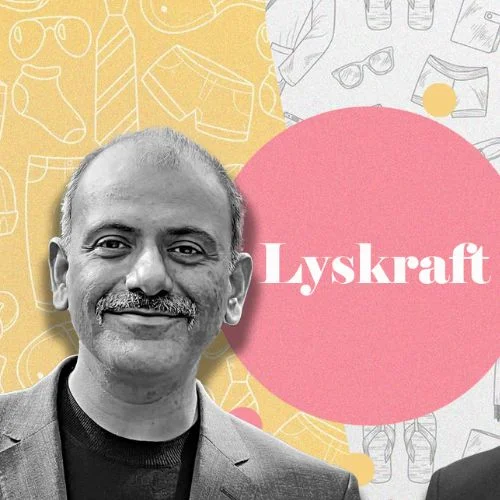

Neil Parekh, the Chairman of SICCI, expressed his approval of the new cross-border real-time digital payment system that links India’s Unified Payments Interface (UPI) and Singapore’s PayNow. He emphasized that small and medium-sized enterprises (SMEs) would benefit from this launch. Parekh also noted that the timing of this launch was opportune, as both countries have returned to normalcy and Singapore has witnessed a substantial number of Indian entrepreneurs visiting the country for business meetings with their counterparts and the Chamber.

The recent launch of real-time payment has the potential to benefit small and medium enterprises (SMEs), according to a statement made by a representative of the Solomon Islands Chamber of Commerce and Industry (SICCI). In an interview with the Press Trust of India (PTI), the representative, named Parekh, urged SMEs who engage in business with India to utilize the real-time payment scheme for increased convenience and efficiency in their transactions.

The adoption of real-time payment technology is expected to simplify the payment process for SMEs, which typically face challenges in managing their cash flows and financial operations due to limited resources. With real-time payment, SMEs can receive payments in a matter of seconds, eliminating the need for lengthy waiting periods and providing them with more control over their finances.

Furthermore, the implementation of real-time payment is likely to foster stronger ties between the SME sector in the Solomon Islands and their counterparts in India. By utilizing this innovative payment solution, SMEs can enhance their competitiveness in the global marketplace, improve their overall efficiency and boost their profitability.

SICCI strongly encourages SMEs to take advantage of this new payment scheme, which can bring significant benefits to their business operations. By leveraging real-time payment technology, SMEs can streamline their financial transactions and improve their bottom line, ultimately contributing to the growth and development of the SME sector in the Solomon Islands.

On Tuesday, Singapore’s Prime Minister Lee Hsien Loong and his Indian counterpart Narendra Modi oversaw the implementation of a real-time digital payment system that connects the two countries. The PayNow-UPI linkage will enable cheaper, faster, and safer cross-border retail payments and remittances for both individuals and businesses, directly from bank accounts or e-wallets. The launch was attended by Parekh, who extended congratulations to the Monetary Authority of Singapore (MAS) and the Reserve Bank of India (RBI) for their efforts in making it possible.

Parekh expressed his congratulations to Ravi Menon, the Managing Director of MAS, and Shaktikanta Das, the Governor of the RBI, for successfully finalizing and launching the real-time payment scheme during India’s G20 Chairmanship. Parekh also mentioned that he was pleased to have discussed the scheme with Das during a fireside chat organized by SICCI, where he addressed the members last July.

The Monetary Authority of Singapore (MAS) has announced that the PayNow-UPI linkage is the first global real-time payment system to use a flexible cloud-based infrastructure that can accommodate future increases in remittance traffic volume. The service is currently being rolled out to DBS Bank and Liquid group customers in Singapore through a phased approach, with transaction limits and eligible user groups set to expand gradually from Tuesday until the end of March 2023.

According to a statement from the Monetary Authority of Singapore (MAS), customers of Indian banks who reside in Singapore can now receive funds using a new service. This will particularly benefit the Indian diaspora in Singapore, including students and migrant workers, who can now enjoy the convenience of quick and cost-effective money transfers between India and Singapore.