Source: Flipkart Stories

As India is undergoing a digital revolution, everything is becoming digital, from shopping to ordering food online, and even groceries.

But have you ever thought what is happening with the local kirana shops?

No? Stop and think…

- Is the emergence of e-commerce fair for kirana shop owners?

- Is there any threat to the local market?

- How are small kirana stores competing with large e-commerce platforms such as Amazon & Flipkart?

Let’s gain insight into the local market and e-commerce platforms we use daily!

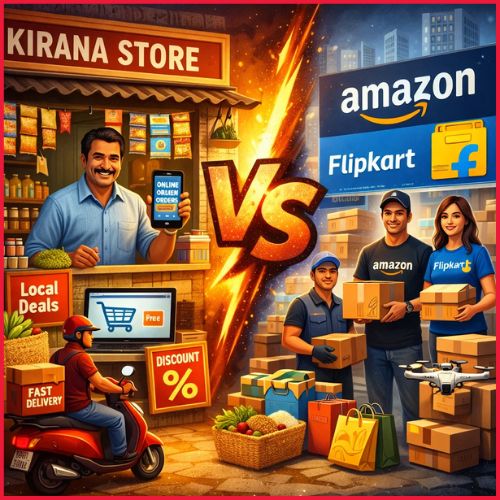

E-Commerce vs Kirana Stores: The Real Battle

India’s kirana stores face intense competition from e-commerce platforms, yet many are surviving by adapting to technology and leveraging local trust.

While digital platforms continue to reshape retail, the government is attempting to balance growth through initiatives like ONDC (Open Network for Digital Commerce) — a system designed to include small retailers rather than replace them.

Role of ONDC in Supporting Kirana Stores

- Over 370,000 sellers across 588 cities

- Platforms like Amazon, Flipkart, Paytm & PhonePe are onboarded

- Enables kiranas to sell digitally without losing independence

- Helps bridge the digital gap for small retailers

How Big Platforms Are Collaborating with Kirana Stores

Major e-commerce players are no longer just competitors — they’re collaborators:

- Kirana stores act as micro-warehouses

- Used for last-mile delivery

- Faster delivery + reduced logistics cost

- Boosts income for small shop owners

Platforms like Amazon, Flipkart, Swiggy, Dunzo, and JioMart are actively adopting this model. worth remains modest, often family-run, with daily sales of ₹10,000 to ₹50,000, but collectives are projected to power a $ 1+ trillion unorganised sector in 2025.

Market Statistics & Industry Data (2024–2025)

Kirana Stores vs E-commerce

| Metrics | Kirana Shops | Amazon/Flipkart |

| Store counts | 13M | N/A |

| Market share | 92.6% in 2023 | <10% |

| FY25 revenue | $800 B collectively | ₹30K Cr in Amazon & ₹20K Cr in Flipkart |

| Digital adoption | 84% using tools | Complete technology |

| Threats | 200K last year | Aggressive expansion |

Nationally, 13 million kiranas employ millions of people, contribute 11% to GDP, and could add up to 3.2 million jobs through modernisation.

Kirana Stores’ New Survival Strategy

With the rise of these platforms and an increase in online shopping, the local kirana shop owners find a way to stay afloat in the market to earn a living.

Kirana shops fight back via digital partnerships. More than 84% of shop owners now use tech tools amid the quick-commerce rivalry.

For example, JioMart partners with thousands of merchants, providing PoS (point-of-sale) devices and hyperlocal fulfilment to drive 4x growth in merchant numbers and increase average purchase value.

UPI also helps: 709 million active QR codes link kiranas to the formal economy, with P2M transactions up 37% in H1 2025.

In short, if kiranas want to survive, they must modernise and upgrade their strengths.

Kirana Stores’ New Approach to Compete

Source: Business Today

Kiranas are a blend of old-school trust and new technology; ONDC, UPI, and partnerships help them maintain their dominance in rural/small-town markets where large platforms are lacking.

Here are some of the new approaches kirana shop owners have taken to adapt to this shift in the market:

- Moving to digital platforms and listing their products online to reach to their customers.

- Partnering with local delivery platforms to provide doorstep delivery services.

- Kirana shop owners can offer personalised recommendations to cater to specific customers’ needs.

- Adopting technology and launching grocery delivery apps can help kirana stores be more efficient, reduce waste, and increase profits.

The Real Truth

The rise of Q-commerce and Offline to Online platforms has introduced new challenges for kiranas.

Large players with sophisticated supply chains, real-time inventory tracking, and advanced logistics are beginning to outperform Kirana stores because they offer convenience for consumers, have good speed in delivery, and sometimes best on the best price because of discounts and offers.

That’s why consumers in urban areas are shifting toward digital platforms for grocery shopping, influenced by the ease of use and fast delivery options that Kiranas often struggle to match.

One thing that nobody talks about is that many small retailers are struggling to adapt.

Unlike quick e-commerce platforms that promise 10-minute deliveries, most kirana shops lack the technology, infrastructure, and logistics to compete.

But at some point, the quick digital shops lose out on trust from local people and customers, an understanding of local demand, and loyalty from them.

Impact of E-commerce Platforms on Kirana Stores: Challenges & Opportunities

According to a study by the Confederation of All India Traders: up to 40% of small retailers in urban areas are reporting of decline in their revenue.

Kirana stores have a long history of serving local communities. However, the rise of e-commerce poses existential threats, including declining foot traffic, revenue losses, and heightened competition.

Challenges Faced by Kirana Stores

- Declining in foot traffic: They face low profit margins as customers increasingly prefer home delivery and online pricing.

- Lack of access to technology: They lack the technological infrastructure to compete with e-commerce platforms. Most kirana shops still rely on manual stock tracking and limited digital payment options.

- Competitive pressure from e-commerce platforms: E-commerce platforms are often backed by foreign direct investments, which engage in aggressive pricing strategies and create disadvantages for kirana stores.

- Loss of customer base: Change in customers’ preferences because of ease, variety, and cashback offers by online platforms has reduced the presence of kirana stores.

Opportunities:

- Integration of online and offline sales: This integration, such as ordering online and digital payments, allows kirana stores to remain competitive.

- Local deliveries: Kirana stores can enhance their market reach by pushing hyperlocal deliveries.

- Partnerships: Collaborating with large platforms such as JioMart, which provides kirana stores with access to a broader network and technical support.

- Customer loyalty: Kirana store owners have built a personalised relationship and established trust over generations, which can be a competitive advantage to them.

The Future of Retail in India

The future of India’s retail market is likely to be a combination of e-commerce, q-commerce, and traditional retail shops. Through this, they will help different customer needs and complement each other.

Kirana shop owners who understand digital transformation, innovate their business, and focus on delivering value to their customers will not just survive, but also thrive in this new shift.

The journey ahead is full of challenges yet life-changing opportunities for Indian kirana shop owners.

The future will be shaped by the ability to innovate, adapt, and coexist to ensure that the benefits of technological advancement are shared across the economy widely.

Conclusion

Market competition is transforming the retail industry. Kirana shop owners must strengthen their ties with the community and use technology efficiently for effective solutions.

The future of kirana shops depends on their ability to compete and upgrade over time, rather than being edged out.

Kiranas have the potential to play a central role in the future of India’s retail by modernising their operations and collaborating with larger platforms.

FAQs

Q1. How many Kirana stores operate in India?

A: As of 2025, around 13 million Kirana stores are operating in India.

Q2. What is the market share battle?

A: Kiranas were at 92.6% in 2023, dipping slowly vs the quick e-commerce rise.

Q3. Are Kirana stores going digital?

A: Yes, almost 84% of stores adopt tools, like ONDC, PoS, and JioMart onboarding lakhs.

Q4. What are the impacts of Amazon or Flipkart?

A: They impacted the Kirana stores in various ways. But mainly, they take urban sales through discounts.

Q5. Can Kirana stores survive long-term?

A: Absolutely. They can survive through partnerships with UPI and other technologies and generate revenue.