Avenue Supermarts, which owns the retail brand DMart, declared a consolidated net profit of Rs 623.35 crore for the second quarter of fiscal year 2023-24 on October 14, down 9.09 percent from Rs 685.71 crore the previous year.

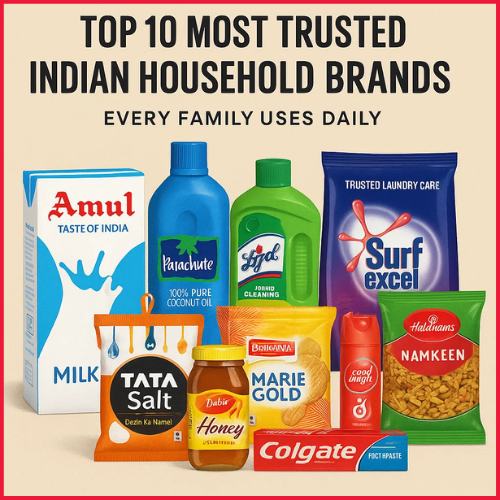

In India, DMart is a hypermarket chain. Radhakishan Damani, who also formed the investment business DMart, launched it in 2002. DMart purchases things in bulk from manufacturers and resells them at a reduced price. It is the country’s biggest retailer, with a net profit over three times that of the next five listed stores combined.

DMart’s success may be ascribed to a number of things, including:

- Customer-centric approach: DMart focuses on offering high-quality goods at reasonable costs.

- Supply chain efficiency: DMart obtains its items directly from manufacturers and suppliers.

- stringent quality control: DMart has a stringent quality control policy in place.

The total net profit of the firm declined 5.36 percent from Rs 658.71 crore in the preceding quarter.

Standalone net profit fell 10.91 percent to Rs. 658.54 crores in Q1FY24, from Rs. 730.4 crores in the same period the previous year.

The company’s consolidated income from operations increased 18.66 percent year on year to Rs 12,624.37 crore, up from Rs 10.638.33 crore the previous year. The revenue increased 6.39 percent from the previous quarter’s Rs 11,865.44 crore.

Standalone total revenue increased 18.51 percent to Rs. 12,307.72 crore for the quarter that ended June 30, 2023, compared to Rs. 10,384.66 crore for the same time the previous year.

Revenue was mostly in line, while profit fell short of expectations. According to three brokerages, DMart’s Q2 sales were Rs 12,592 crore, with a net profit of Rs 675 crore.

EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortisation.

Q2FY24 revenue was Rs. 1,005 crore, up from Rs. 892 crore in the same period the previous year. In Q2FY24, the EBITDA margin was 8.0 percent, compared to 8.4 percent in Q2FY23.

“Our gross margins continue to be lower compared to the same period in the previous year due to lesser contribution from the higher margin General Merchandise and Apparel business. We opened 9 new stores during the quarter taking our total store count to 336.” said. Neville Noronha, CEO & Managing Director, Avenue Supermarts Limited.

Avenue Supermarts ended at Rs 3920 on the National Stock Exchange on October 13, up 1.48 percent from the previous day.