Finance Minister Nirmala Sitharaman has urged Indian fintechs to curb digital scams. But is it really possible for Fintech to solve one of the toughest problems of this digital era? What capabilities of Indian fintech’ players made her believe that this very problem can be solved in-house?

In my view, Payment Fintechs can bring significant control over these transactions. Their current practices are already saving vulnerable users. However, the playbook is vast and still needs to be fully addressed.

The current landscape –

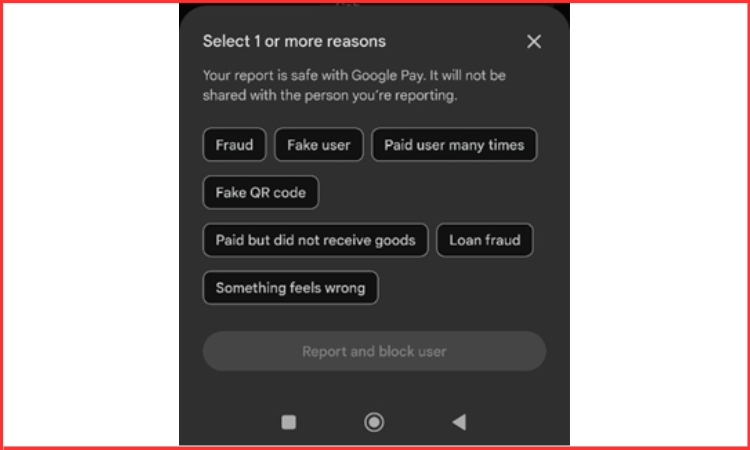

- Fraud reporting on the platform – Currently, users can flag any contact as fraud using these platforms. However, further steps to this report are unknown. Does the platform flag an account based on a single report or do they have an algorithm that determines this? Or, is there a manual review involved?

- Two steps user authentication – For large amount, fintechs have a default practice of two-step authentication. This helps ensure users are giving their consent before the money goes out.

- Tracking sudden pattern – Fintechs monitor unusual activities such as a late-night transaction or abnormally large amount. Some platforms like BharatPe, Razorpay etc. block these suspicious transactions.

- Instant Notification – Platforms offer real-time SMS/ notifications to avoid misuse of the account without users’ knowledge.

- End to end encryption – The transaction is largely secured and there are minimal chances of tampering the transaction details in the transit time.

- Awareness Campaign – Companies are taking proactive steps to educate masses not to fall prey to scammers.

However, the bigger picture to cater-

- Warn innocent users: Prompt fraudster flag if a user is trying to initiate a payment either using a link or contact number, UPI, or QR code.

- Add deterrent to the transfer: Additionally, an extra layer of security can be added in such transactions to increase the transaction time. This will help vulnerable individuals. A senior citizen who does not understand why the delay may check with their trusted family members and can be safeguarded against possible scams.

-

Payment initiation during calls (WhatsApp or Network Call): Feature for users to stop or delay the transfer under various circumstances such as:

- During an ongoing WhatsApp or network call (to avoid digital arrest scenarios).

- Payment link received on SMS/WhatsApp which is tagged as a fraudulent business/user.

-

Reporting to cyber cell: Real-time reporting of changes in payment pattern will help regulators take timely action, such as:

- Transfer to many new parties in a short period.

- Transfer of a large amount to an unknown party.

- Transfer while the phone is switched off or after multiple missed calls.

- SMS alerts not going through after debit transactions.

- Debit of a large amount immediately or within a day of small credits.

- User verification feature (Dating scam): Users should be allowed to do a background check on the other party to avoid emotional traps that lead to money transfer. Users should be able to view fraud commentary and conduct on the platform or other payment platforms to ensure they are interacting with a real person and not a scamster.

Conclusion –

I believe in digital scams; you are not addressing the users consent but their vulnerability. Hence, a little derail in the transaction and monitoring of activities will help them to come out of emotional storm.

Using data and analytics, fraudsters’ faces can be unveiled. I agree, it deviates from their core product offerings, but if they do not take charge, who else will?

These additional security features will have certain fallouts such as –

- High implementation cost with no revenue model mapped to it.

- Users facing inconvenience due to additional security layers

However, the people who really understand the vulnerability of the transaction may switch their platform to get better security.

Authored by

Swapnil Singh

SVP – Risk Management & Operations, CredAble

Views here are personal