Since the eight-month card ban was removed in August of last year, HDFC Bank has recovered quickly.

HDFC Bank Ltd., India’s largest private bank, is aiming to issue a million credit cards every month, a stunning turnaround for the institution after the country’s regulator barred it from accepting new card clients two years ago.

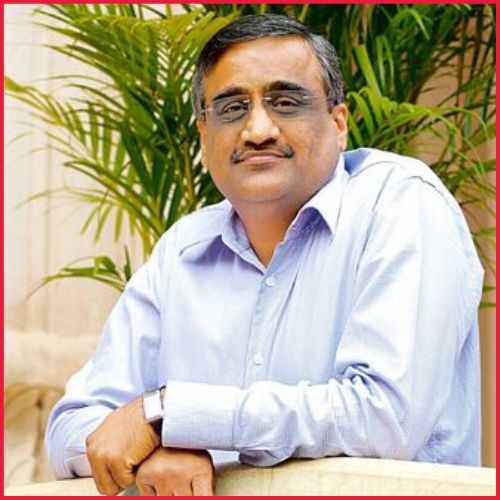

According to Parag Rao, country head for payments business, consumer finance, digital banking, and marketing, the bank plans to treble its current monthly rate of 500,000 new credit card issuances. Rao stated that the company will announce collaborations in a variety of industries, ranging from online shopping to food delivery, in the coming weeks in order to grow card spending.

HDFC Bank’s recovery has been rapid after the eight-month card ban was removed in August of last year, with the lender attempting to move past the penalty for persistent online problems that harmed its clients. According to Reserve Bank of India data, the bank collected 29% of India’s total credit card expenditure in October, the most among its competitors.

“We focus not only on the issuance of cards which is a distribution game, but on deep engagement, ensuring customers find more value in their cards, and keep spending,” Rao said in an interview.

According to Rao, the relationships will also involve two airlines and a significant hotel chain in the coming weeks. He stated that HDFC Bank is in the final stages of designing a new digital credit card to attract younger clients.

Banks in the world’s second most populous country are ready to gain from the rise of internet commerce, where clients pay using credit cards. According to a Bain & Co Inc. research, between 200 million and 300 million Indians are likely to spend $50 billion on online shopping this year.

According to Rao, part of HDFC Bank’s drive will be related to its merger with Housing Development Finance Corp., which would provide it access to the mortgage lender’s clients. The two companies decided to merge this year in one of the largest worldwide transactions to capitalise on India’s surge in housing loans and consumer spending.

According to Rao, the bank also hopes to attract more consumers who use credit cards through India’s local retail payment system, RuPay. He views new laws allowing RuPay credit cards to be linked to the extensively used government-backed payment interface as boosting the market for these cards.

“The credit lines for such customers will be small, but these are future customers who can upgrade to other cards as they evolve,” Rao explained.

And while peers are offering rewards on a slew of products to gain customers, HDFC Bank is avoiding this strategy.

“We never have had the best discounts in the market nor do we want to be known as the card with the most discounts,” Rao said.