Asish Mohapatra’s Success Story is a journey of Vision and Resilience.

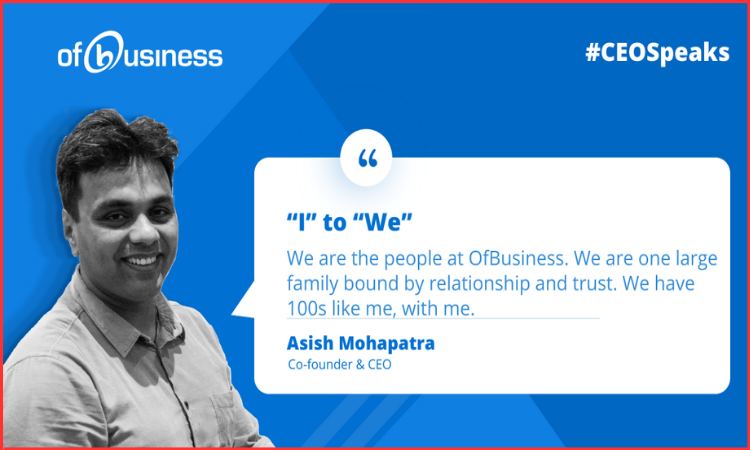

Few stories capture the intersection of determination, industrial insight, and category innovation in the transforming landscape of Indian entrepreneurship. One such story is the journey of Asish Mohapatra, the co-founder and CEO of OfBusiness (OFB Tech Pvt. Ltd.), which demonstrates how deep, ground-level market understanding can accelerate business models.

From his academic beginnings at the Indian Institutes of Technology to leading one of India’s most successful B2B unicorns, Asish Mohapatra now stands among India’s notable profitable unicorn founders.

With a strategic focus on small and medium-sized enterprises (SMEs) that were left behind by digitalisation and financial integration efforts, Asish Mohapatra and his team built a platform that transformed raw material acquisition, working capital financing, and enterprise technology integration for the manufacturing and infrastructure sectors.

Early Life and Education of Asish Mohapatra

Asish Mohapatra was born in 1980 in Cuttack, Odisha. He excelled academically and secured a B.Tech degree in Mechanical Engineering in 2002. His early career included roles at ITC Ltd. as a Maintenance and Operations Manager and as a team leader, followed by McKinsey & Company, where he met Ruchi Kalra.

Like Asish, she is also highly accomplished. They shared similar values, ambitions, and skills. Together, they built one of India’s most successful unicorn stories led by a founding couple.

Academic Background & Early Career

- Bachelor’s in Engineering: He earned his bachelor’s degree from the IIT–Indian Institute of Technology, Kharagpur, India.

- Postgraduation: Later, he did the postgraduate management program from the Indian School of Business (ISB), Hyderabad (PGP/MBA).

Venture Capital Experience at Matrix Partners

In 2010, he joined Matrix Partners, a global venture capital firm, as a senior associate. This role gave him exposure to market trends, financing dynamics, and emerging Indian startups, which he later leveraged to cofound OfBusiness. This perspective proved instrumental in identifying structural inefficiencies in SME supply chains and financing, an opportunity that eventually led to OfBusiness.

Building OfBusiness: From Idea to Profitable Unicorn

Source: JokeScoff

OfBusiness initially started as a B2B e-commerce marketplace for raw materials. It then quickly expanded into working capital financing, backed by technology and data analytics. It also addressed some major pain points faced by SMEs, including:

- Enabling direct sourcing to secure better prices by eliminating intermediaries.

- Tech tools for pricing engines and ERP solutions for SMEs.

- Financial solutions, such as credit, enable faster and more cost-effective material purchases.

Founding the Venture

Founded in 2015, Asish Mohapatra co-founded OfBusiness with Bhuvan Gupta, Nitin Jain, Vasant Sridhar, and his wife, Ruchi Kalra. They believe in and pursue a vision that, at the time, only a few investors fully understood, choosing to leave high-profile corporate careers.

- Headquarters in Gurugram, India

- Industry: B2B Commerce and Fintech

- Model: Digital marketplace, financing, and tech services for Small and Medium Enterprises

The Gurugram-based OfBusiness organisation started with around ₹20 crore in monthly orders and generated approx ₹30 lakh in profit initially. By 2018, it spent ₹100+ crore on loans, reached around ₹500 crore in revenue, and reduced the time from 90 to 72 hours through technology.

Identifying the Challenges

Asish Mohapatra pitched OfBusiness 73 times before securing funding in 2016 from Zodius Capital, focusing on a one-stop platform for raw materials for SMEs, such as metals and cement, as well as collateral-free credit. In 2015, Asish Mohapatra observed a recurring theme while working in venture capital, i.e., SMEs struggled with:

- Inefficient purchasing

- Vague pricing

- Slow credit access

The traditional supply chain was also fragmented, with problems arising from intermediaries, and there was a disconnect from digital platforms. Some of the challenges were also the competition from Udaan and Moglix, which were addressed through an SME focus and a technology edge.

Expansion and Founding of Oxyzo

After realising that third-party financing partners slowed the credit delivery, the OfBusiness team launched Oxyzo Financial Services in 2018, an international lending arm focused on purchase financing for SMEs.

- Oxyzo Unicorn Achievement: Oxyzo Financial Services achieved its unicorn status in May 2022, with external funding.

- Role of the Oxyzo: It was led by Ruchi Kalra, Asish Mohapatra’s wife, with the majority stake holding of OfBusiness.

Asish Mohapatra’s OfBusiness Funding & Unicorn Status

| Metric | Stats |

| Total funding raised | Approx. $978 million+ |

| Latest funding round | Approx. ₹100 crore from Cornerstone Ventures (April 2025) |

| Last major valuation round | Approx. $5 billion (raised $325 M in late 2021) |

| FY25 revenue | Approx. ₹22,241 crore |

| FY25 profit | Approx. ₹597 crore |

| IPO status | IPO planned for 2025 or early 2026 |

| Target IPO size | Approx. $750 million to $1 billion |

| Target valuation (IPO) | $6 billion to $9 billion range |

These figures underscore OfBusiness’s rare position as a scaled yet profitable B2B enterprise ahead of its planned IPO.

In August 2021, OfBusiness became India’s 18th unicorn with ₹1,300 crore from Tiger Global at a ₹10,000 crore valuation. Later that year, a $325 million Series G round was led by Alpha Wave Global, Tiger Global, and SoftBank, valuing the company at $5 billion.

Expansion into chemicals, agri-products, and apparel powered the expansion, serving over 5,000 SMEs with deep engagement across 1,000+ active enterprises.

Funding History & Valuation Milestones

The company raised multiple funding rounds over the years, including a recent ₹100 crore investment from Cornerstone Ventures in 2025, ahead of its IPO. The company’s valuation peaked at $5 billion in 2021, and secondary deals reached $4 billion in 2024.

Analysis and Insights

Asish Mohapatra’s profitability-first philosophy opposes “burn cash” norms, which were driven by the principles of his physicist mother. The OfBusiness integration model for procurement, financing, and logistics reduces SME costs and enables growth without losses.

The net worth of Asish Mohapatra is estimated at ₹8,386 crore (approximately $1.0 billion), reflecting the value of his stake in OfBusiness and its ecosystem companies.

Asish Mohapatra’s Success Story Behind OfBusiness

Source: Facebook

Asish Mohapatra’s successful OfBusiness stands out because of its:

- Profitability before IPO: Unlike other loss-leading platforms, OfBusiness achieved profits early.

- Integrated B2B and FinTech Model: Setting financing at the point of procurement that improved cash flow outcomes for clients.

- Operational Discipline: Disciplined expense management and focus on sales without an increase in margins.

This combination positions the company not just as a high-valuation startup but also as a potentially long-term, sustainable enterprise.

OfBusiness Unicorn: Future Outlook

IPO and Beyond

Industry sources suggest that OfBusiness is preparing for a public listing within the next 18 to 24 months and aims to be one of the largest tech IPOs in India, outside the consumer internet space.

The market remains reachable and expansive, as India’s SME sector contributes around 30% to GDP, employs millions of enterprises, and continues to pursue digital transformation and financial integration. OfBusiness’s integrated supply, finance, and analytics platforms are positioned to capture a material share of this opportunity.

Conclusion

Asish Mohapatra’s success story is not just about building a unicorn valuation but also about creating something that matters to SMEs. In an economy where MSMEs drive employment and output, his company’s solutions are rooted in operational reality, and its financing and tech-enabled execution are redefining how businesses operate and expand.

From the corridors of IIT Kharagpur to building one of India’s most disciplined B2B unicorns, Asish Mohapatra’s journey reflects the power of combining market insight with execution rigour. His success with OfBusiness proves that scale, profitability, and purpose can coexist, especially when innovation is rooted in solving real problems for India’s MSMEs.

FAQs

Q1. What makes Asish Mohapatra’s journey remarkable?

A: Asish Mohapatra stands out because he built a profitable B2B unicorn that many early digital-first startups overlooked. By focusing on core customer challenges such as procurement inefficiencies and integrated financing, he sets himself apart from many other growth-at-all-cost models.

Q2. What is OfBusiness, and why is it significant?

A: Mohapatra’s OfBusiness is a B2B commerce and FinTech platform that enables small and medium enterprises that provide industrial raw materials and access to working capital financing. Its significance lies in solving real operational pain points for SMEs and scaling solutions to a valuation exceeding $1 billion, achieving unicorn status.

Q3. Is OfBusiness Profitable?

A: Yes. Unlike other technology startups that prioritise growth over profitability, OfBusiness believed in pursuing a balanced growth model. The financial results of OfBusiness show steady revenue growth and positive Profit After Tax, which illustrates the company’s sustainable economic model.

Q4. What is the role of Oxyzo in Asish Mohapatra’s business ecosystem?

A: The Oxyzo Financial Services, spun off from OfBusiness. It focuses on providing financial services to SMEs by addressing their primary need for working capital. It was led by Ruchi Kalra, Asish Mohapatra’s wife, and complements the procurement platform of OfBusiness, enabling businesses to buy and pay efficiently.

Q5. How did OfBusiness get started in India?

A: Asish Mohapatra made a bold decision that reshaped the Indian MSME sector. He left behind a successful career in venture capital, and he founded OfBusiness, a startup that aimed at revolutionising the B2B landscape for small and medium enterprises in India.