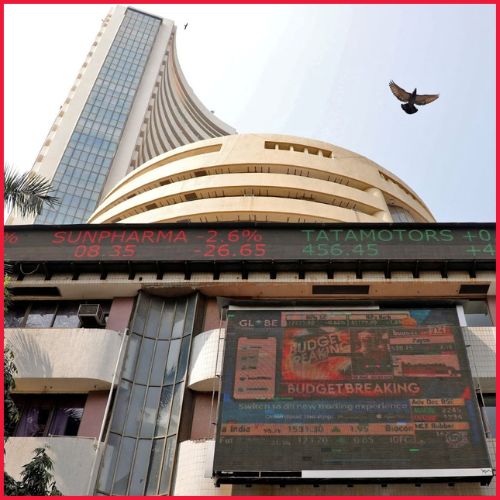

(Image Source: The Economic Times)

Reliance Industries Ltd is still holding back the Draft Red Herring Prospectus for the much-talked-about Reliance Jio IPO, even as market interest around the listing continues to build. The delay is not because of internal issues or lack of readiness. Instead, it comes down to a pending government notification that is expected to clarify IPO norms for very large companies.

For Reliance, this notification is important enough to pause the formal process. Filing the DRHP before the rules are notified could mean restructuring the issue later, something the group appears keen to avoid.

Government Notification Holds the Key to Jio IPO Timing

At present, IPO regulations require companies to offer a minimum percentage of shares to the public. While this works well for most listings, it becomes complicated for companies with extremely high valuations. In such cases, even a small percentage translates into a massive issue size, which can affect pricing and demand.

There has been ongoing discussion within policy circles about allowing large valued companies to list with a lower public float at the initial stage. This is widely seen as a move aimed at making space for listings like Jio Platforms IPO, which does not fit neatly into existing norms.

Reliance is said to be waiting for this clarification before submitting documents to SEBI. Going ahead without it could force the company to dilute more equity than planned, or revisit the structure midway through the process.

Why Public Shareholding Norms Matter So Much for Jio Platforms

Jio Platforms sits at the centre of Reliance’s digital strategy. From telecom services to digital platforms and consumer tech, the business has expanded rapidly over the last few years. Because of its size, the difference between offering, say, 2.5 percent and 5 percent to the public is not minor.

The expected rule changes may allow:

- Lower initial equity dilution at the time of listing

- More flexibility in deciding issue size and pricing

- Reduced pressure on market liquidity during the IPO

For Reliance, these factors directly influence how smooth the listing turns out to be.

Jio IPO Size Expectations and Market Buzz

The Reliance Jio IPO is being seen as the largest private sector public issue in India so far. Estimates doing the rounds suggest the company could raise anywhere between USD 4 billion and USD 4.5 billion, depending on valuation and stake sale. That alone explains why both domestic and global investors are tracking every update closely.

A listing of this scale is expected to have wider implications. It could boost overall market participation, add depth to benchmark indices, and set a reference point for future large digital listings in India. It also signals how regulators plan to deal with mega IPOs going forward.

What Comes Next for the Reliance Jio IPO

Once the government issues the notification on revised IPO rules, Reliance is expected to move ahead with the DRHP filing without much delay. After that, SEBI’s review process will begin, followed by final decisions on pricing, timing, and allocation.

Those following the latest Jio IPO news should keep an eye on:

- Government notification on IPO and public float norms

- DRHP filing by Jio Platforms

- SEBI observations and approvals

- Market conditions closer to the launch window

Most expectations currently point to a listing sometime in the first half of 2026, though this will depend on how quickly regulatory clarity comes through.

For now, the Jio IPO remains a waiting game. The groundwork appears to be in place, but the next move depends on a government signal that could decide how India’s biggest IPO finally takes shape.