(Image Source: India retailer)

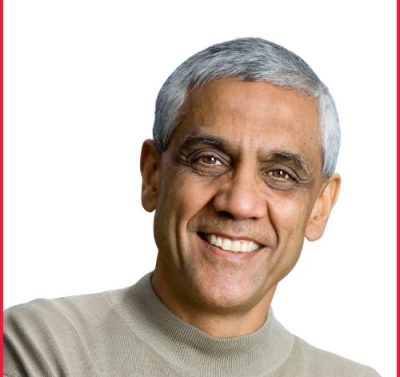

Varun Alagh, who co-founded Mamaearth parent company Honasa Consumer, bought more shares in the company on Monday through a block deal. He purchased 18.51 lakh shares at Rs 270 each, spending roughly Rs 50 crore. His personal stake in the company went from 31.88 percent to 32.45 percent. The move shows Alagh still believes in the company even though the stock price has fallen since the IPO launched at Rs 324 per share.

How Much Alagh Bought and What It Means

Alagh bought 18.51 lakh shares through the block deal on December 29, 2025. Here’s what changed in the company’s shareholding:

- Varun Alagh’s individual stake rose to 10.56 crore shares, now representing 32.45% of the company

- Total promoter and promoter group holding increased to 11.56 crore shares at 35.54%

- The stock price jumped 2.89% to Rs 276.20 on the BSE after the news broke

- Shares went as high as Rs 281.75 during the trading day before settling higher

The stock is trading well below its IPO price of Rs 324. The 52-week high was Rs 334.20 back in June 2025. By buying now at Rs 270, Alagh is essentially backing the company when the stock trades cheaper than it did at launch.

What Honasa Has Been Doing Recently

Honasa has been expanding by buying other beauty brands. The company took a 95 percent stake in BTM Ventures, which owns Reginald Men, a men’s grooming brand, for Rs 195 crore. It also bought a 25 percent stake in Couch Commerce, owner of the oral care brand Fang, for up to Rs 10 crore. The strategy is clear: build a collection of consumer beauty brands instead of just relying on Mamaearth.

The financial results are improving. In the second quarter of this financial year, Honasa made Rs 39.23 crore in profit. A year earlier, the same quarter had a loss of Rs 18.57 crore. Revenue grew 16.5 percent to Rs 538.1 crore. EBITDA, a measure of operating profitability, went up 8.4 percent to Rs 48 crore. When accounting for changes in how Flipkart revenue gets counted, growth actually reached 22.5 percent.

The Bigger Picture for Honasa

Honasa now owns five brands: Mamaearth, The Derma Co, Aqualogica, BBlunt, and Dr. Sheth’s. Each targets different customer groups in beauty and skincare. The company’s market value is around Rs 8,986 crore. Competing in this space is tough because established FMCG giants like Hindustan Unilever and newer direct-to-consumer brands keep pushing.

Alagh has said Honasa looks up to global companies like L’Oréal and Estée Lauder that own multiple brands. By continuing to buy shares even as the company expands and changes strategy, Alagh signals he trusts his own execution. Whether that confidence pays off depends on whether these brands gain market share and improve margins over the next few years.