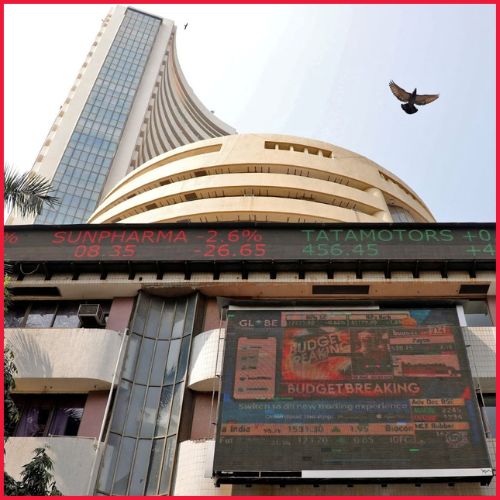

ICICI Prudential Life Insurance has launched the Sector Leaders Index Fund under its Unit Linked Insurance Plans. The fund tracks the BSE India Sector Leaders Index and started on December 15, 2025. You need just Rs 1,000 to invest, making it easy for regular people to start building wealth.

The fund works simply. Instead of having someone pick individual stocks, the fund automatically follows a fixed rule. It holds the top three companies from each of more than 20 sectors in India. This means you get banking, IT, energy, retail, and other sectors all represented without having to figure out which companies to pick. The fund keeps 95 to 100 percent of the money in these company stocks, with up to 5 percent in bonds and cash for emergencies.

How the ICICI Prudential Life Insurance Fund Works

Many people get nervous picking individual stocks. This fund removes that worry. The BSE India Sector Leaders Index automatically finds the biggest companies in each sector. So you get India’s largest banks, top IT firms, major energy companies, and biggest retailers all in one fund. This broad spread reduces risk because you are not betting everything on one company or industry.

When the fund gets dividend payments from companies, that money automatically buys more fund units. This compounds your returns over time without you doing anything. The starting price per unit is Rs 10, which is standard for new funds.

Why People Are Interested in Index Funds Now

In 2025, more investors turned to index funds because markets became unpredictable. A simple approach that removes emotion and complicated stock picking appeals to many. In November, sector-focused mutual funds saw inflows jump 37 percent, with Rs 1,864 crore coming in compared to Rs 1,366 crore in October. This shows people want simple sector exposure without constant monitoring.

ICICI Prudential Life Insurance offers this fund through different insurance plans like Signature Assure, SmartKid Assure, and Smart Insurance Plan Plus. These are different from regular mutual funds because you get insurance protection plus investment growth together. One product gives you both life cover and money growing in markets.

Who should invest in ICICI Prudential Life Insurance?

This fund works well for people planning to invest for five years or more. Students saving for college, working people planning retirement, or parents saving for children’s education can all benefit. You get exposure to India’s economy across sectors without constantly worrying about which stock to pick.

Index funds cost less because they just follow an index instead of paying expensive fund managers to pick stocks constantly. This lower cost advantage adds up over many years. Someone starting with Rs 1,000 and adding money regularly gets exposure to India’s growth across different sectors without the stress of picking individual companies.

The fund is open for investment through ICICI Prudential Life Insurance’s website and partners. You can start a new policy with this fund selected, or switch money from an existing policy to this fund if you want sector diversification without active management.